Gentlemen, and perhaps a few ladies of discernment, let us speak of ASML Holding, a company so vital to the fabrication of these diminutive calculating engines that it has become, in effect, the very arbiter of progress. A singular position, is it not? And yet, as with all monopolies, it breeds a certain… complacency. One observes a swelling of the coffers, a pronouncement of growth – 14% in revenues, 20% in earnings, they declare! – but it lacks a certain… vivacité. A spark. Therefore, I propose a most diverting spectacle: the rise of two potential rivals, companies poised to wrest from ASML the very crown of market capitalization.

The Dutch firm, you see, is like a portly nobleman, resting upon his laurels. Solid, dependable, but lacking the agility of a younger, hungrier contender. We shall examine, therefore, the prospects of Micron Technology and Oracle, two players who, while not yet masters of the realm, possess the potential to become so, and to expose the inherent fragility of any seemingly unassailable dominion.

Micron Technology: A Whirlwind of Memory and Ambition

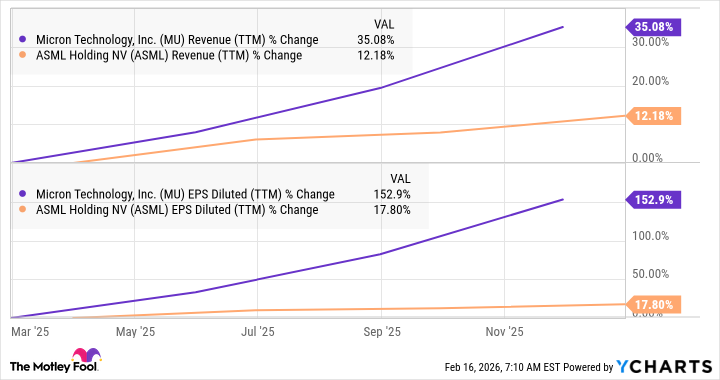

Observe Micron, a company that has, in the past year, performed a feat of financial legerdemain, increasing its value by a staggering 313% while ASML merely… progressed at a respectable 87%. A mere 18% separates the two in market capitalization, a gap that, I assure you, is shrinking with each passing quarter. This is not merely a matter of numbers, gentlemen, but of momentum. Micron, like a spirited steed, is galloping forward, while ASML ambles along at a comfortable pace.

The secret to this ascent? Demand, gentlemen, pure and simple. The insatiable appetite of these new “artificial intelligences” for memory – both DRAM and NAND – has created a supply shortage of the most delightful proportions. Micron, possessing a mastery of high-bandwidth memory, is uniquely positioned to capitalize on this frenzy. Their production is sold out for the year, a circumstance that allows them to dictate terms, and, naturally, to increase prices. TrendForce anticipates an 80-85% jump in DRAM prices! A most agreeable situation, wouldn’t you agree? And yet, despite this burgeoning prosperity, Micron trades at a mere 13 times forward earnings, a pittance compared to ASML’s lofty multiple of 40. A clear indication, if ever there was one, that the market has yet to fully appreciate the scale of this opportunity.

I predict, therefore, that Micron will not merely equal ASML in market capitalization, but surpass it. A bold claim, perhaps, but one grounded in the cold, hard logic of supply and demand, and a healthy dose of observation regarding the follies of the market.

Oracle: From Relic to Renaissance?

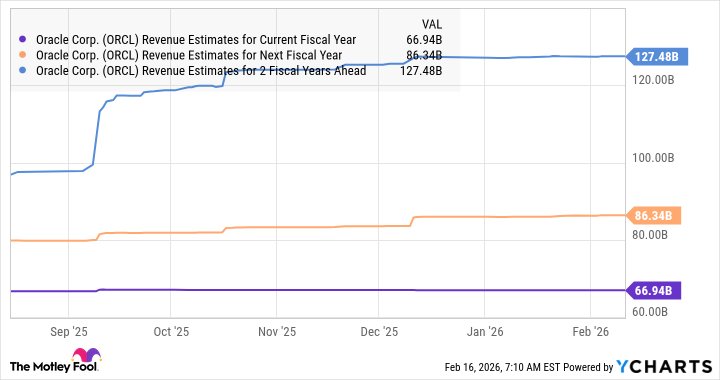

Now, let us turn our attention to Oracle, a company that, until recently, appeared to be a relic of a bygone era. A loss of 8% in the past year is hardly a cause for celebration, and their current spending spree on new data centers is, shall we say, rather… audacious. They propose to raise $45-50 billion through debt and equity! A grand gesture, certainly, but one that smacks of desperation. And yet, beneath this veneer of financial extravagance lies a most intriguing development: a backlog of orders that has exploded by 438% to a staggering $523 billion.

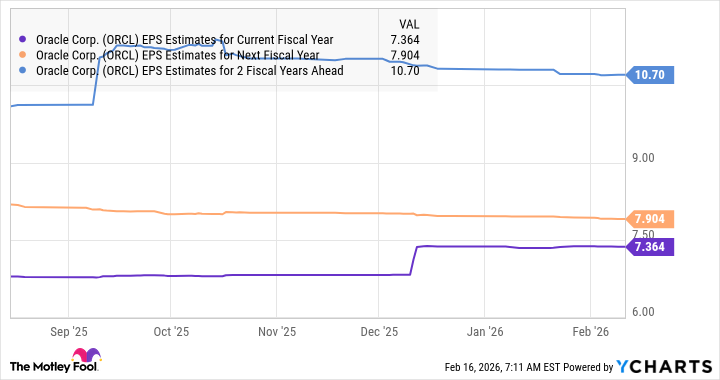

This, gentlemen, is no mere accounting trick. It is a testament to the growing demand for Oracle’s cloud infrastructure solutions. They anticipate a 17% increase in revenue this year, and analysts predict even greater growth in the years to come. The company is, in effect, laying the foundation for a renaissance.

True, the heavy spending will weigh on their earnings in the short term, but once the new data centers are operational, Oracle will be able to convert its massive backlog into revenue and restore its financial health. And at a mere 7.6 times sales, compared to ASML’s 14.1, Oracle is currently trading at a considerable discount. Analysts predict a 72% jump in Oracle’s share price, while ASML is expected to rise by a mere 19%. A most compelling argument, wouldn’t you agree? I posit that Oracle, fueled by its burgeoning backlog and undervalued shares, is poised to become a larger company than ASML in the coming year.

Thus, gentlemen, we have two challengers to ASML’s throne. Two companies that, while not yet masters of the realm, possess the potential to become so. A most diverting spectacle, indeed. And a reminder that even the most formidable empires are built upon shifting sands.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- ‘Bad Guys 2’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Again

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

2026-02-18 23:33