Oh, Ethereum. There it is, teetering just under $2,000, like a teenager on the edge of a trampoline, trying to decide if it’s worth the jump. The broader market? Yeah, it’s showing signs of life—slow, awkward signs—but hey, at least it’s not dead. After what felt like an eternity of sideways price action, and with all the “SELL NOW” buttons slowly losing their appeal, the bulls are starting to creep back in. Momentum is finally building, like that one guy at the gym who’s been lifting 5-pound weights for a year but is now eyeing the 10-pounders. Ethereum’s been hanging out above $1,800, and there’s a whiff of a breakout in the air—though no one’s holding their breath just yet.

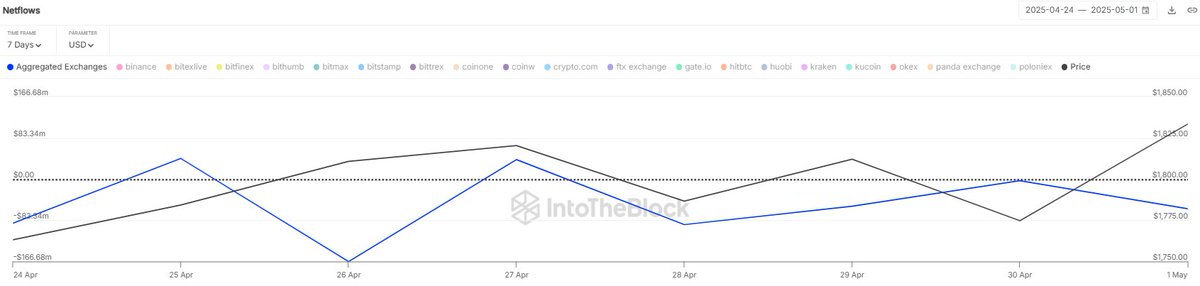

But here’s where it gets spicy. According to some fancy on-chain data from IntoTheBlock, Ethereum’s been making a quiet escape from centralized exchanges. And by quiet, I mean $380 million worth of ETH just walked out the door in the last week. This isn’t just some casual cash-out either—this is the type of behavior that suggests investors are getting cozy, tucking their ETH into cold storage like it’s their favorite hoodie, not preparing to auction it off to the highest bidder. If this trend continues, we might be in for a not-so-slow climb, but don’t get too excited just yet.

We still have that pesky $2,000 resistance level staring us down. It’s like the bouncer at the VIP section of a club. Ethereum wants in, but that velvet rope won’t budge. If Ethereum manages to break through, we could be in for a wild altcoin party—but until then, it’s like waiting for the momentum to show up at a party where everyone’s a little too shy to dance.

Ethereum Faces Critical Test Amid Accumulation Trend

Let’s talk about this critical battle Ethereum’s been facing. Picture this: Ethereum’s trading over 55% below its December highs, clinging desperately to the $2,000 zone like it’s holding onto a lifeline. The broader crypto market is trying to make a comeback, but ETH’s still in the middle of a tug-of-war between hopeful buyers and that looming supply overhead. You can practically feel the tension as buyers try to build momentum—because they know that if they don’t, the price could tumble into the abyss, where the next stop might be $1,700 or even lower. It’s like a rollercoaster that’s about to crest the peak, and you’re holding onto your seat for dear life.

But wait—on-chain data? Oh, that’s looking better. IntoTheBlock tells us that centralized exchanges have been shedding Ethereum like it’s last season’s fashion. Over the past week, net outflows hit around $380 million. Investors are obviously preparing for a move—either that, or they’re starting a new hobby called “hodling.” Whatever it is, it’s reducing the sell-side pressure, which could lay the groundwork for some serious upside. Still, don’t book your tickets for the moon just yet; there’s more than a little caution in the air.

As for the sentiment, it’s like watching a thriller movie—you’re on the edge of your seat, but you’re not sure if it’s going to be a happy ending. Some analysts think Ethereum is about to bust through and skyrocket, while others warn that macroeconomic factors could still drag ETH into a deeper slump. Grab your popcorn. The next few days are going to be crucial in determining whether Ethereum will get its breakout or just break.

ETH Price Analysis: Testing Key Resistance

Here’s where the rubber meets the road: Ethereum is hanging out at $1,837 after a few days of sitting under $1,850 like an awkward date. It’s been trying to form a short-term bullish structure, kind of like a puppy learning to walk—slow and steady. The price has been climbing, but now it’s facing some serious resistance. That $1,850 level is like the top shelf in a store that’s just a bit too high to reach without a stool. The price has been here before, and it’s wondering if it should just skip the ladder and get a step stool.

Volume has been… fine. Not great, but fine. Bulls are around, but they’re not exactly stomping through the door. The 200-day Simple Moving Average (SMA) is sitting at $2,271, while the 200-day Exponential Moving Average (EMA) is at $2,456. Both are looking pretty far away, like distant relatives you only see once a year at Christmas. Breaking through these levels would send all the right signals, but right now? Ethereum’s got to prove it can close above $1,850. If it can’t, we’re looking at another awkward retreat to $1,700 or worse.

For now, all eyes are on the price holding above recent lows and forming those higher lows—because that’s how momentum starts to build. A break above $1,850 would open the door for Ethereum to move into the $2,000–$2,200 range, which, let’s be honest, sounds a lot more fun than hanging out in the $1,800s.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Gold Rate Forecast

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Minecraft update ranked from worst to best

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

2025-05-03 23:12