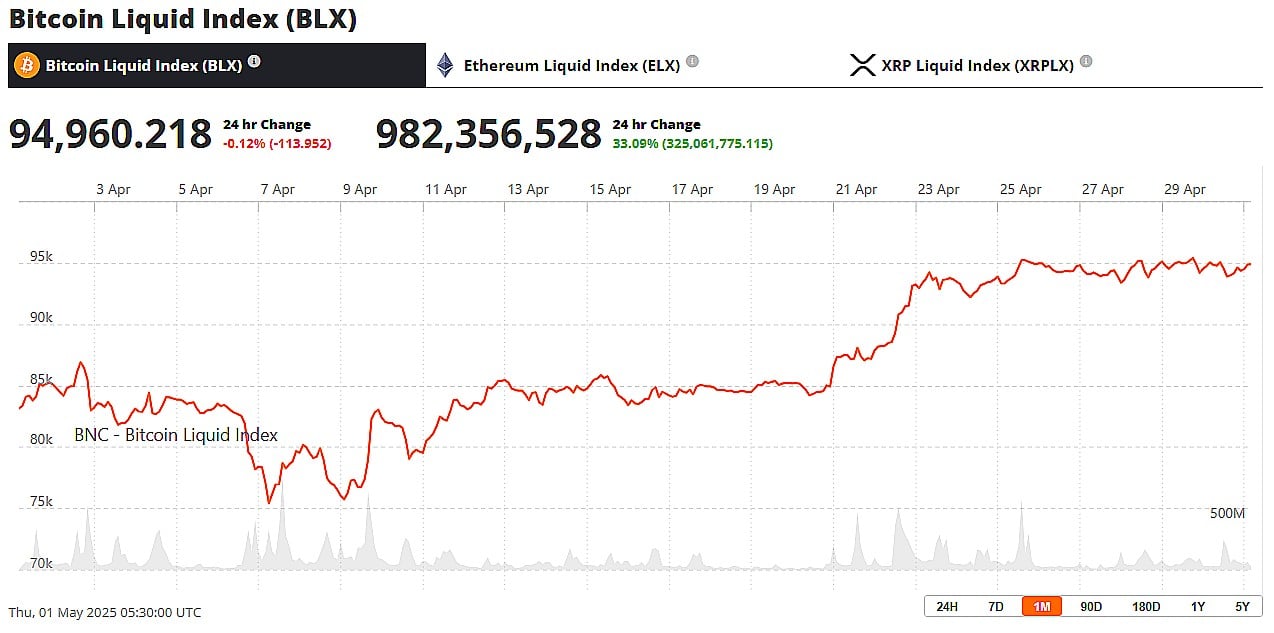

Picture this: Bitcoin, that enigmatic creation—born somewhere between genius and madness—wanders aimlessly in a narrow corridor, exhausted, yet obstinately advancing by a meager 1%. Ah, such is the fate of heroes: advancing, then halted by an invisible wall at $95,000! The traders, cunning as devils in starched shirts, wait in ambush. At the threshold they pounce, selling, profit-thirsty, sealing Bitcoin beneath their arbitrary ceiling—once more, they play at gods.

Yet, the heavy clouds roll in from across the ocean. What is America if not a vast theater where a nation’s fortune is measured in decimal points and dreams? The Commerce Department, that oracle of doom, declares a 0.3% contraction in GDP; a nation’s pulse falters. Growth of 2.4%—forgotten, replaced by the gnawing anxiety of recession. Wall Street, prophets bewildered, had anticipated a meager salvation—alas, their calculations, as accurate as a Dostoevskian debtor’s promise.

The cause? Imports, the specter of tariffs rising like Raskolnikov’s fever. Americans, rational or merely possessed, hoard their goods. President Trump, sage or jester (one never truly knows), attempts comfort: “The children—why, let them play with two dolls! Twenty? Unnecessary; let us embrace deprivation with laughter! And if those two cost a little more, so be it.” Such is oligarchic wisdom—parental, if your parent is an unreliable narrator. 🪆🪆

Should you seek further torment, look no further than the ADP jobs report: a mere 62,000 jobs bloom, where 108,000 were promised by officious alchemists; not even half of March’s harvest. The weakest result since July 2024, though who among us remembers such petty humiliations for long?

Wall Street, mortally wounded, stages a panic worthy of the fevered Karamazovs. Stock indices tumble, Ethereum and XRP dragged through the streets, decoupling in public, dignity shattered—but do not worry; this time, the impact is less than before. It seems Bitcoin has grown cynical, immune to the hysteria swirling about it. 📉

Bitcoin Decouples from Wall Street: A Return to Its Roots?

The wise men—those tireless observers at The Block—whisper of a correlation dropped to 0.3: the lowest since the epoch of 2023. Bitcoin is once more an outsider: different, uncorrelated, sulking in the margins like a literary antihero who hasn’t slept in weeks. The dream returns! No longer shackled to the Wall Street regime, BTC stands proudly—a digital Dostoevsky, misunderstood in its time and yet fiercely independent.

Bitcoin, after all, is a conspiracy against the prevailing order—a decentralized network of rebels, mocking the bureaucrats, eschewing government policy and paper money alike. Its supply is written in code—cold, immutable as death. Against the mountain of debt that underpins modern finance, Bitcoin is simply a pebble—but a pebble that refuses to crumble. Investors gaze longingly, seeing in it a hedge, an escape, perhaps even redemption. Or maybe they just like the memes. 🤑

Thus, while storms lash the world, a few optimistic souls cling to their coins with white-knuckled fervor, convinced the ship is unsinkable—or at least that Bitcoin will float, even as Wall Street goes under for the third time. And should all else fail, there will always be one last desperate hope: laughter at the chaos, a joke scrawled on the margin of a balance sheet, waiting for the dawn. 🥃

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

2025-05-01 09:01