Well, well, well, if it isn’t Bitcoin (BTC) deciding to pull a fast one and strutting glamorously to a jaw-dropping new all-time high of $118,000 this fine morning. But before you drown in champagne and order a yacht, let’s not forget that lurking in the shadows is a $4.3 billion Bitcoin options expiry, waving a caution flag like it’s at a Formula 1 race. 🏁😅

The spot market is flexing its muscles, but the options market? Oh, it’s acting like a shy kid at a school dance, with institutional investors hanging back and twiddling their thumbs instead of jumping in. Talk about a moody crowd.

Meanwhile, Bhutan, probably seeing the price as a golden opportunity, is in full-on sell-off mode, offloading another 100 BTC today. Who knew the Royal Government had such a knack for flipping crypto? Perhaps they should start a financial advisory service! 💼💰

Bitcoin Options Put-Call Ratio: A Recipe for Bearish Sentiment

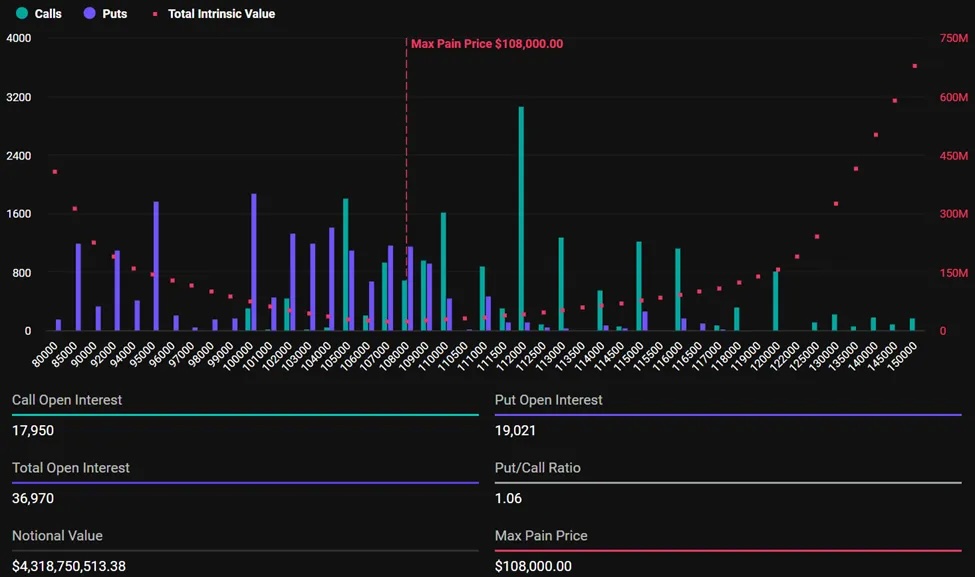

Now, you’d think with BTC inching toward that shiny $120K mark, it would be all cheers and confetti. But today’s options are hanging around with a notional value of $4.3 billion, accompanied by a whopping total open interest of 36,970 contracts. They scream excitement—just not the kind you’d hope for.

According to the wise folks at Deribit, the maximum pain point is sitting pretty at $108,000. This translates to a major ouch factor for option holders who find themselves in the wrong position. As if trading didn’t have enough drama already!

Let’s break it down: a Put-to-Call Ratio (PCR) above 1 means more people are betting against BTC rather than for it. Today, the PCR is frolicking at 1.06, suggesting traders are feeling a bit bearish, which is likely as welcoming as a cactus hug. 🌵

Bitcoin Options Expiry – Source: Deribit

Meanwhile, the analytics whizzes at Greeks.Live are sniffing a rather stale scent of cautious market sentiment, noting the impressive high-leverage positions yet minimal institutional involvement, akin to watching a high-stakes poker game without any serious players. 🎲

July 11 Options Data: 37,000 BTC options expiring with a Put Call Ratio of 1.05, a Maxpain point of $108,000 and a notional value of $4.3 billion.240,000 ETH options expiring with a Put Call Ratio of 1.11, Maxpain point of $2,600 and notional value of $710 million. The smell of…

— Greeks.live (@GreeksLive) July 11, 2025

In the latest gossip, some traders have been throwing around the idea of 500x leverage positions, boasting they’re like skydiving without a parachute—thrilling, but maybe not the best idea? But hey, your risk tolerance might just be a little more adventurous than mine.

Nevertheless, new positions are popping up like popcorn in a microwave, with traders chasing something called “100% signal” trading strategies. It’s a bold mix of confidence and reckless abandon that sounds like a great recipe for a thrill ride. 🎢

Here’s Bhutan Again, Offloading Another 100 BTC

The Royal Government of Bhutan has clearly figured out that this Bitcoin price rally is the perfect time for some strategic profit-booking, much to our surprise!

Earlier today, they shuffled another 100.215 BTC—worth around $11.83 million—into the deep pockets of Binance. Not too shabby for a government that bought 213 BTC just a day before. Too bad they didn’t think to save some for a rainy day! ☔️

In the past year, Bhutan has offloaded a total of 2,262 BTC, transforming it into approximately $200.46 million across six sales—at a rapid-fire average price of $88,612 per Bitcoin. It seems selling BTC is just another day at the office for them!

Even after such fervent selling, Bhutan still holds onto a treasure chest of 11,611 BTC valued at about $1.37 billion. I guess this means they can afford to splurge on some new hiking trails or whatever the Royal Government fancy in their spare time! 🏔️💎

The Royal Government of #Bhutan deposited another 100.215 $BTC($11.83M) to #Binance 20 minutes ago.

In the past year, #Bhutan has sold 2,262 $BTC ($200.46M) across 6 batches at an average price of $88,612 and still holds 11,611 $BTC($1.37B).

The #German government sold all…

— Lookonchain (@lookonchain) July 11, 2025

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Gold Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

2025-07-11 19:37