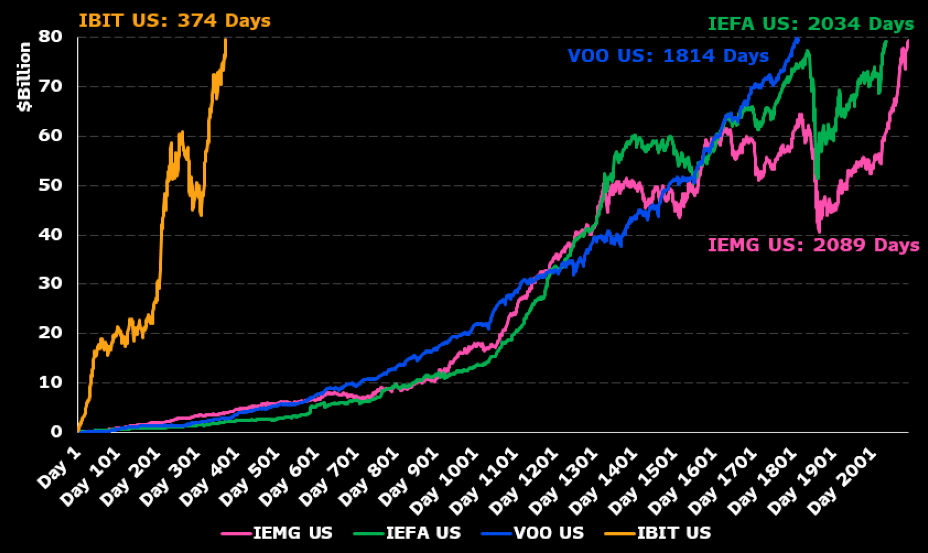

It’s official: Blackrock’s IBIT has become the fastest exchange-traded fund (ETF) to reach a whopping $80 billion in assets under management (AUM). And by “whopping,” I mean “utterly absurd.” It took a mere 374 days to hit this milestone, which is roughly the same amount of time it takes to watch the entirety of “Days of our Lives” from start to finish. 📺

This achievement is all the more impressive when you consider that the previous record-holder, Vanguard’s S&P 500 ETF ($VOO), took a leisurely 1,814 days to reach the same mark. That’s like the difference between a cheetah and a sloth on valium. 🐯

According to Eric Balchunas, Senior ETF Analyst for Bloomberg, IBIT has surged to $83 billion in AUM, making it the 21st largest ETF in the world. Because who needs actual bitcoins when you can have a fund that tracks the price of bitcoins? 🤔

This news comes as BTC hits a new all-time high of over $118,000, because why not? It’s not like the value of bitcoin is tied to anything tangible or rational. 🚀

The broader market for spot bitcoin ETFs has also crossed the $140 billion mark, because apparently, people can’t get enough of investing in things they don’t fully understand. 🤷♂️

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Gold Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

2025-07-12 01:57