Imagine, if you will, not a carriage thundering down the cobbles of St. Petersburg, but Ethereum rattling at $1,800, as stoic as a forgotten official in a dusty, government corridor. April, oh April! What a month, filled with more ups and downs than the mustache of a provincial bureaucrat on his third cup of tea. While Bitcoin and the memecoins invited themselves to an orgy of gains, Ethereum stood with the neutrality of a government functionary eyeing his empty soup bowl—waiting, always waiting.

In thirty days, the price of ETH twitched a mere 1%. Yes, one percent, comrades! All while the townsfolk, peasants and noblemen alike, ran about crying “FOMO!” as if Chicken Little had whispered in the ear of every crypto enthusiast.

So, what shall May bring, dear friends? Shall Ethereum don its Sunday best and stride to $2,500? Oh, we shall peer behind the bureaucratic curtain of technical and on-chain analysis, that most reliable of soothsayers, to predict if ETH will dazzle or disappoint.

Bullish Reversal or Just Another Bureaucratic Stamp?

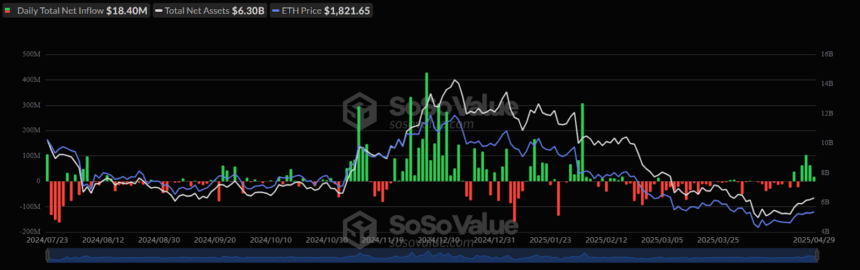

The Ether ETF began the month less like a proud troika, more like an overworked postal clerk. But by the last week of April—remarkably!—momentum returned, much like lost rubles found behind the samovar. Over 21 days, the ETF spent 6 days in the sun and 15 in the fog, causing concern amongst the investors, who, being of delicate constitution, nearly fainted at the sight.

But behold! A 4-day streak of positive inflows! The negative days, twelve in all (that’s a dozen, mind you), gnawed away at $222.35 million—but the six golden days brought a miraculous $290.97 million. The result? A net flow of +$68.62 million—enough to make even the most pessimistic landowner briefly forget his rheumatism.

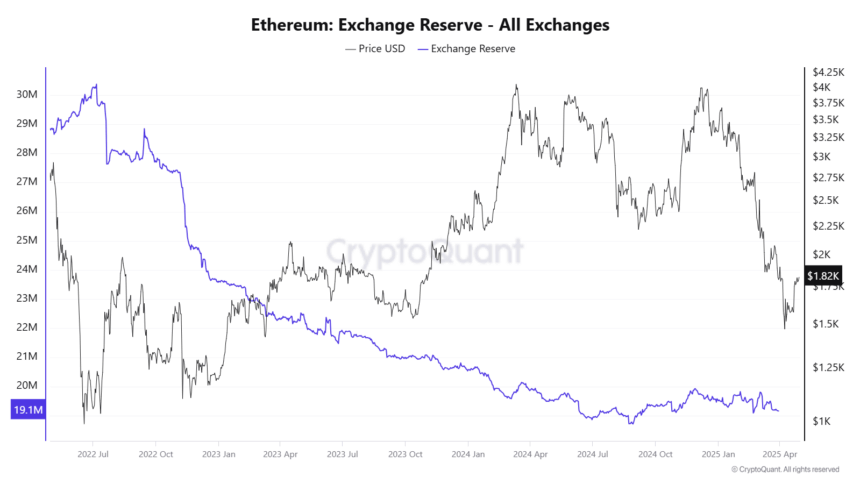

Drama unfolded in the exchanges too, where ETH tokens shuffled about with the uncertainty of a clerk summoned before his superior. The reserves, a solid 19 million, loomed over all, threatening liquidation much as a stern countess threatens to cancel the ball.

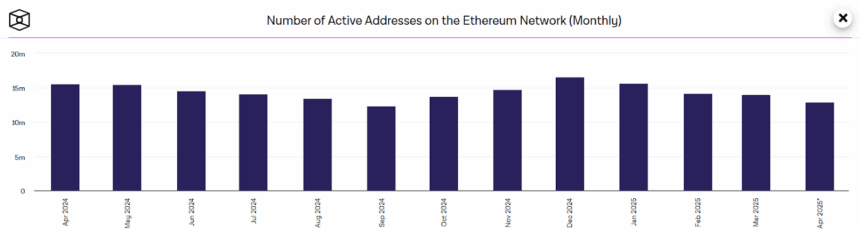

Even network activity has grown as steady as an old man’s habits, though the active addresses slipped a modest 4.3%—no need for alarm, perhaps just some addresses lost themselves on their way from the samovar to their wallets.

Ethereum Eyes $1,800: The Most Exciting Stalemate Since Russian Chess

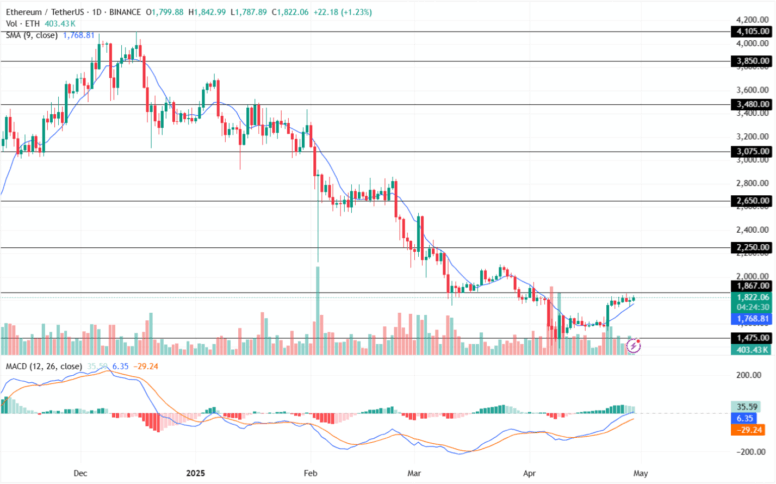

ETH’s early April correction was less like a catastrophe and more like a bureaucratic shuffle—slow, ominous, but ultimately recoverable. Over three weeks, the price picked itself up, dusted off its coat, and returned to $1,822. Even the trading volume chimed in at $14.27 billion, a sum to make even the tightest-fisted accountant widen his eyes.

Indicators, those mystical oracles—MACD, EMA, SMA—each mutter their bullish prophecies. The charts show green, the lines slope heroically upward, and for a brief moment, everyone believes: Tomorrow, prosperity! Or at least, no catastrophic decline.

The Eternal Question: Will ETH Rise or Sulk?

Should ETH cling to the $1,800 marker as steadfastly as a clerk clings to his inkpot, the path to $2,000 is clear—a triumph worthy of a czar’s banquet. With luck and bullish sentiment, perhaps, it might even flirt with $2,250. Yet beware! Should bearish winds howl and the market catch a cold, there’s every chance this altcoin will tumble toward $1,700 or, heavens forbid, $1,500—where even the cockroaches are nervous. 🤔💸

So, do we expect a triumph or a fiasco? Only time—and perhaps an overfed cat napping atop a pile of rubles—can say. One thing’s sure: in crypto, much like in Russia, predictability is for bureaucrats and bored poets. 🪙🎩

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2025-04-30 21:49