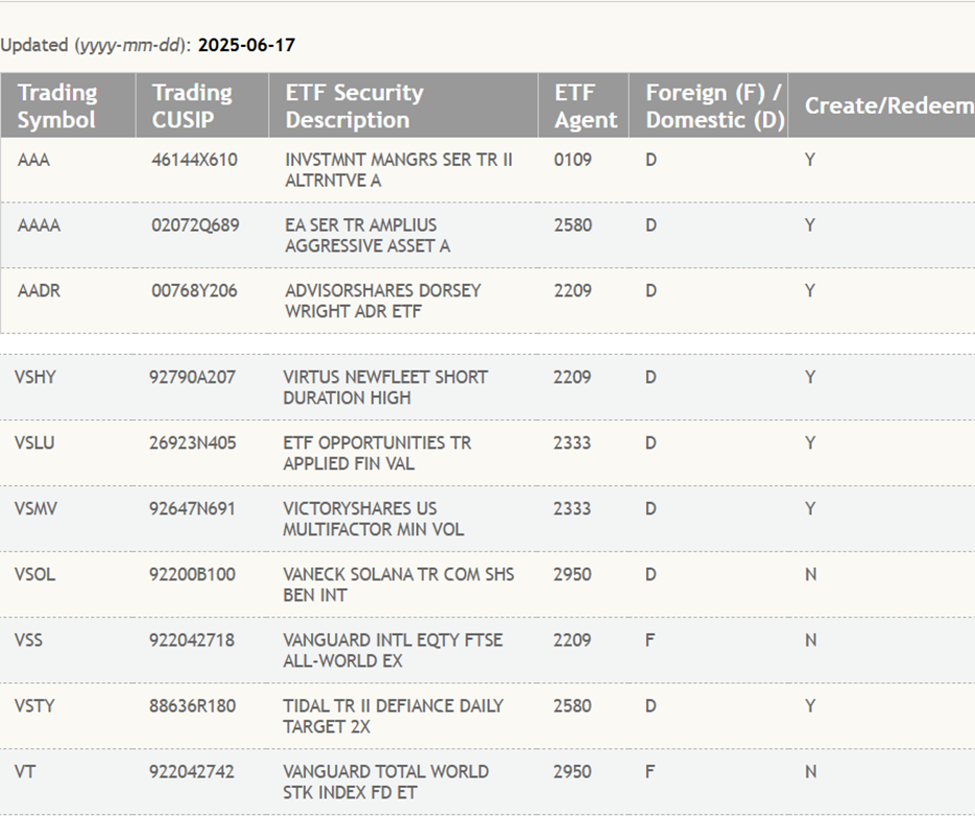

In a twist befitting a tale spun by the fates themselves, VanEck’s audacious proposal for a spot Solana ETF (exchange-traded fund) has waltzed its way into the hallowed halls of the DTCC (Depository Trust & Clearing Corporation) under the illustrious ticker VSOL. A monumental leap toward the elusive regulatory approval, or merely a mirage in the desert of finance?

Ah, the listing! A siren’s call to institutional investors, beckoning them closer to the shores of Solana, as if whispering sweet nothings about trading on US exchanges. Will they heed the call, or will they be swept away by the tides of uncertainty?

VanEck’s VSOL ETF: A Step Closer to the Golden Gates of Approval

The DTCC, in its infinite wisdom, has categorized this listing as “active and pre-launch,” a fancy way of saying, “We’re ready, but don’t hold your breath!” The fund is poised for future electronic trading and clearing, pending the ever-watchful eye of the US SEC (Securities and Exchange Commission).

But lo! VanEck’s VSOL remains a phantom, unable to be created or redeemed. Yet, the firm clings to this listing as if it were a lifebuoy in a stormy sea, though it offers no guarantees of safe passage.

Bloomberg’s seers of the ETF realm, James Seyffart and Eric Balchunas, predict that the SEC might soon bestow its blessing upon this fund. But beware! This prophecy hinges on the smooth sailing of filings, which can be as unpredictable as a cat on a hot tin roof.

“The SEC is engaging on S-1 for Solana Staking ETFs and that’s a *very* positive sign. Still, timelines for approvals are less certain IMO,” Seyffart mused, perhaps while sipping a cup of irony.

Indeed, this registration comes hot on the heels of the SEC’s directive for issuers to submit amended S-1 filings for their Solana ETFs. A sign of life, or merely a dance of shadows between regulators and fund managers?

In this grand race, several contenders, including Bitwise, CoinShares, and the ever-ambitious Franklin Templeton, have thrown their hats into the ring for Solana-based ETFs. Yet, the SEC has chosen to delay its decision on Franklin Templeton’s offering, leaving them in a state of limbo.

SEC DELAYS FRANKLIN SPOT SOLANA ETF

— Phoenix » PhoenixNews.io (@PhoenixNewsIO) June 17, 2025

VanEck, a seasoned player in the ETF arena, has previously unleashed Bitcoin and Ethereum futures ETFs upon the world. Now, it seeks to offer a regulated gateway to the next generation of blockchain networks, with Solana leading the charge.

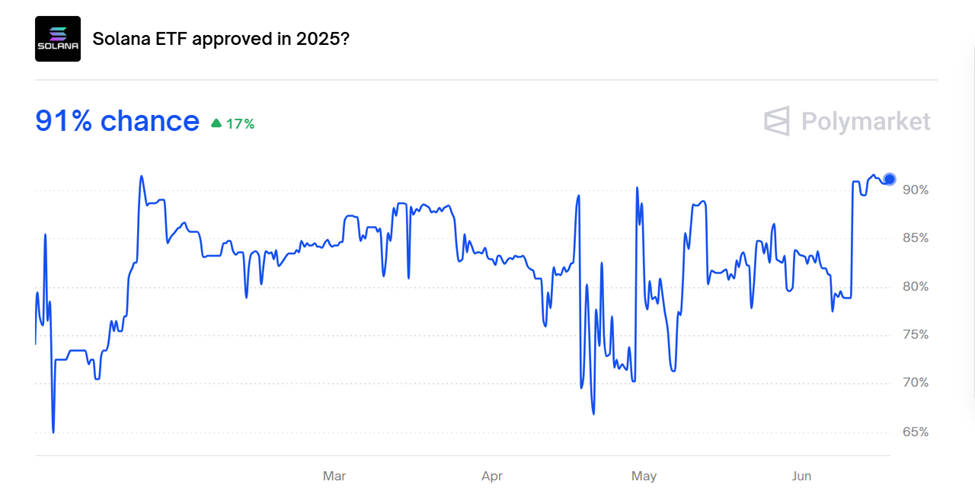

SEC Engagement and Polymarket Odds: A Glimmer of Hope for Solana ETF

While the SEC has already waved its wand of approval over spot ETFs for Bitcoin and Ethereum, Solana remains in the waiting room, twiddling its thumbs. Yet, optimism is bubbling like a pot of borscht on a cold winter’s day.

On the decentralized prediction platform Polymarket, traders are now placing a staggering 91% probability on the approval of a Solana spot ETF in 2025. A bold bet, indeed! 🎲

The DTCC’s recognition of VSOL is but a reflection of the growing institutional appetite. Earlier this year, they also listed futures-based Solana ETFs, SOLZ and SOLT, though those remain in a state of redeemable-only purgatory.

Beyond the realm of ETFs, the DTCC has hinted at a deeper interest in blockchain infrastructure, including plans for a stablecoin and a tokenized collateral platform. The future is indeed bright, or perhaps just a little too optimistic?

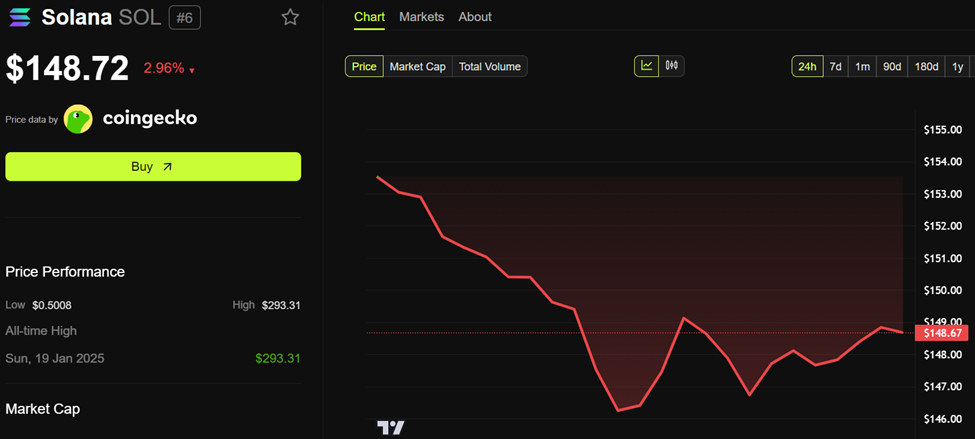

With Solana’s impressive transaction throughput, a bustling developer ecosystem, and a burgeoning DeFi and NFT landscape, it stands as a formidable contender for mainstream financial products. Will it rise to the occasion?

The SEC’s willingness to engage with spot Solana ETFs, coupled with its approval of Solana’s futures on the CME, suggests that this network could soon join the ranks of the elite, becoming the third crypto to gain full ETF status in the US.

Though VanEck has yet to announce an official trading date for VSOL, its appearance on the DTCC’s list is a significant milestone. If the stars align and approval is granted, VSOL could ignite a wave of ETF innovation, perhaps even introducing staking-enabled products or multi-asset crypto baskets.

Such a move could send Solana’s price soaring to the heavens! Yet, despite the DTCC’s listing, SOL was trading at a mere $148.72 as of this writing, down nearly 3% in the last 24 hours. Ah, the irony of fate!

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2025-06-18 09:41