It is a truth universally acknowledged, that a single Bitcoin in possession of a good fortune, must be in want of a stable market. Alas, dear reader, such is not the case, for Bitcoin has tumbled to a most unfortunate $103,900, amid the tumult of Israeli military action in Tehran.

A brief perusal of the particulars reveals the following:

- Israeli forces, in a most ungentlemanly manner, have bombed targets in Iran’s capital, as confirmed by the esteemed Al-Jazeera.

- The Israeli President, Mr. Netanyahu, has declared his country’s intention to remove Iran’s ballistic missile capabilities, and that strikes will continue until the threat is removed.

- Axios, a most reliable source, first reported the Israeli operation inside Iranian airspace, citing unnamed sources, which was later confirmed by Al-Jazeera.

Bitcoin, that most mercurial of cryptocurrencies, has thus added to its earlier losses, now down more than 4% over the past 24 hours. The International Atomic Energy Agency, in a most distressing report, revealed that Iran was not complying with restrictions on enriched Uranium for the first time in two decades.

President Donald Trump, in a most statesmanlike manner, expressed his preference for a deal with Iran over a conflict, warning that an attack could lead to a “massive conflict.” Meanwhile, bettors on Polymarket were unsure about the chance of a strike taking place, with the likelihood of Israeli action against Iran by July priced in at under 30 cents.

A Most Unsettling Reaction from Traditional Markets

U.S. stock index futures, in a most disconcerting manner, have fallen by about 1.5% across the board, while European market futures have followed suit. Bond prices, gold, and oil, however, have risen, with the 10-year Treasury yield dipping two basis points to 4.32%, and gold adding about 0.75% in the past hour to $3,428 per ounce. Crude oil, in a most dramatic fashion, has soared 9% to $74 per barrel.

The U.S. dollar, in a most curious twist, is gaining against the euro and British pound, but losing ground versus the yen and Swiss franc.

Ethereum Treasury Firm SharpLink Gaming Plunges 70% – But There May Be a Twist 🤔

Crypto Cracks Late in Day, Bitcoin Slumps Below $106K 😱

Coinbase to Launch Bitcoin Rewards Card With Amex, While Eyeing U.S. Futures Expansion 🚀

Shopify to Enable USDC Payments on Coinbase’s Base for Merchants Worldwide 🌎

Bitcoin Will Rally as U.S. Growth Improves, Crypto Bills Progress: Coinbase Research 📈

DeFi Adding $5B of Solana Buying Power With New Line of Credit 💸

Coinbase to Launch Bitcoin Rewards Card With Amex, While Eyeing U.S. Futures Expansion 🚀

Donald Trump: Administration Will Work Toward ‘Clear and Simple’ Crypto Frameworks 📊

Dollar Index Falls Below 98 for First Time in Three Years, Gives Room for Crypto Run 📈

Crypto Lender Maple Partners with Liquid Staking Specialist Lido Finance 🤝

Bitcoin, Dogecoin, Ether Could See Profit-Taking Even as Macro Conditions Improve 📊

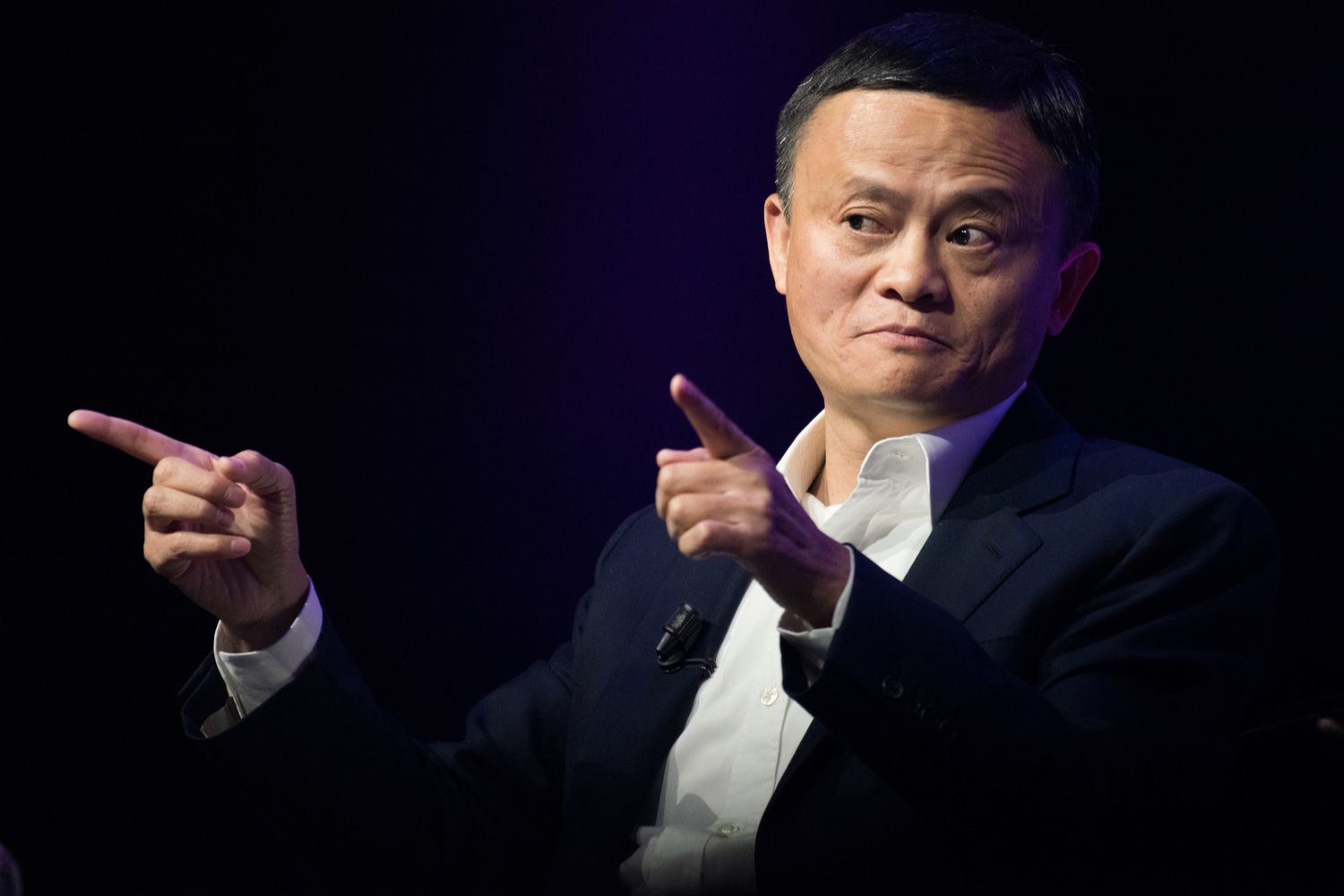

Jack Ma’s Ant International Seeks Stablecoin Licenses in Hong Kong, Singapore: Bloomberg 📈

Read More

2025-06-13 04:18