In a turn of events that would make even the most seasoned stockbroker raise an eyebrow, U.S. stocks have decided to climb higher, as if they were on a particularly spirited game of leapfrog, thanks to some rather soft inflation data that has improved the prospects of a Fed rate cut. Who knew that a little bit of inflation could be so generous?

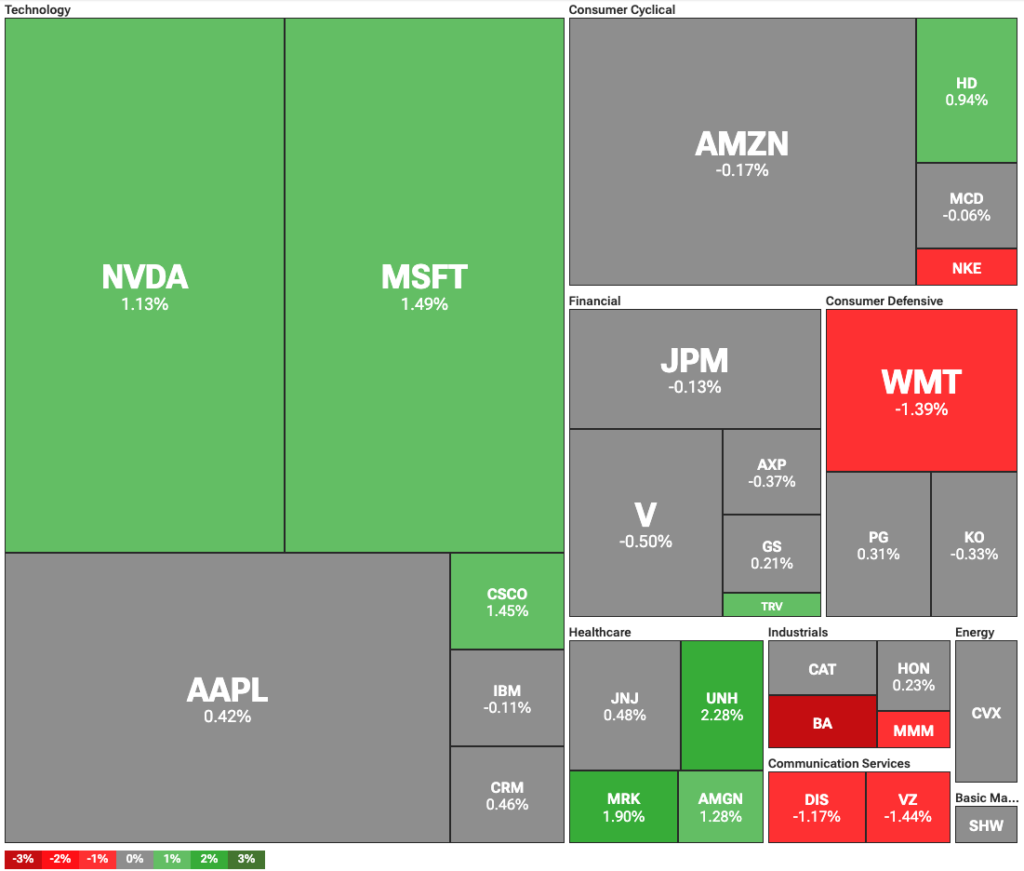

On this fine Tuesday, June 12, the Dow Jones, that venerable old chap, was up a modest 0.17%, or 70 points, while the S&P 500 and the Nasdaq both decided to join the party with a sprightly gain of 0.35%. It’s as if they all had a good breakfast of optimism and decided to strut their stuff!

Low inflation data is still tickling the fancy of trader sentiment, with many a trader anticipating potential rate cuts following last month’s rather soft CPI figures. However, the Federal Reserve, in a display of caution that would make a cat on a hot tin roof look positively relaxed, has remained hesitant to lower rates, citing the potential inflationary effects of U.S. tariffs on major trading partners. Oh, the drama!

This hesitation has not gone unnoticed by the White House, where U.S. President Donald Trump, in a move reminiscent of a schoolyard bully, reiterated that the Federal Reserve should cut rates by one point. While he clarified that he wouldn’t seek to fire Fed Chair Jerome Powell (how magnanimous!), he did suggest he might have to “force something” on rates. One can only imagine the look on Powell’s face!

Boeing Takes a Nosedive, Oracle Soars to New Heights

Meanwhile, the Dow Jones found itself weighed down by Boeing stock, which took a significant tumble after the unfortunate Dreamliner crash in India. Shares of the aircraft manufacturer were down 4.5%, as the latest crash compounded recent scandals involving the company. It’s a bit like watching a soap opera, really—one scandal after another!

In 2024, Boeing faced a series of scandals, all starting with one plane that had its door ripped off mid-air. This led to whistleblowers exposing corner-cutting when it comes to safety, as well as attempted cover-ups. It’s enough to make one wonder if they were building planes or playing a game of Jenga!

On the flip side, Oracle stock decided to jump 14% to an all-time high after its earnings beat Wall Street expectations. The firm revised its expected revenue for 2026 to a staggering $67 billion, up from the previous estimate of $66 billion. Talk about a generous upgrade!

The reason for this rosy forecast? The expected growing demand for its AI-powered cloud services, of course! Revenue from its cloud service rose 14% quarterly, largely due to the built-in and integrated AI services the company provides. It seems the future is bright, and it’s powered by artificial intelligence!

Read More

2025-06-12 21:07