The great and tumultuous surge of the broader market in the past 24 hours has roused the spirits of traders, spurring them to place their hopes—perhaps misguidedly—on Hedera (HBAR). It is as if the very air were thick with the anticipation of some forthcoming miracle or disaster. One thing is certain: traders are betting on further price gains with a reckless optimism worthy of the most tragic of Dostoevskian heroes. 🙄

The long/short ratio for HBAR has ascended to an alarming height, the likes of which we haven’t seen in the last month. One might almost say the market is shifting in its sleep, changing its very allegiances without a whisper of consent. Ah, the thrill of betting on an uncertain future, how delightfully human! 😅

The Desperate Rise of HBAR: A Bullish Frenzy or Foolish Pursuit?

At this moment, the long/short ratio stands at 1.09—a triumph of foolishness or wisdom, depending on one’s temperament. In the last 30 days, this figure has climbed to its highest peak, like some mountain climber striving toward the impossible, completely ignoring the dangers that await below. 🏔

Ah, the long/short ratio! A simple measure of the market’s soul, revealing the proportion of those who bet on price increases to those who bet on declines. Below one, we know that despair reigns and that the shorts outnumber the longs. But above one, as we see now, traders place their faith in a mighty rally, hoping—no, desperately praying—that the uptrend will carry them to glory. 🙏

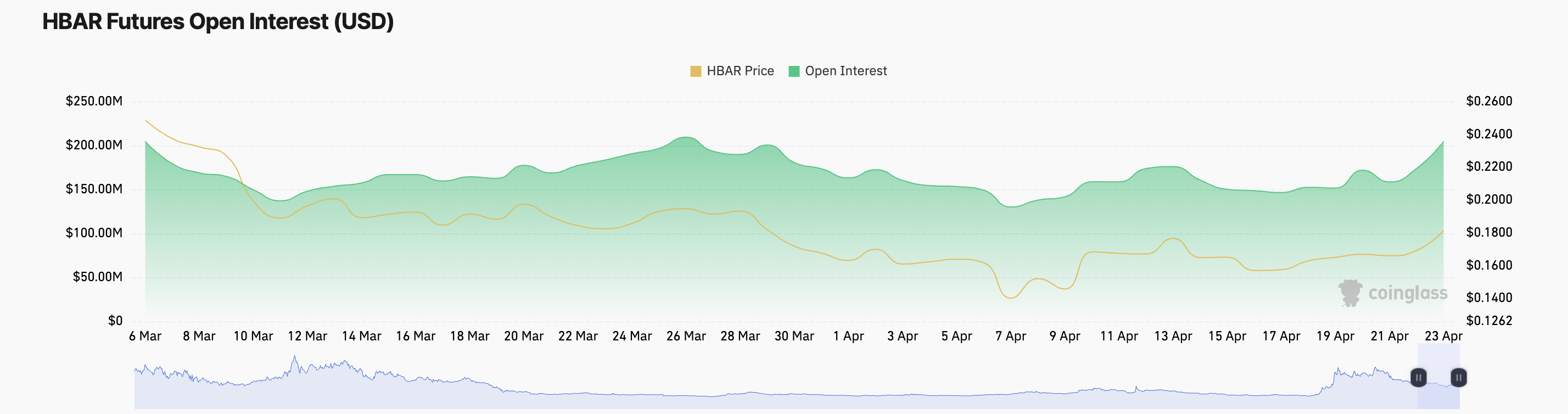

What a beautiful contradiction it is: traders seeking safety in volatility. The very concept of futures open interest speaks to this grand spectacle. At this moment, open interest stands at a heart-stopping $205 million, an increase of 18% in a single day. Why, it almost seems as if new money is rushing in to support this uptrend, like moths to a flame. Will they be burnt? Perhaps, but in the meantime, they will enjoy the warmth. 🔥

But what is open interest, you ask? Oh, it is the total number of futures contracts that remain unsettled, hanging in the balance like a moral dilemma with no resolution. When this number rises alongside the price, as it does now, it suggests that new capital is entering the fray, daring to dream of further gains. It is a gamble—a foolish one, but a gamble all the same. 🎲

HBAR’s Crossroads: Can It Break Free from Its Chains?

And so, we find ourselves at a crossroads. HBAR is now trading at $0.187, poised delicately above the resistance level of $0.190. If, by some miracle, demand intensifies, and HBAR bulls manage to transform this resistance into a sturdy floor beneath their feet, there is hope yet for a further rally to $0.199. It is as if we stand before a closed door, wondering if it will open to freedom or despair. 🚪

Yet, should the bears awaken from their slumber, there is no salvation for HBAR. The token may slip into the abyss, losing all that it has gained and plummeting to $0.153. It is a tragic tale, one that has been written before in the annals of the market. But then again, who are we to resist the allure of a good tragedy? 🎭

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- Who Is Abby on THE LAST OF US Season 2? (And What Does She Want with Joel)

- ALEO PREDICTION. ALEO cryptocurrency

- General Hospital Spoilers: Will Willow Lose Custody of Her Children?

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- Fact Check: Did Lady Gaga Mock Katy Perry’s Space Trip? X Post Saying ‘I’ve Had Farts Longer Than That’ Sparks Scrutiny

- SDCC 2024: Robert Downey Jr. Confirms MCU Return As Dr Doom In Avengers: Doomsday

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

2025-04-23 18:52