Well, hold onto your hats, folks! Bitcoin has decided to throw a party in April and May, and guess what? Everyone’s invited! 🎉 From April 9 to May 22, the Bitcoin price did a little dance, surging by a whopping 46.32%! And just when you thought it couldn’t get any better, it pulled off an 18.48% rally between May 5 and 22. Talk about a glow-up! 💃✨ The price recovery has also sent its Compound Annual Growth Rate (CAGR) soaring—because who doesn’t love a little market optimism?

BTC CAGR Spikes as Price Recovers

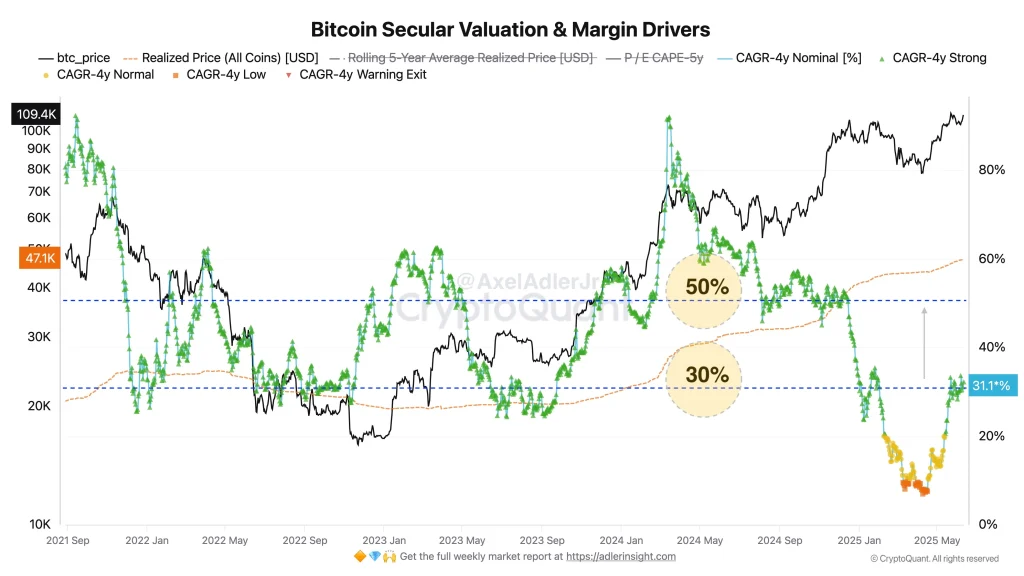

Our favorite crypto analyst, Axel Adler Jr, recently pointed out that Bitcoin’s 4-year CAGR had a bit of a meltdown earlier this year. In April 2025, it plummeted to a sad 7%, which is basically Bitcoin’s way of saying, “I need a break!” 😩 In January, BTC was feeling itself with a 9.54% growth, but then it decided to take a nosedive—down 17.5% in February and 2.19% in March. It even hit a low of $74,446.79 in April. Ouch!

But wait! The market pulled a classic comeback. By June 2025, Adler reports that Bitcoin’s CAGR climbed back to 31%. Who knew it had it in it?

“This sharp rebound shows how quickly the long-term trend can shift when strong buyer momentum enters the market,” Adler quipped. But let’s be real, 31% CAGR is still below historical bull market peaks, which means there’s still room for this rollercoaster to climb higher!

$168K BTC by October?

Now, hold onto your wallets! Axel Adler Jr is throwing out a bold prediction: a possible Bitcoin price target of $168,000 by October 2025. That’s right, folks! Assuming the futures market and leverage keep the party going, we might just see fireworks! 🎆

He’s basing this on some fancy math and historical patterns from previous bull runs. Because, you know, history always repeats itself… or does it? 🤔

Adjusting for Risk: CAGR vs. Standard Deviation

In a riveting discussion thread, X user Manu suggested a more sophisticated way to interpret CAGR—by dividing it by the standard deviation. Because who doesn’t love a little math to spice things up? 📊 This way, we can eliminate volatility and focus on risk-adjusted returns. Genius!

Adler was on board with this approach, stating it gives a clearer view of market performance. But he also dropped a truth bomb:

“The real inflection point comes when investors start taking profits based on expected returns.”

According to him, the risk of a bear market grows once BTC trading volume crosses 1 million coins. So, if you see a stampede of profit-taking, you might want to hold onto your hats and wallets! 🐻💰

Read More

2025-06-12 14:38