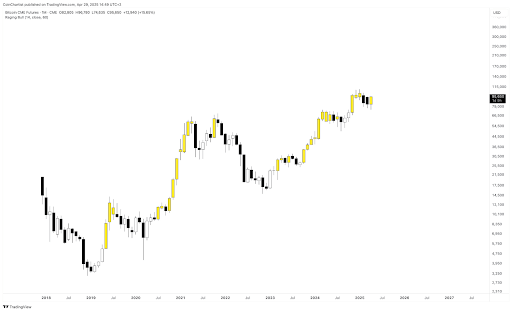

Ah! Behold, good Mesdames et Messieurs, the immortal stage upon which our hero, Monsieur Bitcoin, prances still—clad in garments of digital gold and whirling exuberance! As the curtain rises, we find him teetering magnificently upon the vertiginous heights of ninety-five thousand ducats (forgive my boldness: dollars, sirs!); the more he stumbles from April’s tempest, the more gallant his somersault to reclaim his former glory. Imagine, if you will, a candle—nay, a candlestick!—so robust and bullish that a fabliau bard might compose odes to its girth. If, by some cosmic mercy, this engorged waxen monument maintains its figure till week’s end, we may yet see May blushing with another bullish bloom.

Let us not jest: even the most bearish of seers—yes, those whose hearts beat with pessimism profound—might quiver at the knees, says the illustrious Tony “The Bull” Severino, part-time soothsayer, full-time dramatist in the great crypto theater.

Enter, the Raging Bull! Or, How CME Futures Became the Stage of the Absurd

Picture two weeks of merriment! Bitcoin pirouettes stage left, the crowd gasps, and behold: the much-maligned bullish spirit tiptoes shyly back, like a maiden at her first ball. Such is the fevered delight among crypto traders, some of whom have even glimpsed the mythical “net taker volume” rise from the dead!

Is it witchcraft? Is it fate? Is it merely the result of Severino fiddling with knobs on the mighty indicator contraption, known throughout the land as “Raging Bull”? Whatever the cause, verily, the Raging Bull has cast its greenly glowing eye not on the plebeian spot BTC/USD chart, but solely upon the noble CME Futures tableau! A nuanced twist that Molière himself might have woven into a comedy of errors.

Yet, the plot thickens! For whilst the stagehands on the CME are all aflutter, the spot market stands like a dull understudy waiting behind the curtain. “Patience!” quoth Severino—never trust a Raging Bull without a weekly close, lest ye find yourself trampled beneath the stampede of FUD and hubris.

The Ceiling of 96,000 Ducats: Or, the Perils of Overshooting One’s Mark

Consulting his monthly chart (illuminated by a single flickering candle and a great deal of wishful thinking), our analyst finds a bullish candlestick so large, it threatens to singe the very stage. From the dire depths below eighty-three thousand, dragged down still further to the grotesque seventy-five, Bitcoin did arise (presumably by climbing atop the corpses of bearish traders and bad tweets).

But! There is a catch most devilish: a ceiling, fortified by bears with nothing better to do, stretches from ninety-six thousand to a round, poetic hundred thousand. Should Bitcoin fail to bust through this plaster, our Raging Bull will be exposed for a mere costume, unable to dance ‘til curtain close.

Let it not be forgotten: for all Bull’s bravado, the spot market requires its own revelry. Only if Bitcoin leaps over ninety-six thousand with the grace of a tightrope walker pursued by a taxman shall this bullish ballad find its true crescendo.

As this missive is inked, Monsieur Bitcoin flutters at roughly $94,934—so close to the summit, yet so easily dumped by tomorrow’s drama! Will our Bull roar, or merely moo?

Read More

2025-04-30 20:15