- Guess what? An Ethereum whale just woke up after four years of napping and pulled out 1,202 tokens worth a cool $2.2 million. Talk about a beauty sleep!

- Long-term Ethereum holders are clearly stacking up – some people just can’t resist holding onto their precious ETH.

So, after Ethereum hit the $1.8k mark ten days ago, you’d think it would take off like a rocket. But nope, here we are, stuck in a consolidation phase. ETH’s been bouncing around between $1727 and $1877 like it’s trying to find a comfy spot on the couch.

Despite this sluggish behavior, Ethereum’s faithful holders aren’t panicking. Nope, they’re sitting tight, holding their ground like the real MVPs of the crypto world.

Unrealized losses? Pfft, doesn’t faze them. Even with Ethereum’s price just chilling in neutral, these holders are adding to their stash like it’s Black Friday.

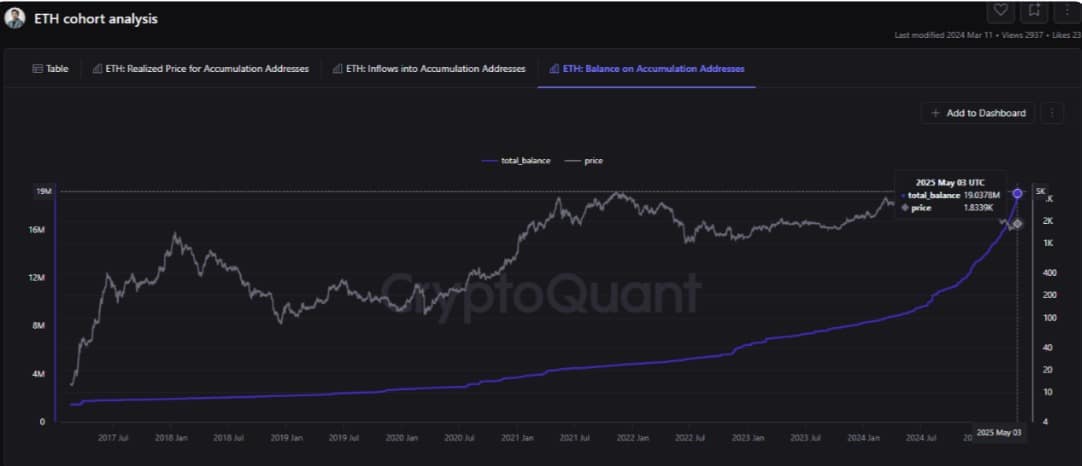

According to CryptoQuant, the “accumulating addresses” (fancy term for people who just keep buying) have boosted their holdings by a jaw-dropping 22.54%. In just a couple of months, ETH holdings have gone from 15.5356 million to 19.037 million. Is anyone else tired just thinking about how much buying that must’ve involved?

But wait, there’s more! The whales – yes, the big kahunas of the crypto sea – are also getting in on the action. One whale woke up after a four-year nap (seriously, they slept through an entire bear market!) and withdrew 1,202 ETH from Binance, worth a whopping $2.2 million. Good for them. Maybe they just needed a little nap to re-charge their crypto addiction?

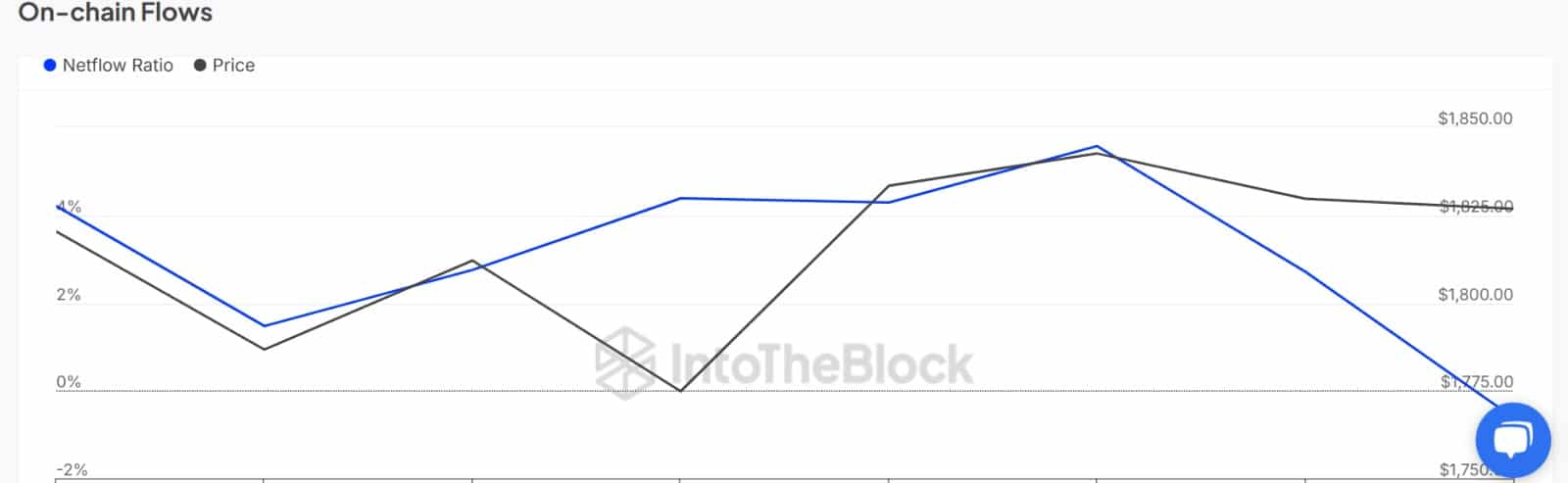

This whole “whale thing” isn’t just a fluke – the Large Holders’ Netflow to Exchange Netflow Ratio (yes, that’s a mouthful) shows that the big fish are quietly hoarding ETH, as the ratio drops to -0.62%. Negative values mean whales are pulling more ETH off exchanges than they’re depositing, which is just another way of saying, “They don’t plan on selling anytime soon.” What a shocker!

And guess what? This behavior isn’t exclusive to the big guys. Nope, even the small-time players are joining the Ethereum withdrawal party. Ethereum’s Exchange Netflow has been negative for six out of the past seven days. You know what that means? People are holding tight, preparing for Ethereum to do something big – hopefully, that’s not just “take a nap again.”

With all this accumulated ETH and rising scarcity, Ethereum’s stock-to-flow ratio has surged to its highest point in a year: 374. When there’s less ETH available and more people want it, well… guess what happens next? You know, supply and demand… it’s like basic math or something.

Now, let’s talk about what this means for ETH: Even though the price is taking its sweet time, the accumulating trend signals that people believe in Ethereum’s value like they believe in their morning coffee. It’s strong, it’s reliable, and it might just make the price go up.

Simply put, Ethereum holders are in it for the long haul. They’re betting big that ETH will break out of its current consolidation and shoot toward $2K. But, like all good reality TV, there’s drama. If the battle between holders and the speculative bears continues, it could be a while before ETH breaks free from this price cage. But hey, who doesn’t love a good underdog story?

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-05-05 15:06