On Thursday, Aerodrome Finance (AERO) experienced a rise, defying the downtrend observed in the wider cryptocurrency market, which is currently affected by ongoing geopolitical tensions.

The main trading platform and liquidity source for Base is the Decentralized Exchange (DEX). This DEX directs transaction fees towards individuals who store their AERO tokens for a specific duration.

Coinbase App Integrates Aerodrome, AERO Jumps 35%

The increase occurred following the confirmation of a significant new integration of Base chain DEX services directly into its primary application, positioning Aerodrome as a key figure in this field.

On platform X (Twitter), it was officially disclosed by the Base Chinese account that the Coinbase application intends to offer Decentralized Exchange (DEX) services through the Base chain for its users. This decision was based on a recent announcement made by Aerodrome Finance regarding their integration with the system.

Coinbase APP将为用户提供base链的DEX服务。

— Based Chinese(Base中文) (@base__chinese) June 13, 2025

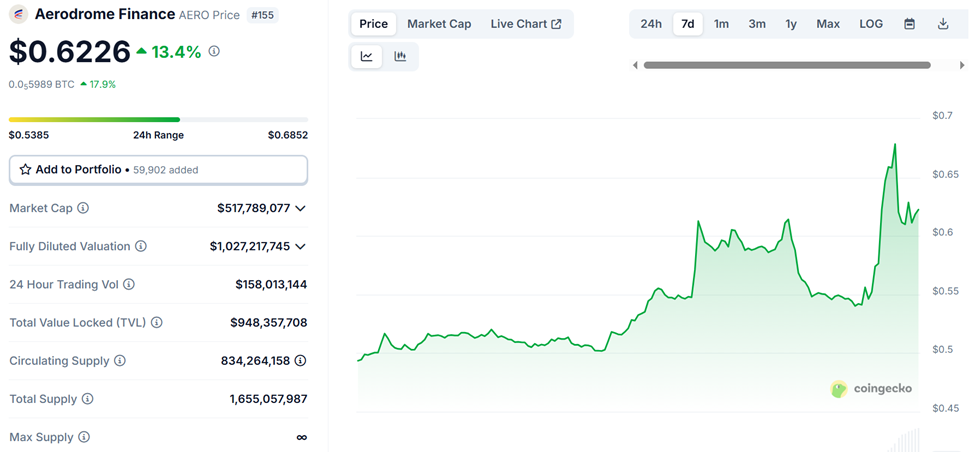

The news caused an immediate response in the market, as AERO’s price surged approximately 35% at first, but later experienced a decline of around 15%.

Although AERO was corrected, it surpassed many top-100 assets in Thursday’s trading session, given that the crypto markets were significantly impacted by geopolitical stress. As of the press time, AERO is still up by more than 13%, trading at $0.6226.

In 2023, Aerodrome was introduced and has since expanded to become the second most prominent decentralized exchange on the Base network in terms of market share.

As reported by DeFiLlama, its current total value locked stands at approximately $950 million, and on a typical day, its trading volume surpasses half a billion dollars.

Coinbase Brings Base DEX Access to Millions

Reaching this integration is a major step forward for Aerodrome and the Base ecosystem. By choosing to incorporate Base DEX access directly into their app, Coinbase is aiming to combine the smooth user experience of centralized systems with the decentralized infrastructure. This ambition fits well with their broader “on-chain summer” vision.

On day one, Coinbase is initiating its business operations by offering a Bitcoin-collateralized loan within just 60 seconds, all conducted on the blockchain in collaboration with Morpho Labs on their platform. So, what exciting developments would you like to witness next?

— jesse.base.eth (@jessepollak) January 16, 2025

The action is anticipated to significantly broaden Aerodrome’s reach to a vast, mainstream audience of millions of Coinbase exchange users.

The collaboration might significantly alter user perceptions regarding ease of on-chain trading. By channeling Decentralized Exchange (DEX) liquidity through Aerodrome within the Coinbase platform, users can enjoy high liquidity and minimal price discrepancies when trading on Base, all without switching applications.

The progress made in its development further cements Base’s lead in the competition for Layer-2 scaling solutions. Recently, there has been a surge of interest from developers and DeFi protocols seeking affordable, swift transaction processing, which Base offers as Coinbase’s Ethereum L2 solution.

The supremacy of Aerodrome over Base gives it an advantageous strategic stance, particularly as the pace of institutional and retail adoption for Level 2 blockchain networks quickens.

Although there might be temporary fluctuations in the price of AERO in the short term, the underlying story revolves around the merging of infrastructures. This means that a prominent centralized exchange could incorporate smooth Decentralized Exchange (DEX) features into its system.

As a researcher, I am excitedly anticipating that for me, Aerodrome might mark a pivotal point in its evolution – solidifying its position as a cornerstone for the emerging generation of user-friendly, blockchain-based financial solutions.

Additionally, it’s important to mention that Aerodrome is up against tough rivalry in Base, where Morpho has surpassed it to claim the top spot as the largest Decentralized Exchange (DEX) by market share.

According to DefiLlama’s data, Morpho’s Total Value Locked (TVL) stands at $1.032 billion, which is more than Aerodrome’s. The Morpho protocol enhances lending efficiency by directly linking liquidity sources, leading to better interest rates.

Today marks the introduction of the Morpho V2 – an innovative lending platform that empowers borrowers through predetermined interest rates and repayment terms. This platform is specifically designed to unlock the power of decentralized loans.

— Morpho (@MorphoLabs) June 12, 2025

Read More

2025-06-13 11:17