Across a span of 1,438 days, the Ethereum network has torched over 4.6 million ether, wiping out $13.57 billion worth of the digital asset. But even after all that crypto up in smoke, ether’s supply keeps growing, with an annual inflation rate currently pegged at 0.801%.

Ethereum Has Destroyed 4.6 Million ETH

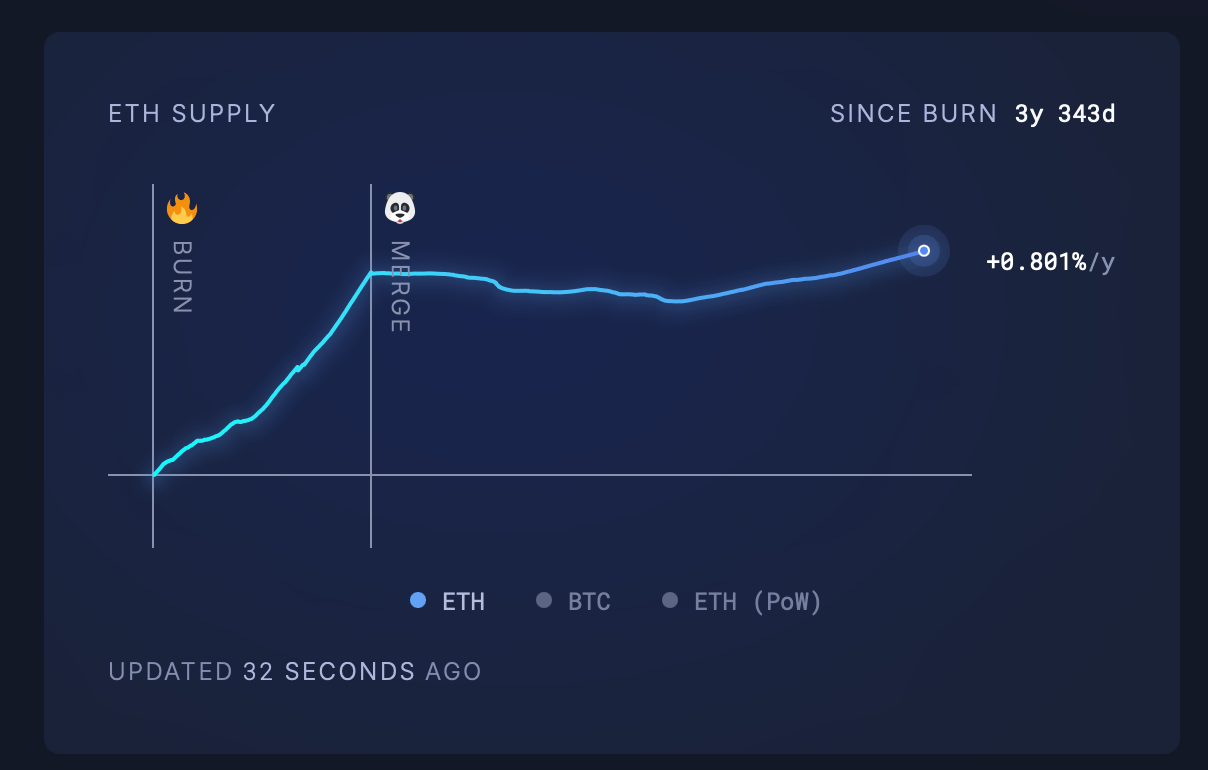

It’s been nearly 3 years and 11 months since the Ethereum blockchain rolled out the London hard fork on Aug. 5, 2021, at block height 12,965,000. That upgrade introduced a key tweak: a portion of transaction fees—aka gas—started getting burned, permanently removing ether from circulation. Oh, the irony of burning money to save it, isn’t it?

Data pulled from ultrasound.money this week reveals the Ethereum network has torched over 4.6 million ether since that upgrade. At today’s ETH/USD rates, that burn amounts to roughly $13.57 billion in vaporized value. Over the span of 1,438 days, that averages out to 2.22 ETH going up in flames every single minute—and ETH transactions are doing most of the heavy lifting. 🌞🔥

So far, ETH transactions have burned through 375,959 ETH, trailed by the NFT marketplace Opensea, which has sent 230,051.12 ETH to the digital bonfire. The decentralized exchange (DEX) Uniswap version 2 has torched 227,044.95 ETH on its own, while transactions involving the stablecoin tether (USDT) have racked up a burn total of 210,070.05 ETH—just from moving the fiat-pegged token around. Quite the bonfire, wouldn’t you say?

Even with 4.6 million ETH burned, the network remains inflationary, clocking a median issuance rate of 0.801% since the London hard fork. That’s nearly in lockstep with Bitcoin’s current rate of 0.809%, according to data from Santiment. Interestingly, seven-day figures from ultrasound.money show Ethereum’s rate dipping to 0.723%, with 16,745.66 ETH newly minted over the past week. It’s a delicate balance, isn’t it?

Since the London hard fork and as Ethereum’s economic model continues to evolve, the balance between issuance and burn has remained a focal point for analysts. Whether this tightrope walk ultimately benefits ether’s valuation or not, the network’s monetary policy mechanics are clearly unlike any other in the crypto sphere. And while a 0.801% rate is technically inflationary, it’s a far cry from the 3.394% Ethereum would have seen had it stuck with proof-of-work (PoW). 🤔

For context, Bitcoin’s current issuance rate sits at 0.809%, but its mean average over the past 1,438 days comes in at 1.476%—noticeably higher than Ethereum’s 0.801% average since Aug. 5, 2021. Since that moment, 3,695,537 ETH has been minted—adding about $10.89 billion in value to the network. Meanwhile, over the same 1,438-day span, including the most recent 2024 halving, bitcoin miners have generated 1,092,150 BTC, which translates to a massive $129.92 billion in newly issued coins. Quite the contrast, wouldn’t you say? 🤑

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Monster Hunter Stories 3: Twisted Reflection launches on March 13, 2026 for PS5, Xbox Series, Switch 2, and PC

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- 🚨 Kiyosaki’s Doomsday Dance: Bitcoin, Bubbles, and the End of Fake Money? 🚨

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- First Details of the ‘Avengers: Doomsday’ Teaser Leak Online

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

2025-07-14 19:57