Welcome to the bleak dawn of the modern age—where fortunes rise and fall with the whisper of a blockchain. Today’s tales promise chaos or comedy, perhaps both.

Pour yourself a cup of whatever extraordinary substance you find necessary, and ponder the strange obsession with Bitcoin’s silent rebellion against the mighty dollar. Experts, with a mixture of dread and fascination, warn of a looming catastrophe, lurking just beyond the horizon like a dog in a dark alley.

Crypto Gossip of the Day: Max Keiser, El Salvador, and the Collapse of the Fiat Empire

Max Keiser, the eternal optimist—or perhaps the perpetual prophet of doom—claims Bitcoin’s treasury gambits are nothing short of a reckless attack on Uncle Sam’s greenback. To him, MicroStrategy’s relentless BTC accumulation isn’t just business; it’s an existential insurrection against the crumbling fiat order.

He remarks that inflation is prancing around at 15%, although the official figures are more polite, and interest rates are artificially kept low—because nothing screams ‘free market’ like central banks playing dice with our savings.

“Using Saylor’s numbers, that inflation is running at 15%—when you include asset inflation—interest rates should be much higher. But highly manipulative programs—overriding free market price discovery in the bond market—like QE & YCC—pressure rates to absurdly low levels (to keep banks from declaring life threatening losses),” Keiser wrote on X.

In his dark vision, this tampering with yields enables Bitcoin-laden treasuries to outshine everything else—probably even the sun, if they could figure out how to mine it. This financial superweapon, he suggests, is nature’s way of punishing those stubborn enough to cling to traditional finance.

“Acquiring one-way-up Bitcoin with this ridiculously cheap money is a mathematically guaranteed way to outperform everything,” he proclaimed, probably with a grin that only a prophet of chaos could wear.

Keiser foresees the inevitable: a desperate scramble into Bitcoin that will shatter the bond markets, send rates soaring—more than fifty percent, no less—and leave the world clutching at digital straw. And somehow, MSTR will emerge as the king of the ashes, defining a new global standard, or so he says with a gleam of irony.

“At that point the game is over and we’ll see who won. $MSTR no doubt will win this, defining adjustment to a global Bitcoin standard,” Keiser confides, as if sharing a secret with doom itself.

He even predicts that the US dollar—once the king of currencies—will vanish like a bad mood after a rainstorm, replaced by stablecoins referencing the unmoored dollar, a ghost of what was once money.

Unearthing rare optimism, Keiser points to El Salvador, that tiny republic ruled by the charismatic Bukele, who apparently thrives amid societal upheaval—what scholars call the “Fourth Turning,” a cycle best interpreted as society’s nervous breakdown.

“Not every country is navigating the ‘Fourth Turning’ as well as El Salvador thanks to the most popular leader in the world (91% approval), President Bukele.

Every country is dealing with the unwind of the global, fiat money, central bank Ponzi scheme.

Only El Salvador is thriving.”

— Max Keiser (@maxkeiser) June 10, 2025

US-China Trade Deal: Done or Just Delayed? 🚧

President Donald Trump, whose word is gold—or perhaps just fool’s gold—announced a breakthrough with China after their second meet. The deal, he claims, is “done,” pending the final nod, as if the world were a bureaucrat’s game.

“Our deal with China is done, subject to final approval,” Trump tweeted, sounding as confident as a man betting on a losing horse.

The terms include China’s supply of rare earth minerals—a topic usually as thrilling as watching paint dry—and a modest tariff compromise, with China paying a 10% fee and America holding tight at 55%, just because they can.

Trump added that he and Jinping are to work together, possibly to open China’s markets or just to see who’s boss—either way, it’s a ‘great WIN,’ or so he promises with that signature flair for drama.

Coincidentally, inflation slowed to a gentle 2.4% in May, giving the markets a reason to cheer—probably because they’ve given up entirely on understanding what all the fuss is about.

Trump says the China trade deal is done. Inflation numbers also just came in month to month lower than “experts” expected. Past time to cut rates. Let’s roll!

— Clay Travis (@ClayTravis) June 11, 2025

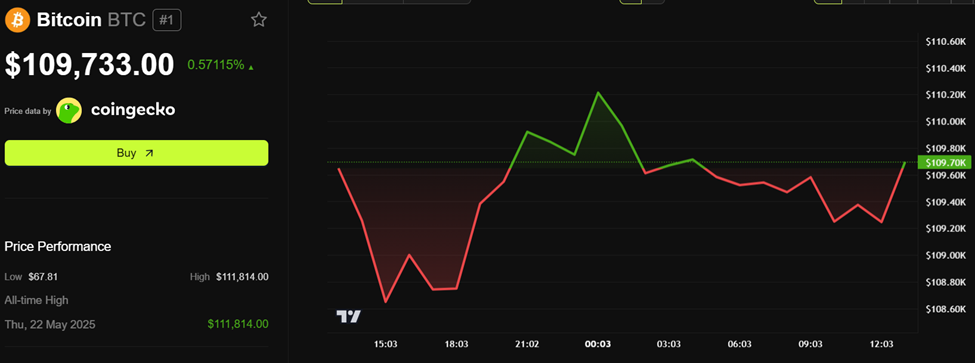

This gentle inflation decline and the easing of geopolitical tensions sent Bitcoin soaring, flirting with $110,000—a number that sounds as absurd as believing politicians tell the truth. Investors, ever hopeful or just desperate, see salvation in these rises.

Experts say if this deal is sealed, it might help untangle supply chains and bring a longed-for sense of stability—though one might wonder how long such fantasies last before reality crashes in, chuckling quietly.

Chart of the Day: Bitcoin’s Home | Is this where it’ll stay? 📊

Behold the chart, which depicts Bitcoin nestled securely in a supply zone between $109,242 and $111,634. Traders who like to gamble might watch for a decisive close above $110,634—assuming they trust numbers and not legends.

Byte-Sized Wisdom: Crypto on the Brink (Or Not) 🧐

Crypto Stocks: The Morning’s Mood Forecast

| Company | June 10 Close | Pre-Market View |

| Strategy (MSTR) | $391.18 | $389.33 (-0.47%) |

| Coinbase (COIN) | $254.94 | $255.48 (+0.21%) |

| Galaxy Digital (GLXY.TO) | $20.00 | $20.15 (+0.75%) |

| MARA Holdings (MARA) | $16.49 | $16.42 (-0.42%) |

| Riot Platforms (RIOT) | $10.45 | $10.43 (-0.48%) |

| Core Scientific (CORZ) | $12.77 | $12.64 (-1.02%) |

Read More

2025-06-11 18:29