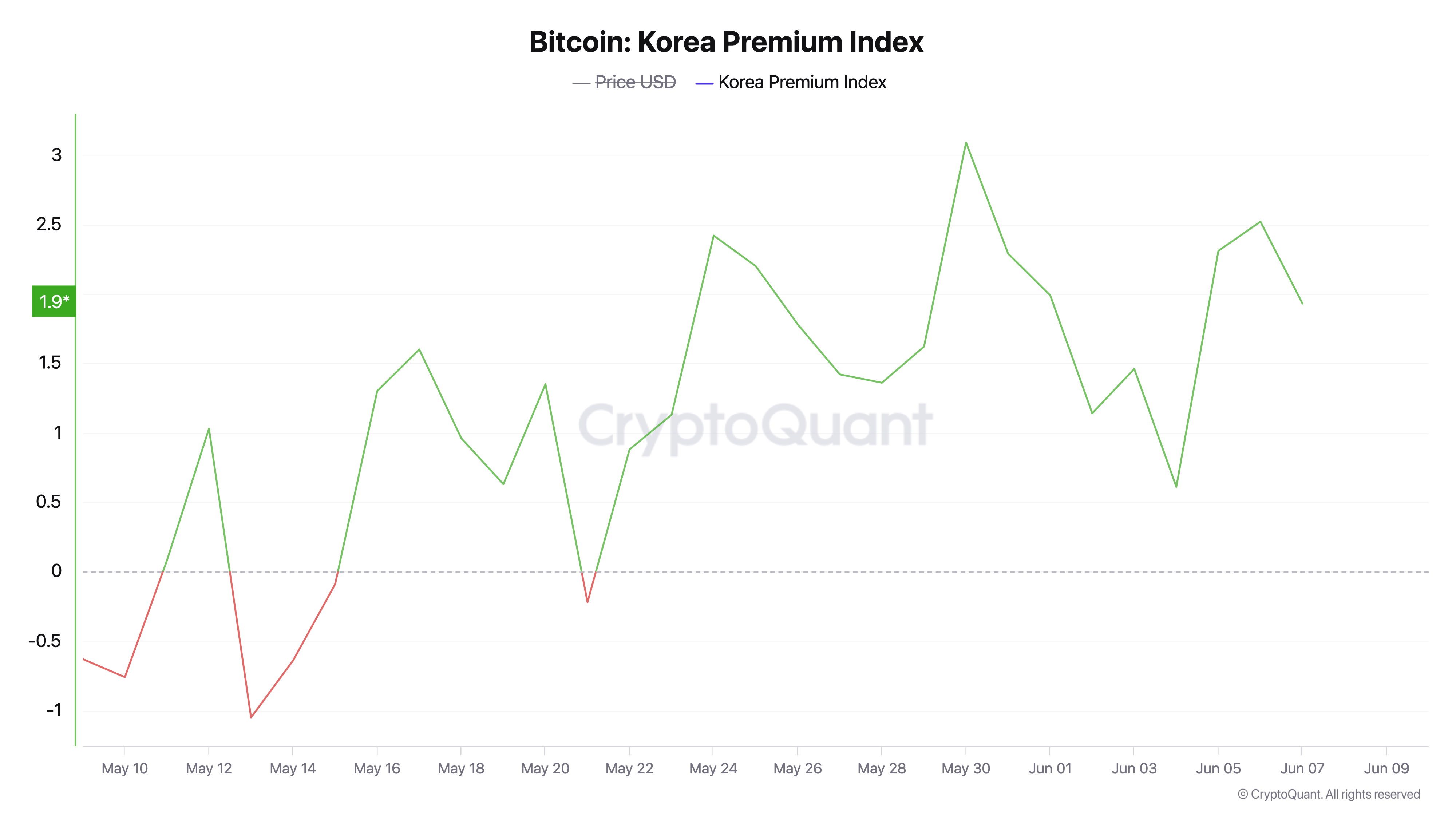

Ah, since the fateful days of late May—those 17 days that felt like an eternity—the price gap for bitcoin in the land of kimchi has soared, reaching a dizzying height of over 3% by the month’s end. As of this very Sunday, June 8, 2025, our dear bitcoin is trading at a staggering $1,500 above the global average. What a delightful absurdity! 😅

Crypto Prices Break Away in South Korea, Sparking Premium Frenzy

Bitcoin, that elusive creature, is currently basking in a 1.43% premium in South Korea compared to the global average, as revealed by the ever-reliable Upbit and coinmarketcap.com. At precisely 9:55 a.m. Eastern time, BTC was priced at a modest $105,896 per coin globally, while the South Korean exchanges, in their infinite wisdom, listed it at $107,412—a delightful 1.43% difference. Oh, the irony! 😂

Let us not forget the fateful day of May 21, 2025, when cryptoquant.com reported a mere 0.22% discount. On that day, BTC’s global average hovered around $106,786, while the South Korean platforms like Upbit and Bithumb displayed a slightly lower price of $106,551. But lo and behold! The price gap has since flipped into premium territory, peaking at a staggering 3.09% on May 30. What a rollercoaster! 🎢

On that fateful day, BTC’s global rate was a humble $103,998, yet in South Korea, it fetched a princely $107,118—an extra $3,120 per coin! This delightful discrepancy, affectionately dubbed the “kimchi premium,” arises from South Korea’s stringent capital controls and financial regulations, which limit cross-border fund flows and shrink the bitcoin supply on local exchanges. Ah, the sweet taste of irony! 🥢

But wait, the premium trend is not confined to bitcoin ( BTC) alone—ethereum ( ETH) is also trading 1.71% above the global weighted average on South Korean exchanges. XRP follows suit, priced at $2.31 in South Korea versus $2.27 globally, marking a 1.76% difference. And let us not forget Solana ( SOL), which is also fetching 1.49% more on platforms like Upbit and Bithumb compared to its international rate. What a delightful mess! 🤪

These pricing gaps whisper tales of persistent demand from South Korean traders. The consistent premiums across multiple assets suggest that local market forces are orchestrating a unique symphony of price behaviors. As global and regional markets respond differently to new policies and access, South Korea continues to dance to its own pricing rhythm within the grand crypto economy. What a spectacle to behold! 🎉

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Summer Game Fest 2025 schedule and streams: all event start times

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Elden Ring Nightreign update 1.01.1 patch notes: Revive for solo players, more relics for everyone

- ‘This One’s About You’: Sabrina Carpenter Seemingly Disses Ex-Boyfriend Barry Keoghan in New Song Manchild

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

2025-06-08 18:57