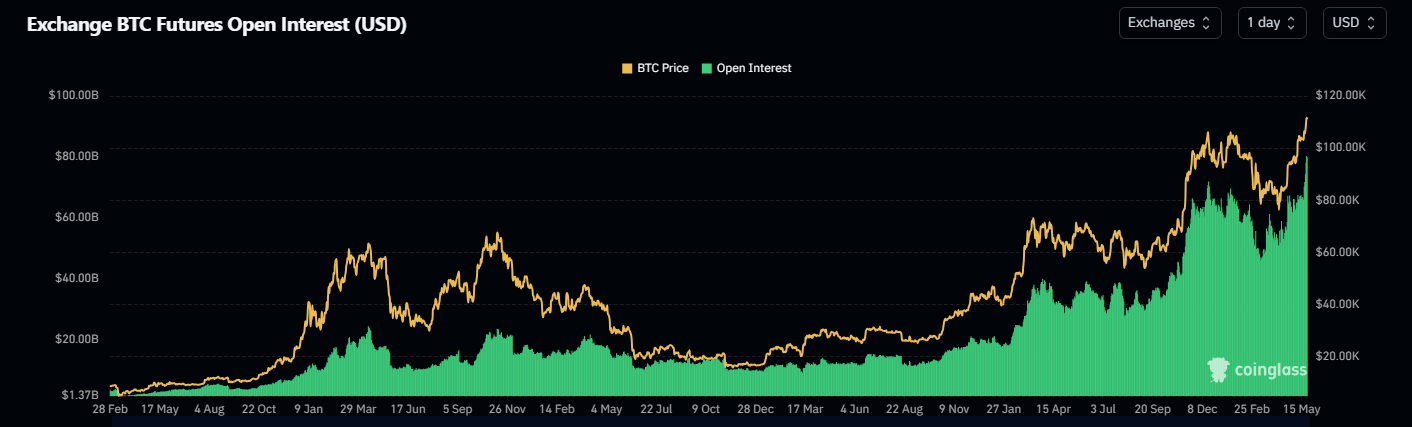

So, it turns out that Bitcoin futures are having a bit of a moment—like, a *really* big moment. This week, open interest has skyrocketed to a jaw-dropping $80 billion! That’s right, folks, a whopping 30% increase since the start of the month. It’s like everyone suddenly decided that betting on Bitcoin is the new black. Who needs a stable job when you can gamble on digital coins? 🎰

Futures Interest: The New Hot Trend

According to the ever-reliable CoinGlass (because who doesn’t trust a website with “glass” in its name?), over $80 billion in Bitcoin futures contracts are still open. That’s the largest total ever recorded! Traders are throwing caution to the wind, boosting their positions by about 30% since May 1. And let’s be real, many are using borrowed funds—because what’s life without a little debt, right? Just remember, if the market flips, it could be a *real* rollercoaster ride! 🎢

ETFs: The New Best Friend

In a plot twist worthy of a soap opera, spot Bitcoin ETFs have attracted over $2.5 billion in inflows this week. Yes, you heard that right—real coins are moving into vaults! Institutions are not just playing Monopoly with paper money; they’re actually buying Bitcoin. These flows are like a safety net when risky bets start to wobble. Who knew Bitcoin could be so… dependable? 🤷♀️

High Stakes: Option Bets Galore

And if you thought that was wild, wait until you hear about the Bitcoin options! Traders have piled in over $1.5 billion in bets at the $110,000 and $120,000 strike prices. There’s even more than $1 billion at $115,000, $125,000, and $130,000. It’s like everyone is convinced Bitcoin is going to the moon! But let’s be honest, it also means there’s a lot of money riding on a very narrow band of outcomes. Talk about putting all your eggs in one basket! 🥚

Expiry Risk: The Sword of Damocles

Now, here’s where it gets spicy: nearly $2.76 billion of Bitcoin contracts are set to expire today, May 23. The put/call ratio is at 1.2, which means slightly more bets are on a price drop than a rise. The so-called max pain level is hovering around $103,000—the point where the most options will finish worthless. If the price drifts toward that level, it could trigger some serious panic. Buckle up, everyone! 🎢

Bitcoin Price: Almost $112K!

In the latest episode of “As the Bitcoin Turns,” the spot price has climbed to around $111,150, peaking at $111,999 earlier today. That’s a new high, but it’s been a steadier climb than past breakouts. Some are pointing fingers at easing trade tensions between the US and China, while others blame Moody’s downgrade of US sovereign debt for the surge in interest in alternative stores of value. Who knew economics could be so dramatic? 📈

Looking ahead, traders will be glued to their screens, watching whether ETF demand can keep counterbalancing the risks from crowded futures and options markets. A small pullback could send prices tumbling faster than you can say “liquidation.” But if those ETF inflows keep coming, this rally might just have some legs. Either way, it looks like volatility is here to stay! 🎉

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- All 6 ‘Final Destination’ Movies in Order

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2025-05-23 20:48