Ripple’s XRP has been on a wild ride since June 22, surging by nearly 30% over the last couple of weeks. Of course, this rally didn’t happen in a vacuum—nope, it was largely driven by a renewed interest across the broader market, which has pushed many assets to multi-week highs. Who doesn’t love a good rally, right?

But—and here’s where it gets interesting—there’s a catch. As always, there’s a catch. Despite all the good vibes and bullish sentiment, two key on-chain signals are waving red flags, suggesting that a pullback might be just around the corner. Get ready, folks!

XRP Rally Faces Test as Long-Held Coins Return to Market

Let’s break it down: after XRP took a dive to $1.90 during a rather painful intraday trading session on June 22, it has been steadily climbing back up like a rockstar on tour. Now, it’s sitting pretty at $2.58, a 30% rise. Not too shabby, huh?

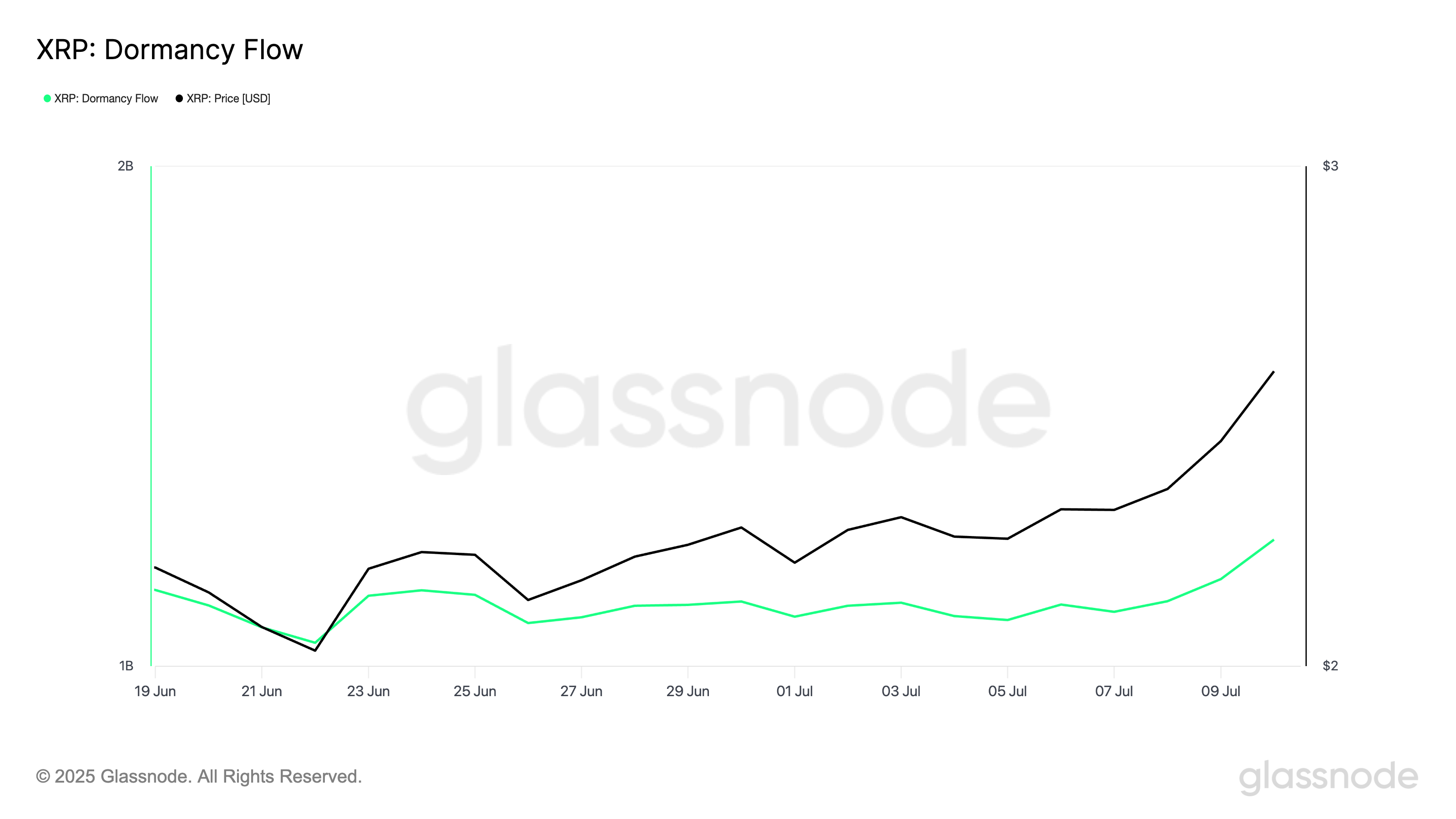

Since the rally kicked off, XRP’s Dormancy Flow has been on the rise. If you’re scratching your head wondering what in the world that means, don’t worry—I’ve got you. The Dormancy Flow measures the activity of long-term holders (LTHs)—you know, the ones who have been hanging onto their XRP for dear life. When it goes up, it signals that these long-term holders are starting to move their coins. Translation: they’re finally getting off their hands and either selling or shifting coins. Sounds like the end of a good time, right?

This uptick in Dormancy Flow indicates that seasoned investors are confident enough to start cashing in on their investments. And you know what happens when seasoned investors start selling? That’s right, it could lead to a bearish reversal. Buckle up!

Traders May Want To Lock In Profits

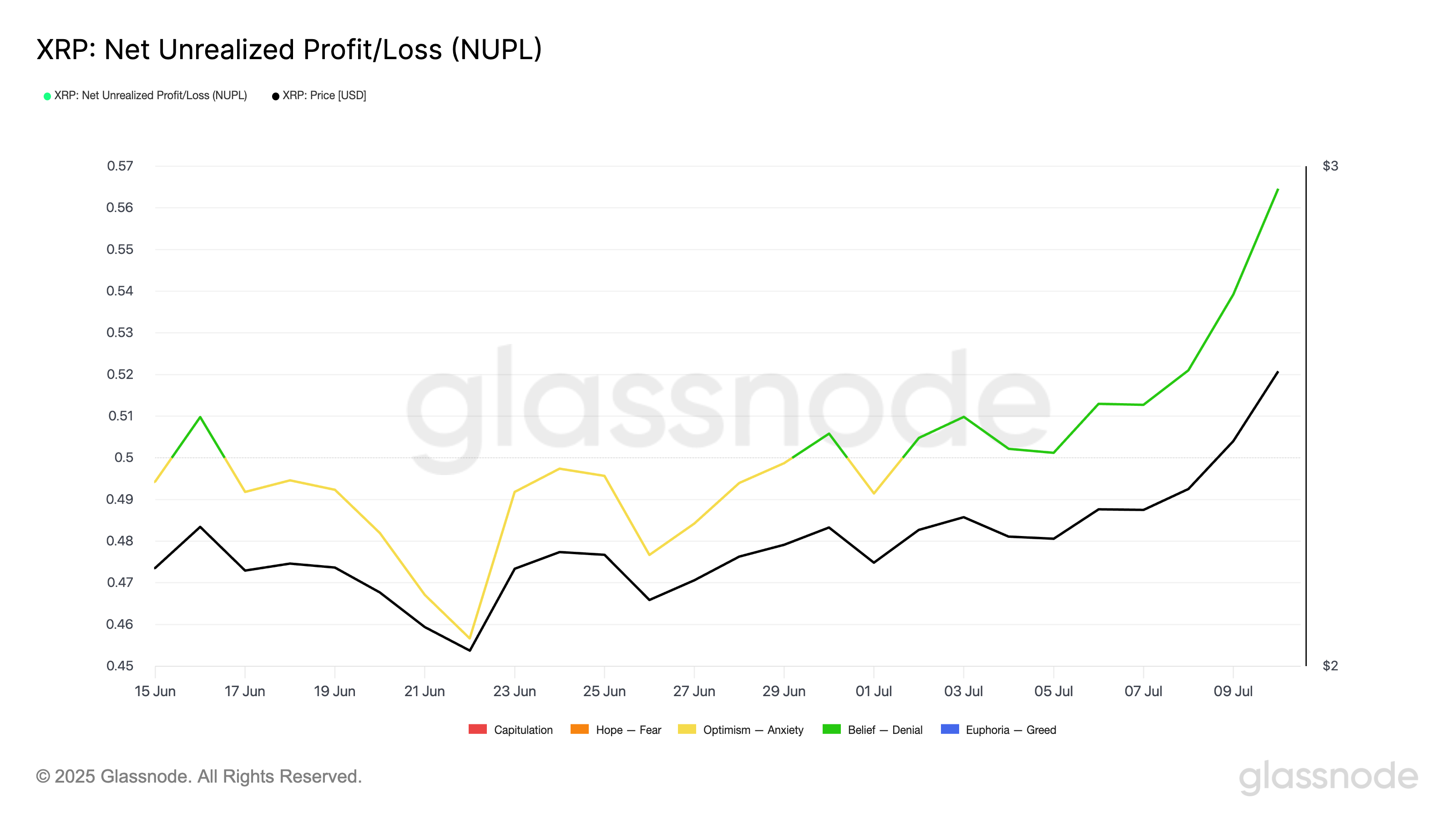

Moving on, there’s another metric you should be aware of: Net Unrealized Profit/Loss (NUPL). And guess what? According to Glassnode, XRP is currently sitting pretty in a phase called “belief”—yes, belief. I mean, who wouldn’t believe after a nice run-up like this?

Now, NUPL measures how much unrealized profit or loss an asset has compared to its original value. When it’s in the “belief” phase, it means investors are sitting on some serious gains. And you know what happens when people realize they’ve got some serious gains, right? Yep, they start thinking about cashing out. So, while the mood is all happy and “I’m a genius” right now, it might not last.

As more LTHs start moving their coins, we could see a selling wave that could trigger a price correction. So, maybe it’s time for some traders to lock in those profits before the music stops. Who needs to hold on to XRP like it’s an unclaimed treasure chest, right?

XRP Bulls Show Signs of Exhaustion

Oh, and one more thing. On the daily chart, XRP’s Relative Strength Index (RSI) is flashing a warning sign. As of now, it’s above 70 at 72.95. What does that mean? Well, it suggests that the market is getting a little overheated—kind of like that moment when you think your coffee is too hot to drink, but you go ahead and sip anyway. Bad idea!

The RSI is a nifty little tool that shows whether an asset is overbought or oversold. Anything above 70? It’s overbought and probably due for a cool-down. Below 30? Oversold and could bounce back. XRP’s RSI is creeping up to 73, so yeah, buyers might be running out of steam.

If this trend continues, the price of XRP could slip to around $2.45. But hey, if buyers keep the pressure on, we could see it push up to $2.65. Talk about a rollercoaster.

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Gold Rate Forecast

- EUR UAH PREDICTION

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR TRY PREDICTION

2025-07-11 14:01