- Ethereum Foundation hoists the mainsail and shuffles its deck of captains.

- Market folk barely raise an eyebrow, but hey, green is green.

April 28th broke, and with the rising sun came word from the Ethereum Foundation—an outfit known to chase wide horizons, and sometimes, its own tail. The big news at the water trough: a brand new pair of executive directors, Hsiao-Wei Wang and Tomasz K. Stańczak, now steering the operational ox cart, yoked together in the never-ending furrow of “strategic division.” The word “strategic” landed on their shoulders with all the weight of a wet burlap sack, but they carried it just the same.

Wang and Stańczak weren’t the only ones shuffling papers and titles around. The EF also picked four hands to sit around a table they call the ‘board of directors.’ Vitalik Buterin, still very much the riverboat captain, keeps his hand on the rudder, with Aya Miyaguchi, now president, guiding from the backseat. There’s talk of “compliance” and “oversight.” It all smells faintly of new paint in an old barn.

“The recent appointments…are part of a broader effort to strengthen the Ethereum Foundation, and this structure is designed to ensure our vision, strategic and balanced execution, technical direction, and ecosystem development.”

Visions and Twin Intentions—Crypto Farmers Take Note

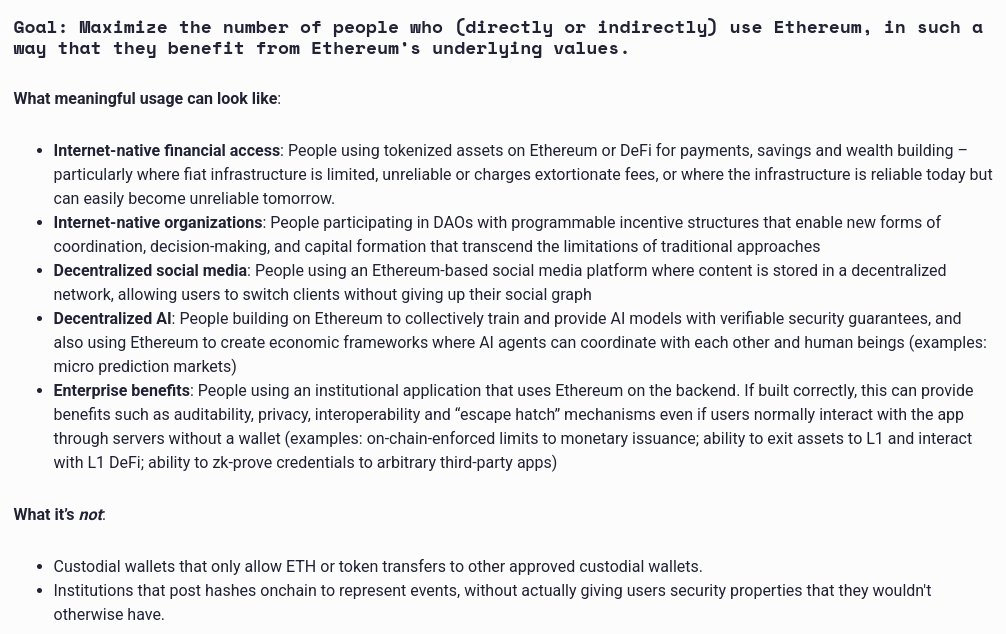

Not just new faces, but new dreams too. Buterin, always the philosopher in the middle of the field with his shoes caked in mud, spoke about the twin goals of the EF—real-world use and decentralization.

“Twin goals of EF: Usage of Ethereum – but usage of a type where users are actually benefiting from Ethereum’s underlying properties. Resilience and decentralization of Ethereum – viewed holistically, focused on addressing points of weakness anywhere in the stack.”

Poor Miyaguchi, she didn’t get to keep her executive chair—booted upstairs to president after a good, old-fashioned townsfolk uprising. Seems the Ethereum community wanted a technical wizard, not just an executive with conference shoes. Oh, and let’s not forget those pesky ETH sell-offs that poured a little vinegar in the communal soup.

Stanczak, they say, will pull double-duty: run this show for two years, keep one eye on his Nethermind farm, and dabble in his own would-be Ethereum emporium. Multi-tasking, some call it. Others call it “Tuesday.”

Praise rained lightly, but not all were impressed. Pierre Rochard, for one, sniffed at the whole affair.

“These two goals do nothing to help ETH accrue value…EF should instead IPO on the NASDAQ and run the ETH treasury company playbook with convertible bonds.”

Modest cheer by way of rising charts—just enough to keep the speculators’ horses from wandering. ETH shuffled past a few key moving averages, eyeing that stubborn $1900 fence post like a cow eyeing a new patch of grass. Of course, if $1,755 gives out, expect a rodeo in the support pastures.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2025-04-29 13:25