In a move that could only be described as a masterclass in economic chaos, US President Donald Trump has decided to impose a staggering 50% tariff on all goods imported from the European Union, effective June 1. Naturally, this announcement sent shockwaves through the crypto market, which was previously riding high on a wave of bullish optimism. Talk about a party crasher! 🎉

//beincrypto.com/wp-content/uploads/2025/05/image-221.png”/>

According to data from Coinglass, a whopping $64.13 million in crypto liquidations occurred over the last four hours. Long positions took the brunt of it, accounting for $34.05 million, while short positions were not far behind at $30.09 million. It’s like a liquidation sale, but nobody wants to buy! 🛒

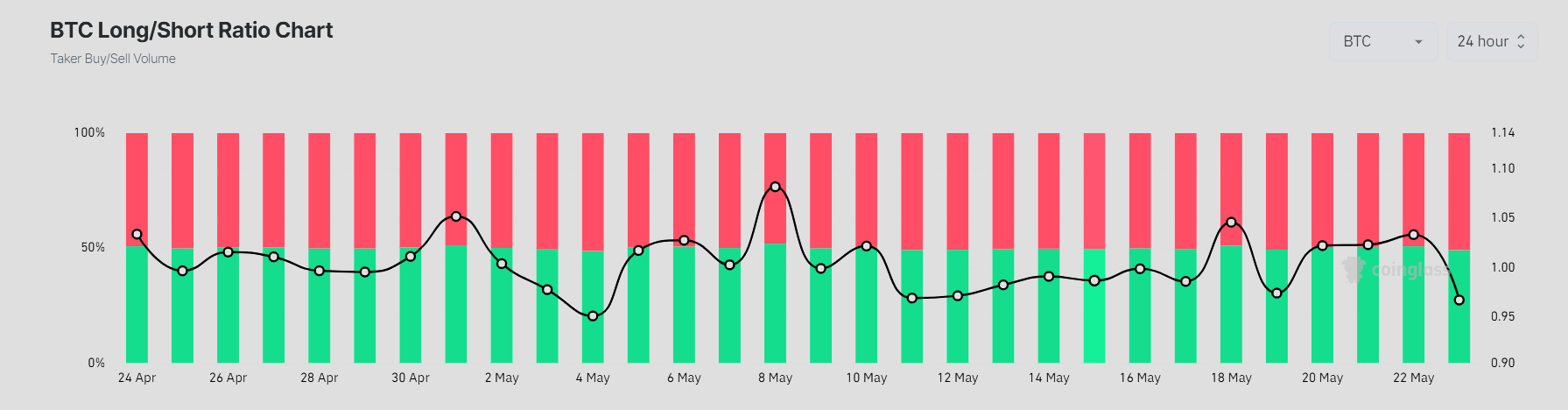

Bitcoin alone saw $24.4 million in liquidations, with Ethereum trailing behind at $15.16 million. Meanwhile, Bitcoin’s long-short ratio is hanging on by a thread, indicating a market that’s as confused as a cat in a dog park. Just yesterday, long positions were the belle of the ball at 54%. 🎭

Solana, XRP, and a host of altcoins also experienced sharp volatility, reflecting a market that’s about as stable as a tightrope walker on a windy day. Most altcoins saw a greater wipeout in long positions, suggesting that retail traders were caught completely off guard by this sudden policy shift. Surprise! 🎢

Rising Concern Over Macro Volatility

Earlier this month, the US-China trade deal provided a much-needed boost to the crypto market, hinting that macroeconomic uncertainty might finally be priced in. But alas, Trump’s EU threats have injected a fresh dose of anxiety. It’s like a bad sequel to a movie nobody wanted to see. 🎬

Analysts are warning that this tariff announcement could be the beginning of a broader economic disruption. European stock indices have taken a nosedive, and US tech shares are also feeling the heat. It’s a veritable market meltdown! 🔥

The trade war is back:

After a brief pause, Trump just threatened 50% tariffs on the EU beginning June 1st and 25% tariffs on Apple.

In 5 days, the S&P 500 has erased -$1.5 trillion of market cap.

What’s next? Here’s why you NEED to watch the bond market.

(a thread)

— The Kobeissi Letter (@KobeissiLetter) May 23, 2025

In the crypto world, the liquidation heatmap reflects a market caught between the fear of falling and the hope of a rebound. It’s like watching a seesaw with no one on either end. 🎢

//beincrypto.com/wp-content/uploads/2025/05/image-222.png”/>

In the past 24 hours, 162,419 traders were liquidated, totaling a staggering $567.65 million. While crypto has often acted as a hedge during traditional market stress, today’s moves show it is not immune to global policy shocks. Volatility may persist as geopolitical uncertainty mounts. Buckle up, folks! 🎢

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- ANDOR Recasts a Major STAR WARS Character for Season 2

2025-05-23 21:07