Ah, a recent revelation emerges from the hallowed halls of Ethereum‘s universe, a transformation that would make even the most hardened skeptic raise an eyebrow! The heavens have declared that Layer 2 networks now command a staggering 85% of all transactions! Perhaps they’ve taken a page out of a Dostoevskian tale, where the underdog seizes the throne, but I digress.

In the colorful tapestry of this digital agora, we find some familiar characters: the likes of Base and Arbitrum. What’s that? Base is now the aristocrat of L2 transactions? Well, one could say the Ethereum mainnet, dear reader, remains the venerable yet humble base from which all value doth spring forth. It still processes a monumental 85% of transactions; perhaps it has learned the value of intrusion by delegation? 🤔

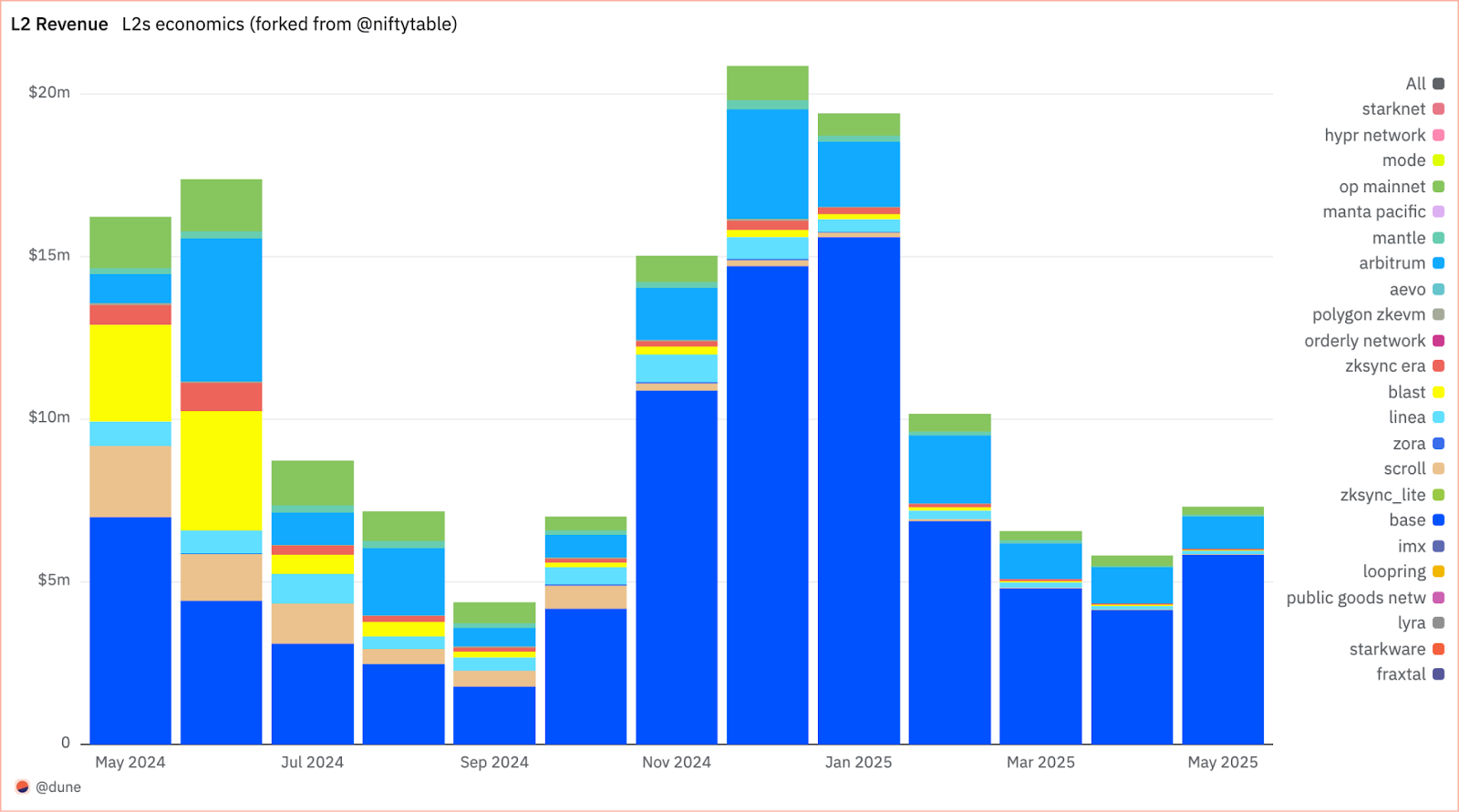

This striking epistle, released on the 10th day of July in the year 2025 by those analysts at Dune, delivers the news with all the pomp that might accompany a royal decree. Base, replete with self-importance, claims its right as the undisputed champion of Layer 2 transaction fees, raking in a cool $5.8 million just in May of this year. And the whispers predict an annual bounty of over $70 million! Imagine the soirees they might throw in their digital palaces! 🎉

A New L2 Economy Fueled by Dencun

Ah, behold a meticulous dissection of the moneys earned across this bustling Layer 2 ecosystem from May 2024 to May 2025. The robust Base (the much-envied blue) emerges as the overlord of revenue generation! A toast with virtual wine, anyone? 🍷

This unprecedented proliferation, I might add, sprang forth in the wake of Ethereum’s Dencun upgrade back in March 2024. Enter the “blobs,” those whimsical creations that have artfully slashed settlement costs to what we might call “near-zero.” Like a magician revealing their secrets, Base now operates with an enviable 98.3% profit margin! 🎩✨

Lower costs, you say? A siren call for users indeed! At decentralized exchanges, it seems trade has doubled yearly to a jaw-dropping 132 million by May 2025, with Base effervescently managing over half of these exchanges. And lo and behold, for the very first time, the trading volume of Base has eclipsed that of our beloved Ethereum! What a turn of fate! 🎊

Yet, let us not forget the tried and true mainnet, steadfast in its role as the bastion for high-value assets. Ethereum L1 still cradles an astonishing 90% of the $150 billion stablecoin trove and reigns over 83% of the $6 billion in real-world assets. It is a stronghold that attracts interest and reflects an undeniable shift towards institutional adoption, as hints of new ETF proposals featuring Ethereum flutter about like an errant butterfly! 🦋

In the grand tapestry of this digital age, the report from Dune paints a vivid portrait of Ethereum’s bright, modular future. The mainnet emerges as the steadfast backbone for security, while L2s shimmy into the limelight, eager to forge the next epoch of consumer applications. And one can only wonder, what delightful absurdities await as the dance of progress continues? 💃🕺

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- The Hidden Treasure in AI Stocks: Alphabet

- If the Stock Market Crashes in 2026, There’s 1 Vanguard ETF I’ll Be Stocking Up On

- Warby Parker Insider’s Sale Signals Caution for Investors

- Beyond Basic Prompts: Elevating AI’s Emotional Intelligence

- Actors Who Jumped Ship from Loyal Franchises for Quick Cash

- Berkshire After Buffett: A Fortified Position

- Celebs Who Fake Apologies After Getting Caught in Lies

- 20 Must-See European Movies That Will Leave You Breathless

2025-07-15 01:56