ZS“>

Zscaler’s Revenue Surprises No One… Except for Perhaps Everyone

In a twist of fate that might bemuse even the most seasoned of analysts, Zscaler generated $2.67 billion in revenue during the enchanting period known as fiscal 2025, marking a delightful 23% increase from the previous year. This figure, astonishingly, surpassed management’s rather conservative estimate of $2.66 billion, which, it must be noted, had already undergone the corporate equivalent of a triannual makeover.

While Zscaler’s revenue could have danced ahead with even more grace during fiscal 2025, the company deliberately chose to tighten its belt for the sake of fiscal prudence. Consequently, although it reported a loss of $41.4 million-an amount that makes one wonder about Friday night takeout-the decline was a 28% reduction from its previous year’s losses, and thus, a small victory indeed.

After adjusting for non-cash expenses and the various corporate shenanigans that can skew numbers (one cannot stress enough how confusing stock options can be), Zscaler found itself boasting a profit of $535.8 million for fiscal 2025-continuing the tradition of improving year-on-year by a noteworthy 29%. This adjusted measurement (non-GAAP, for the connoisseurs of financial terminology) is the company’s preferred interpretation of its profitability, much like how the best ways to achieve enlightenment are often hotly debated over tea.

The Wall Street Bullhorn Sounds for Zscaler’s Stock

In another sprightly report, The Wall Street Journal reveals that a curious flock of analysts is closely following Zscaler’s fortunes, with 30 opting to endorse it with a buy rating, while another 6 fall into the bullish “overweight” category. Meanwhile, 13 suggest holding, clearing a path for no one to dare utter the word “sell”-a word that, at this juncture, could provoke the ire of the market’s hidden gods.

These sharp-eyed analysts have an average price target of $318.26, which implies a modest potential upside of 13% over the next 12 to 18 months. Yet, on the cosmic scale where aspirations collide with market realities, the most celestial target of $385 hints at a whopping 37% upside possibility-bringing Zscaler tantalizingly close to its 2021 lofty heights of near $393.

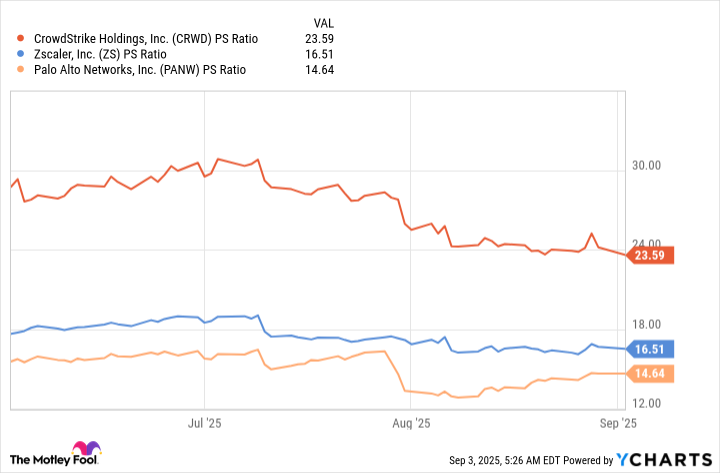

Interestingly, Zscaler’s price-to-sales ratio peaked at a dizzying 60 during the record-breaking bonanza of 2021, a valuation so inflated it made one yearn for a good old-fashioned deflation. Now, however, thanks to a cocktail of significant revenue growth and a 25% dip in stock price, this ratio has deflated (delightfully) to a more manageable 16.5, nestled comfortably between Zscaler’s formidable rivals-Palo Alto Networks and CrowdStrike:

On the whole, it appears Zscaler’s stock occupies a pleasant middle ground, existing somewhere between “cheap-as-chips” and “expensive-as-a-dinner-party-with-no-peas.” But rest assured, paying a fair price is often preferable to gambling wildly on underwhelming stocks-especially in light of Zscaler’s considerable growth potential that resembles a sprawling urban landscape of untapped markets. With an addressable market estimated at $96 billion, Zscaler has barely dipped a toe into the brimming ocean of possibilities based on its accomplishments in fiscal 2025.

As a grand conclusion, it might be argued that Wall Street’s price targets could indeed be too conservative for the long haul, indicating that Zscaler stock could be a rather splendid purchase at the current moment, encouraging one to take a leap of faith (or merely a well-calculated market step). 🐾

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

2025-09-05 13:19