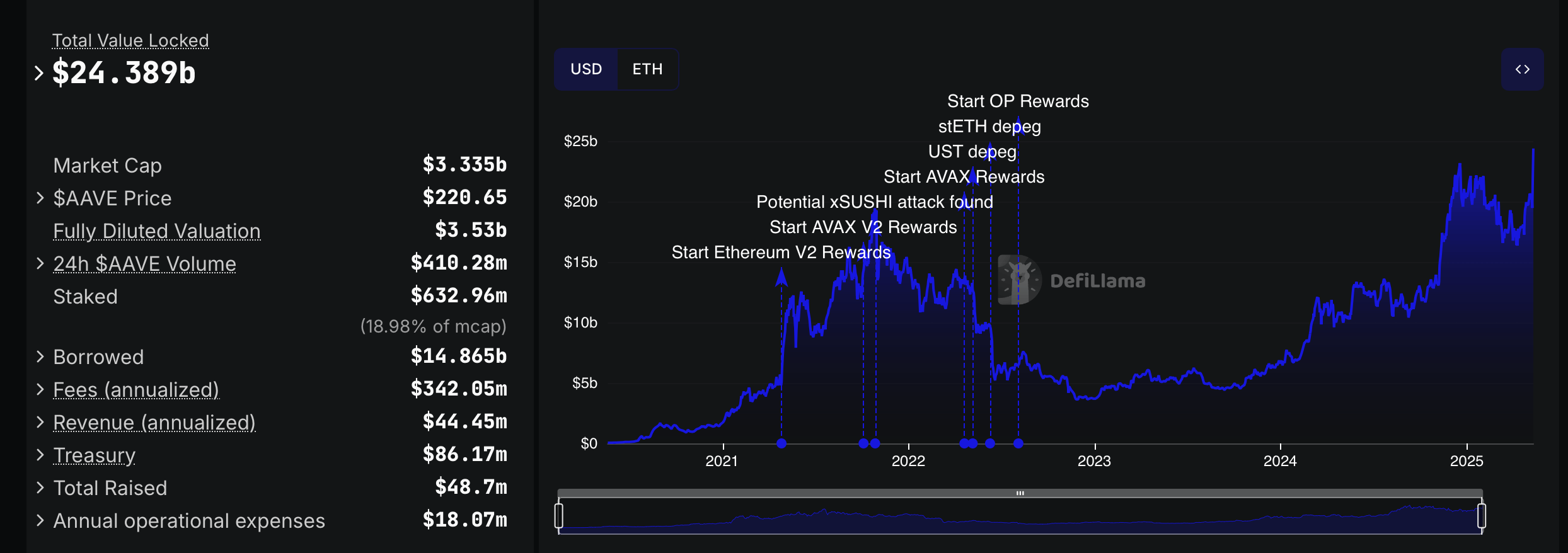

Now the value—oh, the value—locked up in that Aave contraption has thumbed its nose at the old highs and broken right on through to $24.389 billion. It’s like the county fair jar of jellybeans, only every bean’s a whole dollar and nobody’s guessing, they’re just piling ‘em in for keeps.

Out West in DeFi: When Aave Swelled Bigger Than the Dust Bowl

Here’s Aave, some digital barn-raising business, staking its claim as one of the biggest, baddest homesteaders in all of decentralized finance. They talk of a capitalization worth $3.335 billion, though what that means for a fella with holes in both pockets, nobody’s rightly sure. The whole shebang could go for $3.53 billion if the wind’s just right. The AAVE token itself? Trading hands at $222, as if you could swap it for a sack of potatoes at the general store. Volume’s $410.28 million, or enough to buy everyone in the county a pair of new boots and a round of lemonade.

There’s $14.865 billion borrowed on Aave—possibly by folks who need a new tractor, or possibly just because they like the idea. They’ve staked $632.96 million worth of AAVE, which isn’t quite the whole harvest but makes you wonder about the size of their wheelbarrows. Protocol fees toll up to $342.05 million for the year, with revenues trotting along behind at $44.45 million. The treasury rattles with $86.17 million in its tin, a real comfort on sleepless nights.

Meanwhile, the folks running Aave raised $48.7 million—must have been a barn dance no one forgot. And it all costs $18.07 million a year to keep the lights on, which is a lot of lantern oil and late suppers. They say both institutional and retail types are stirring up the dust, as defi comes back around like a stubborn mule that refuses to stay put.

Trace your eye down the TVL chart—like following cattle tracks through a dried-up creek. There’s the time of Ethereum V2, the Avalanche (AVAX) rewards roundup, the bewildering stETH and the infamous UST’s depeg (sure as a tornado in spring), plus Optimism (OP) programs luring folks with fresh pie. History’s all right there, wriggling on the numbers.

This Aave, it ain’t your granddaddy’s lending protocol; there’s no kindly banker with a green visor, just a big invisible hand that takes your coins, holds ‘em close, and maybe gives ‘em back with crumbs for your trouble. The loans are overcollateralized—sorta like demanding three chickens for a goose. Any digital critter can join, across chain and plain, provided it squawks the right way.

Aave offers up flash loans (quick as a fox in a henhouse), shifting interest rates faster than a poker game, and staking where every voice claims a vote—because who wouldn’t want a say in where the wagon rolls? All of it, a grand parade waving the decentralization flag, and everyone’s invited. No pitchforks required—just a wallet and a little bit of nerve.

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Does Oblivion Remastered have mod support?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- DODO PREDICTION. DODO cryptocurrency

- Oblivion Remastered: How to get and cure Vampirism

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Demon Slayer: All 6 infinity Castle Fights EXPLORED

- Summoners War Tier List – The Best Monsters to Recruit in 2025

2025-05-12 03:05