Oh dear, it seems Bitcoin exchange-traded funds (ETFs) are having a bit of a meltdown! For the second day in a row, they’ve managed to shed a whopping $48 million, all thanks to a dramatic exit from Blackrock’s IBIT. Meanwhile, ether ETFs are throwing a party with their 15th consecutive day of net inflows. 🎉

Bitcoin ETFs in a Tailspin as Ether ETFs Keep the Good Times Rolling

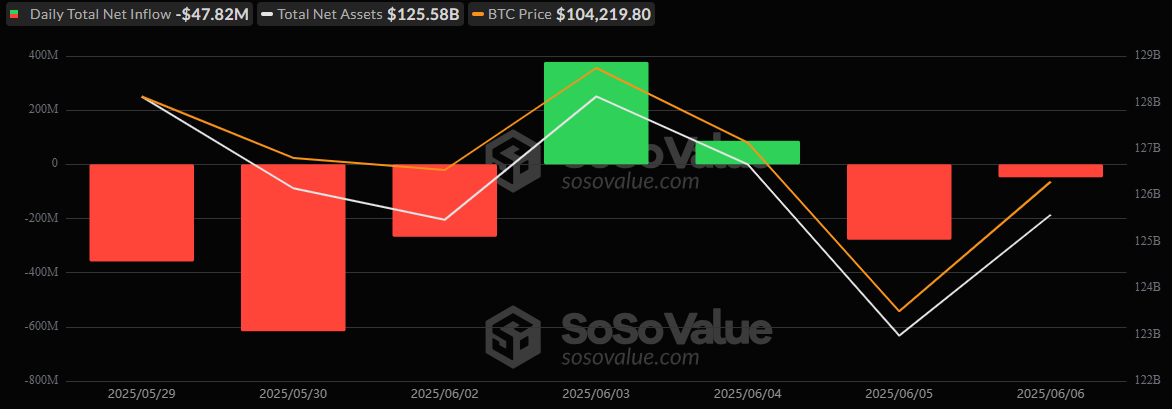

So, picture this: the bulls are strutting around the U.S. spot bitcoin ETFs, but it’s like trying to stop a freight train with a feather. Despite five bitcoin ETFs managing to pull in some cash, a staggering $130.49 million has fled from Blackrock’s IBIT, dragging the overall net outflow down to a dismal $47.82 million. Ouch! 😱

Leading the charge for inflows was Bitwise’s BITB, strutting in with a solid $31.81 million, while Fidelity’s FBTC followed closely with $22.77 million. Ark 21shares’ ARKB added a respectable $11.45 million, and Grayscale’s Bitcoin Mini Trust and Vaneck’s HODL chipped in with $9.24 million and $7.38 million, respectively. But alas, with IBIT’s dramatic exit, the day turned a rather unfortunate shade of red. 🟥

But wait, there’s more! Interest in the market is still sizzling, with a total value traded of $2.67 billion and net assets settling at a cool $125.58 billion. Not too shabby, right?

Meanwhile, Ether ETFs are riding high on a wave of investor confidence. On June 6, they celebrated their 15th straight day of net inflows, adding $25.22 million across two major funds. Blackrock’s ETHA contributed a delightful $15.86 million, while Grayscale’s Ether Mini Trust followed with a respectable $9.37 million. Talk about a winning streak! 🏆

Total trading volume in ether ETFs reached $339.49 million, with net assets holding steady at $9.40 billion. For ether exposure, the flow remains decisively green. 🌱

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-06-07 20:27