The U.S. crypto scene is having a field day, as spot bitcoin and ether exchange-traded funds piled up nearly $700 million last Friday, sealing the week with a flourish. Don’t worry, though, it’s not your average crypto story – this one has a twist.

Blackrock’s Bitcoin ETF Shakes Down $675M in a Single Day, Leaving Rivals in the Dust

It was a classic crypto frenzy. The bitcoin ETFs closed the day strong, hauling in $674.91 million while the ethereum ones crawled up by a modest $20.10 million. The big winner? Well, no surprise – Blackrock’s IBIT took home the lion’s share. Rivals? They just kind of stood there, like kids watching the cool kid get all the attention at the school dance.

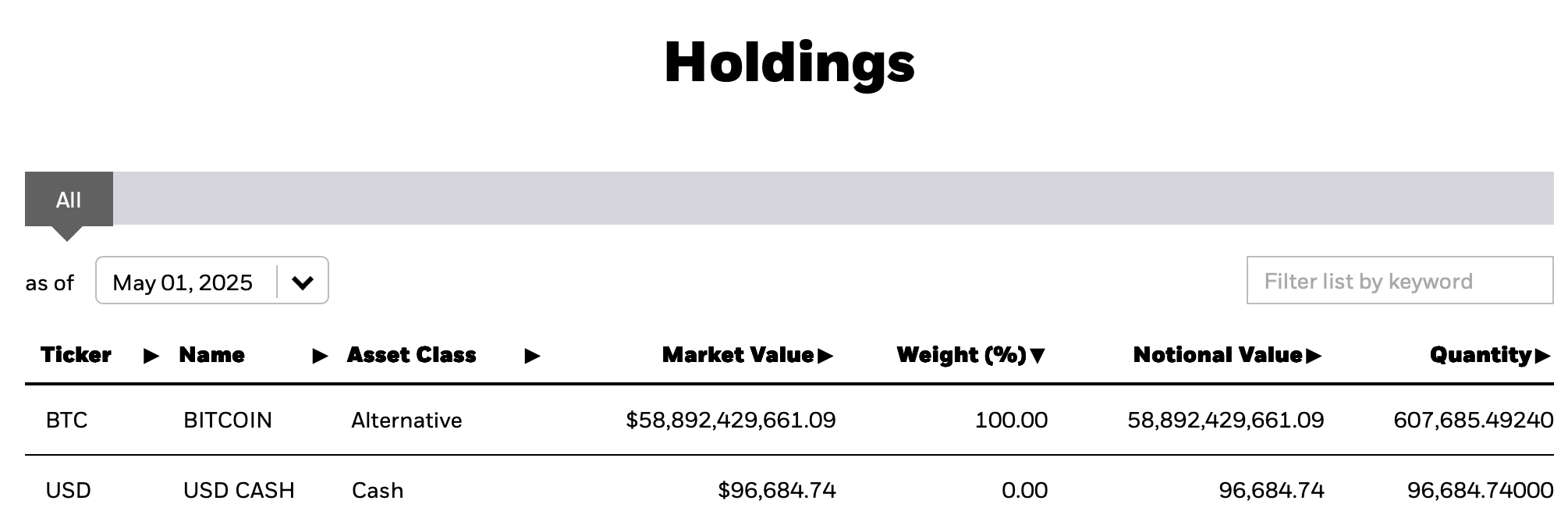

The rest of the pack didn’t get much action. Meanwhile, Blackrock’s IBIT pocketed all of that $674.91 million, pushing its total stash to 607,685.49 bitcoins, worth a casual $58.5 billion. To put it mildly, they’re doing a bit better than your average investment fund. Since January 2024, the twelve funds have raked in a jaw-dropping $40.24 billion in net inflows. I’m sure that doesn’t even cover their coffee budget.

The Ethereum ETFs followed suit, but not as impressively. The $20.10 million came in, and once again, it was all Blackrock’s ETHA that got the spoils. The other eight? They just watched. From their launch last year in July to now, they’ve managed to scrape together $2.51 billion in inflows. But hey, better luck next time, right?

Collectively, the nine ether funds now command $6.4 billion in ether, about 2.87% of its market cap. But when you look at the twelve spot bitcoin ETFs, their combined value comes to a hefty $113.15 billion, which is 5.87% of the total bitcoin market cap. And yes, you guessed it – Blackrock’s IBIT holds a lion’s share of that, controlling roughly 51.71%. If this was a game of poker, Blackrock would be holding all the aces.

Read More

- Does Oblivion Remastered have mod support?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Elder Scrolls Oblivion: Best Bow Build

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Everything We Know About DOCTOR WHO Season 2

- 30 Best Couple/Wife Swap Movies You Need to See

- Persona 5: The Phantom X Navigator Tier List

- Luck stat in Oblivion Remastered, explained

- Insane ‘Avengers: Doomsday’ Theory Suggests Dr. Doom Will Attack Loki’s TVA and the God of Mischief Will Assemble the Multiversal Superheroes for Help

- Is Taylor Swift And Travis Kelce’s Love Story Being Adapted To Screens? All We Know About Christmas In The Spotlight So Far

2025-05-03 21:03