May 2025, and in the world of Ethereum, whales are misbehaving again – honestly, you’d think with all their money they’d keep it together for a single week. Apparently not.

In classic whale fashion, they’re flip-flopping between “I’m never letting go!” and “Sell everything, even the yacht!” Investors, strap in; it’s like watching your parents argue about dinner over Monopoly.

Enter: The Whale Wars 🐋

First up: Mega-Whale #1 just bought 3,029.6 ETH for a cool $5.74 million. Big flex. And yet, as the market wobbles (classic crypto), said whale is nursing a $142,000 loss and probably feeling as salty as a blockchain maximalist at an NFT art show.

On May 1st, the blockchain airwaves (thanks, Lookonchain) buzzed as multiple whales gulled up thousands of ETH in only two hours. No FOMO there, just regular “we definitely know something you don’t” whale confidence powering through the dip.

But, naturally, not everyone’s in it to hold. Some whales decided to dump their holdings faster than you can say “bear market.” On May 2nd, OnchainLens spotted a whale shoving 2,680 ETH onto Kraken, eating a bitter $255,000 loss. Maybe someone needed to pay for a new yacht? 🛥️

Meanwhile, speed-demon Whale #3 YOLOed 3,000 ETH to Kraken in just 10 minutes. It’s the blockchain equivalent of a Black Friday sale at the panic aisle.

10 minutes ago, a whale 0xaDd deposited 3k $ETH (~$5.53M) into #Kraken.

Those $ETH were bought since ICO and have been dormant in 3 years before depositing.

Just now, he still has 2k $ETH (~$3.69M) in his wallet.

Address:

— The Data Nerd (@OnchainDataNerd) May 2, 2025

Special mention: the ancient whale from the 2015 ICO is back, offloading 6,000 ETH for a mere $10.92 million profit. Next up: a TikTok about how to HODL for a decade.

Of course, somebody’s got the urge to short the thing. On May 1st, a whale increased their already ambitious short by borrowing 4,000 extra ETH, bringing the total to 10,000 ETH—approximately $18.4 million worth of “I told you so, Jerry.”

So, in the left corner: diamond-hands, accumulating. In the right: paper-hands, dumping. Never a dull moment. 🍿

Market Drama & Feeling the Feels

Meanwhile, outside the whale pool, the market’s swinging between euphoria and existential crisis. ETH scored a 10% rise this week, only to trip over its shoelaces and slide back to $1,842. The ghosts of March 2025 run wild, when ETH bravely hit $2,500, before remembering it prefers drama.

Still, the institutions are swooping. Last week, Ethereum investment funds gulped $183 million in inflows, after eight weeks of giving it the cold shoulder. The Ethereum spot ETF rallied with a $6.49 million net inflow yesterday. Apparently someone’s cousin at Goldman Sachs still believes in fairy tales.

On the other hand, that 10,000 ETH short is hanging over the market like your boss during Friday happy hour—if sentiment dips, ETH could be in for a rough ride.

Retail investors are, predictably, hiding under their digital beds. Trading volume is down 10% in 24 hours, as everyone quietly wonders: “Is this the bottom, or just the middle of the Jenga tower?”

Risks, Rewards, and Existential Dread

ETH investors are at a crossroads, and no, there’s no helpful sign that says ‘Riches’ or ‘Rags.’ Whale sell-offs (giant short included) could drag ETH lower, especially since the market is about as overextended as your friend who maxed out five credit cards on dog coins.

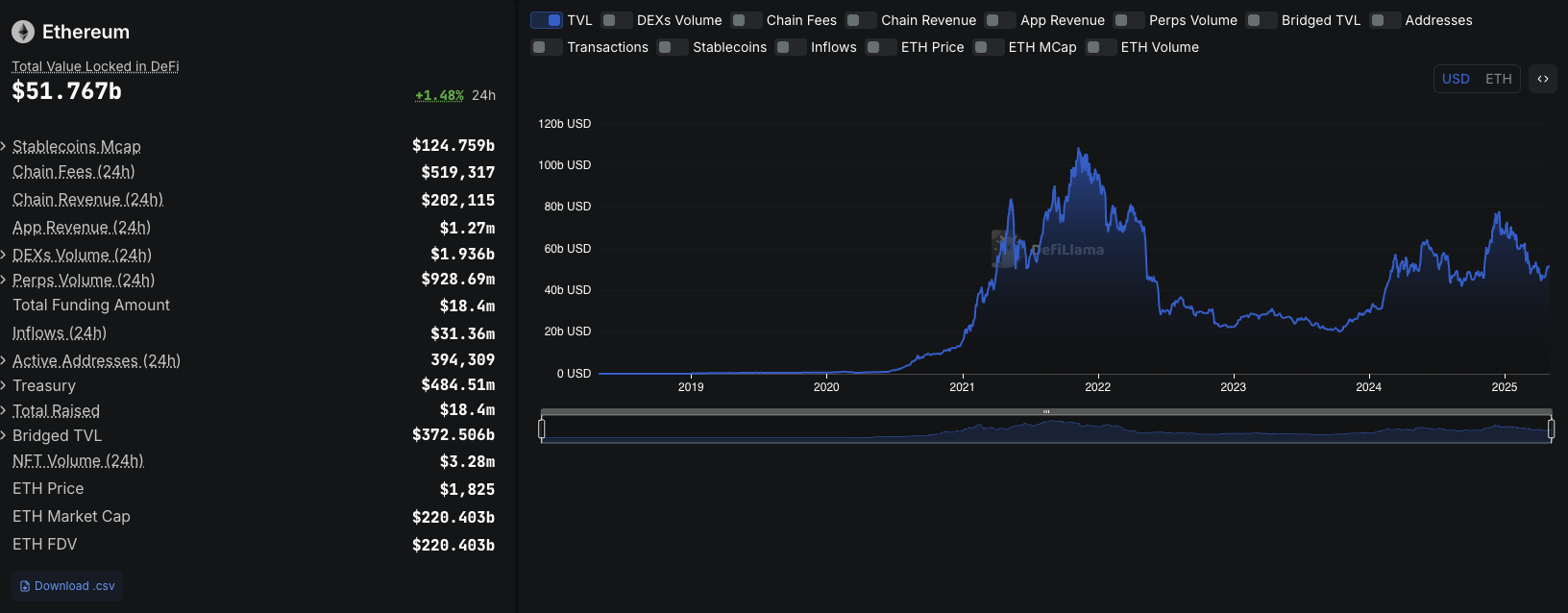

But opportunity beckons! The big-spending whales accumulating say, “Hey, we’ve done this dance before – good things come to those who wait, probably.” DeFi is still booming, with Ethereum’s total value locked sitting at a monumental $52 billion, making your piggy bank look very silly by comparison.

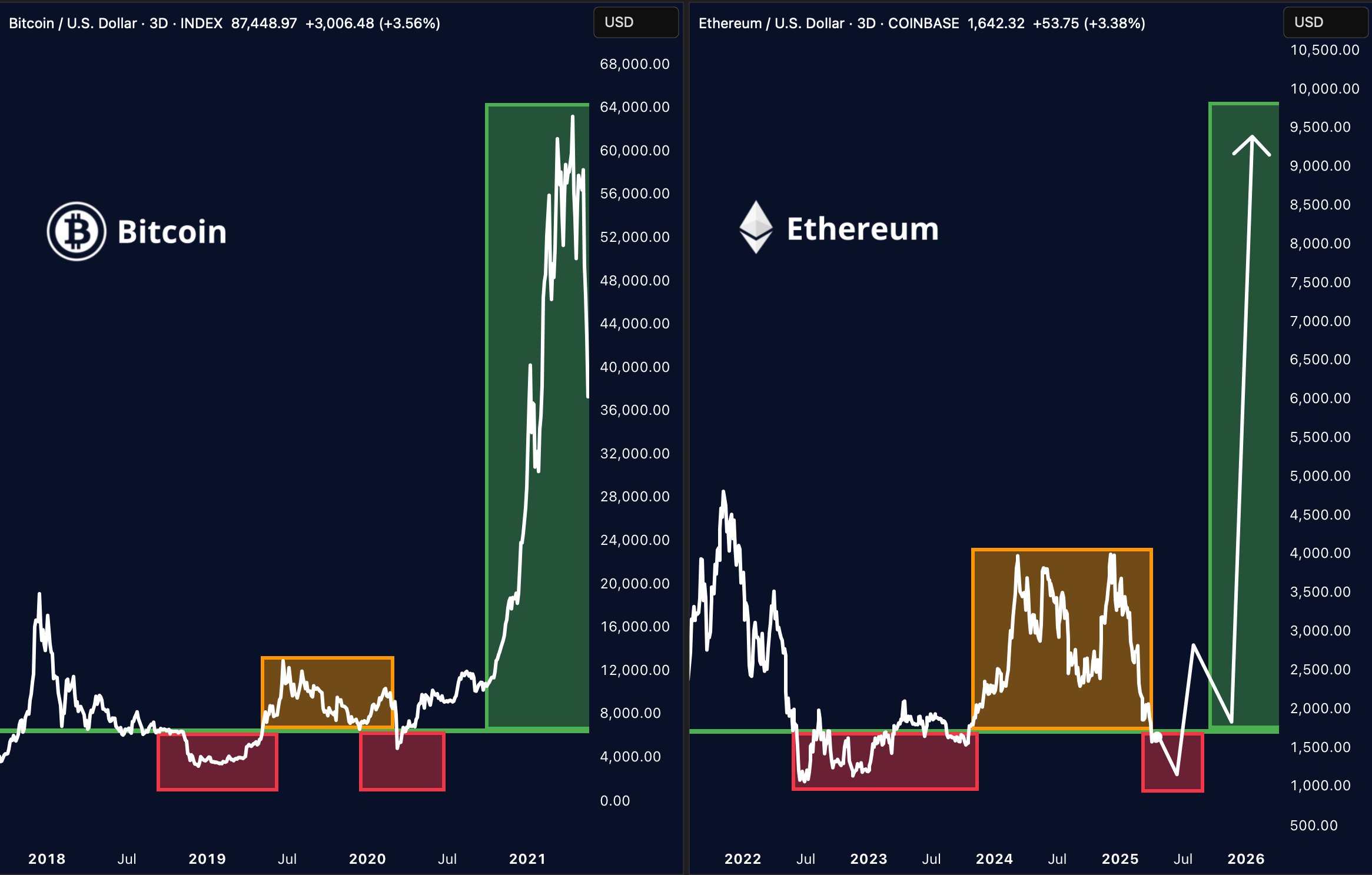

Analyst Merlijn popped up to compare ETH’s price structure to Bitcoin in 2020 – read: “If history repeats, moon incoming!”

Don’t get too comfy, though. Ethereum risks losing its brightest to Team Solana because they throw better parties (and have shinier tech). Tangled in the plot: Ethereum 2.0, Layer 2 sidekicks like Arbitrum and Optimism, and—your favorite emotional rollercoaster—market indicators.

Investors are eyeing these low ETH prices, wondering if now’s the time to buy the dip or just buy some ice cream and hide. Either way: watch the whales, watch the charts, and maybe keep a stiff drink handy. 🥂

Read More

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

2025-05-03 12:38