As the great clock struck 9:45 in the morning upon the 27th day of April, 2025 (Eastern time, naturally), the infamous digital creature known as bitcoin held its ground with a price numbering exactly 93,810 dollars. It loomed grandly, a colossal sovereign reigning over a domain worth 1.86 trillion shimmering coins—or so they say—with merchants trading goods up to a staggering 15.71 billion in a mere 24 fleeting hours. Between the treacherous valleys of 93,780 and the dizzying peaks of 95,115, our heroic bitcoin engaged in an epic dance, a slow-motion duel where bulls huff and bears puff, setting the gloomy curtain for its imminent grand leap—or perhaps calamity.

Bitcoin

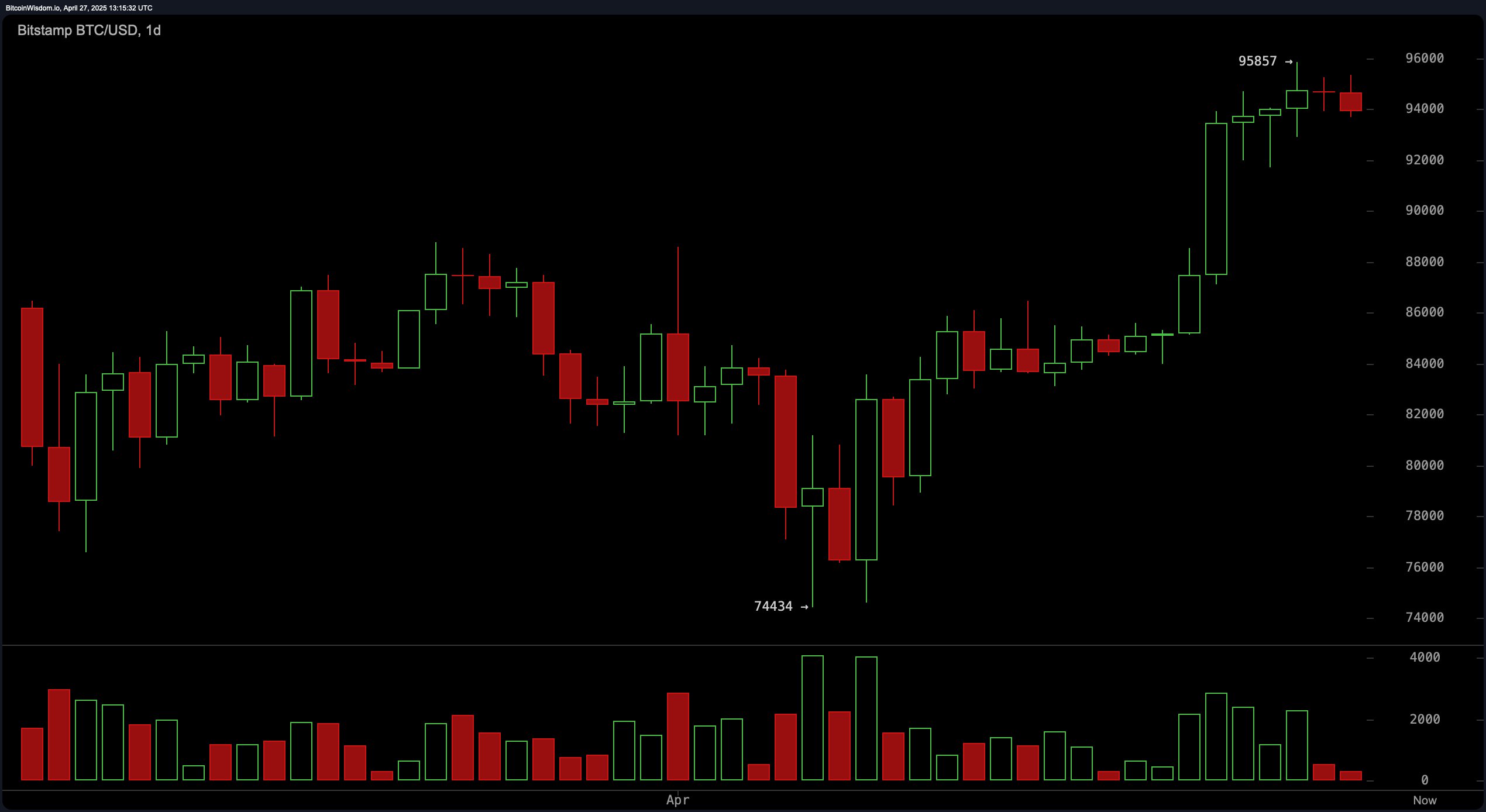

On the grand canvas of the daily chart, the unruly bitcoin (BTC) shines with a bullish glimmer like a peasant who inexplicably found himself heir to a fortune, having broken free from the gloomy shackles of a downtrodden past near the paltry level of 74,434. Curious eyes noted a sudden bustle in the marketplace since mid-April, as eager buyers swarmed like bees to honey, propelling our protagonist skyward. Yet, staring menacingly at the horizon stood the towering wall of resistance at 95,857—a fortress not so easy to scale. Should our bullish comrades vanquish this blockade with grandeur, the rally’s steeds may gallop with unmatched fury. Alas, should they falter, the bear’s lair between 88,000 and 90,000 waits with open jaws to swallow the hopeful whole.

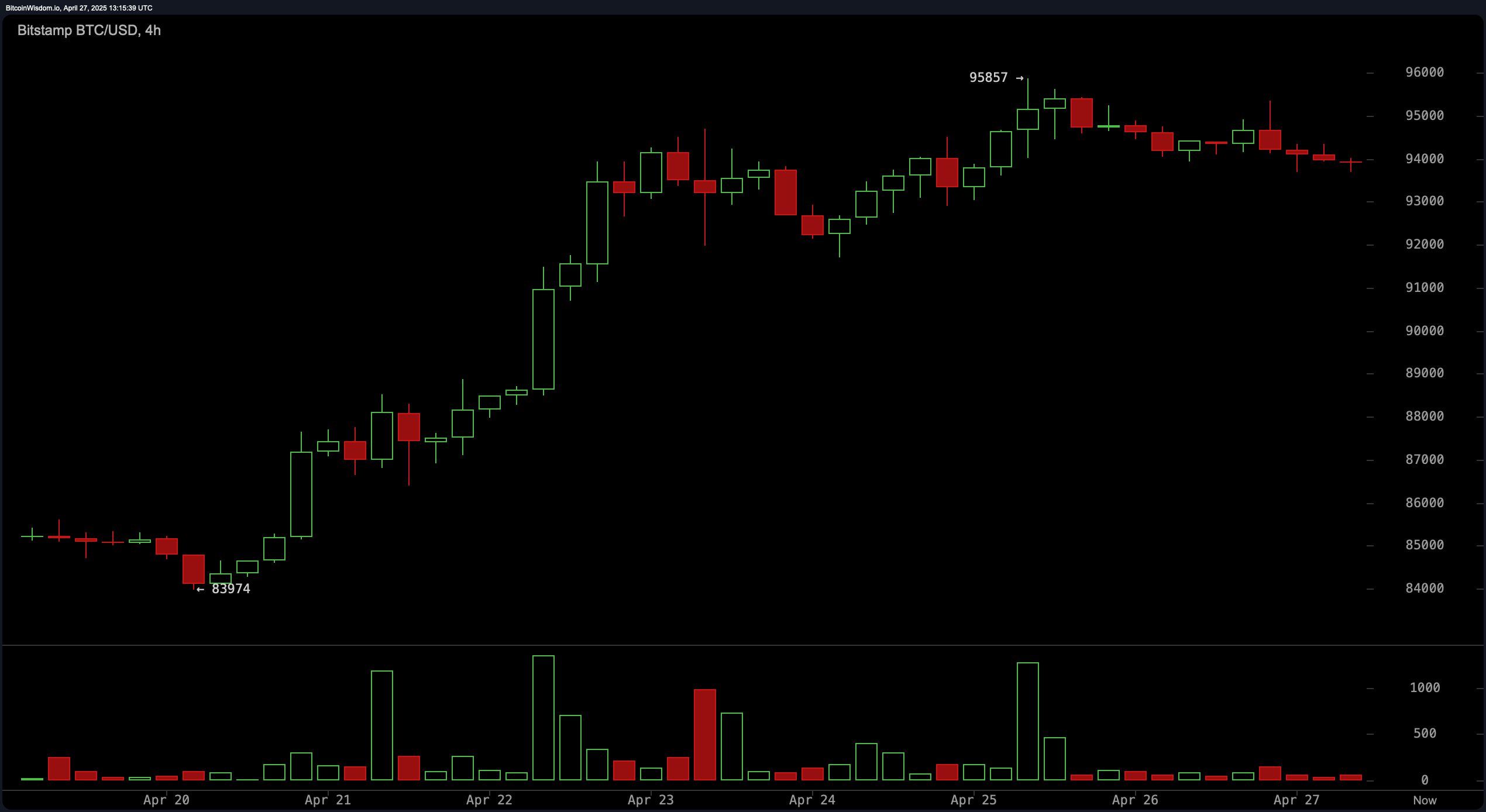

Turning the spyglass to the 4-hour chart, our brave bitcoin is caught mid-battle in a consolidation stalemate, after tasting the lofty heights of 95,857. Its fighting spirit seems log-jammed by fading volume—like a playwright losing his audience’s interest mid-act. A rounding top, the sinister whisperer, creeps on the horizon, threatening a corrective pirouette, should the stout-hearted support fail. Holding fast between the 94,000 and 94,200 battlements might rekindle the bullish fervor. Yet, a tumble below 93,500 may awaken the beast of despair, dragging prices to the darkened dungeon near 92,000.

The 1-hour chart reveals a somewhat apathetic bitcoin, eyes glazed with neutral-to-bearish ennui and very little trade volume—like tavern patrons too weary to wager more coin. Short-term support flickers briefly at 93,685; yet, one must resist the siren call of fresh long entries unless bitcoin boldly closes above 94,500 with majestic volume backing the effort. Should its price slip beneath 93,500, expect a torrent of selling—a veritable stampede of despair.

Oscillators, those mysterious instruments of fate, sing conflicting ballads: the relative strength index (RSI) at a bland 66 and the Stochastic flirting near 89 whisper neutrality, while the commodity channel index (CCI) at 121 and momentum indicators leering at 8,895 croak ominously of bearish prowling. On the other hand, the ever-hopeful moving average convergence divergence (MACD) at 2,794 beams with a bullish endorsement, supporting the grand dream on the higher stages. Such contradictory voices compel the cautious dance of investors—half feverish, half petrified.

Moving averages (MAs) rally legion after legion in support of the bulls, flashing unwavering green lights across all the key lengths: 10, 20, 30, 50, 100, and even the ancient 200 periods. The exponential moving average at 10 and the simple moving average at 10 pipe up at $91,334 and $90,669 respectively—comfortably cozy beneath bitcoin’s current lofty perch, like loyal sentinels guarding the gates. Together, they assure the rabble that while volatility may wag its mutinous finger, the overall trend swells with bullish might.

Bull Verdict:

Bitcoin struts its bullish stuff on the daily chart, backed by a chorus of buying signals and the proud MACD standard waving high. Should the $93,000 fortress hold steadfast, and momentum awaken like a boreal bear from hibernation, bitcoin may gallop triumphantly past $95,857 toward horizons unknown. Steely-eyed bulls salivate at the notion of scooping bargains between $90,000 and $92,000—an appetizing feast no doubt.

Bear Verdict:

Yet, swaggers and cheers aside, the shorter 4-hour and 1-hour arenas tell tales of slowing vigor and oscillators spinning their hat-tips to uncertainty. Failing heroic defense of $93,000 spells a grim pathway descending into the shadowy land of $92,000 or even the deeper abyss below $90,000. Prudence is the watchful guard—lest one step on the rickety plank unwittingly.

Final Verdict:

The grand fate of bitcoin tilts bullish on the sprawling horizon, but nearer travelers must brace for the swirling tempests of volatility and the occasional thunderclap of retracement. The rally’s next heroic chapter depends on a bold surge above $94,500, volume roaring like a Cossack charge. Until then, a cautious step, a keen eye, and a stout heart will be the trader’s best companions.

Secure your internet browsing with a NordVPN subscription. [Learn more](https://pollinations.ai/redirect/432264)

Read More

2025-04-27 17:29