- Money is taking its jet set lifestyle global, chasing greener pastures with a flair previously reserved for expats and lost tourists.

- Bitcoin, that digital bull in a china shop of traditional markets, is stealing the spotlight amidst the chaos.

In a twist no one saw—or perhaps everyone ignored—global liquidity has ballooned like an overambitious souffle, despite (or maybe thanks to) Donald Trump’s merry-go-round policies throwing markets into a wild spin. The folks at Alpha Extract tell us it’s hitting dizzy new highs.

As if on a caffeine rush, Bitcoin [BTC] has been climbing the charts like an overachieving squirrel, defying the tumult to stay ahead. It’s tiptoeing up to the levels last seen in September 2024, right before BTC majestically moonwalked to a cool $100k.

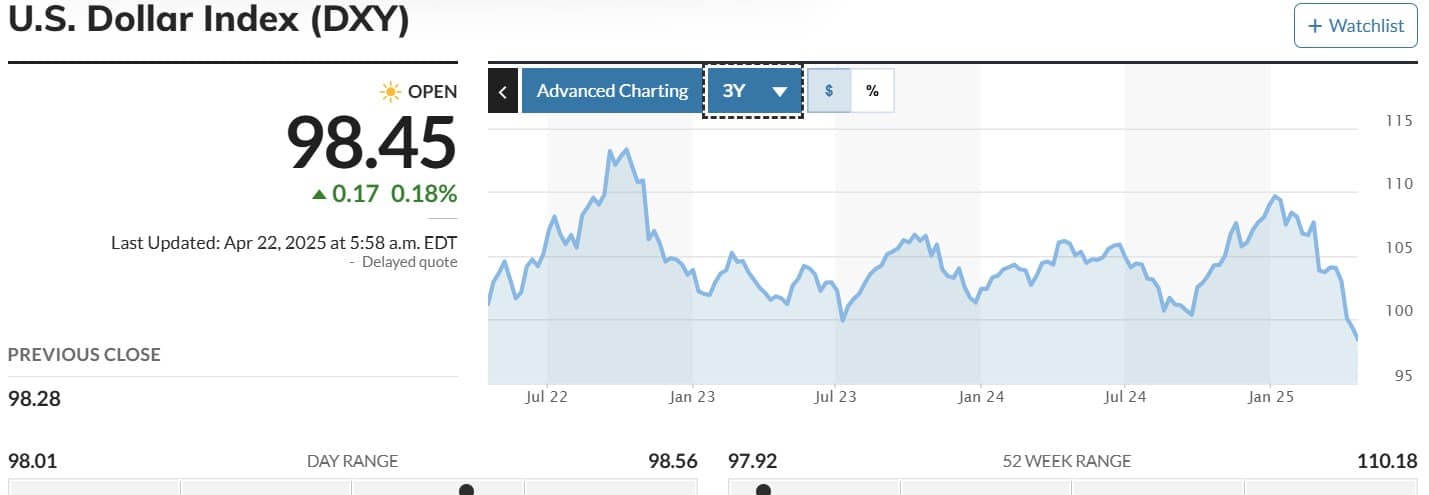

The U.S. Dollar Index (DXY) is currently channeling its inner rock climber but sliding down the cliff—breaking out of a two-year snooze and plummeting to its lowest since March 2022. This isn’t just some random nosedive; it signals markets are gently catching their breath and, believe it or not, liquidity is frolicking about with renewed gusto.

With the DXY taking a well-earned nap, capital is apparently packing its bags and heading for foreign shores like it finally read those travel brochures promising better returns and fewer headaches.

Capital is basically like that one friend who only shows up where they’re treated well. And right now, the U.S. market might want to check what it’s serving at the party.

Could this be Bitcoin’s Cinderella moment?

Whenever global liquidity gets a shot of espresso, Bitcoin seems to follow the bounce, often with happy price jumps that make investors do a little celebratory dance. This week, the Global Liquidity Index grew by a staggering $4.175 trillion—yes, trillion with a T—upping the ante by 3.31%.

Coincidence? Possibly not. Bitcoin leapt from $78K to $88K, riding the liquidity wave like a pro surfer on a monster swell.

Even the usually poker-faced U.S. institutional buyers have dusted off their Bitcoin hats and are back in the game.

Enter the Coinbase premium index, which decided after three gloomy days to put on a smile and go positive—classic institutional optimism doing its thing amid the chaos.

The Korean Premium Index is blissfully enjoying the sun too, staying firmly positive and confirming Bitcoin’s global fanbase is alive and well.

When both the U.S. and Korea are singing Bitcoin’s praises, it’s a surefire sign that big players see BTC not just as a volatile gamble but as a cozy fortress against market storms.

As uncertainty spreads like gossip at a small-town diner, Bitcoin is becoming the new ‘safe space’—an asset people actually want to cuddle with.

Among the usual suspects of store-of-value assets, Gold is still the mayor of the town, but Bitcoin is giving it a run for its money, comfortably outshining SPX, NDQ, and NLT—making stocks look a bit like last season’s fashion.

Bitcoin’s recent performance chart is probably giving traditional equities a mild existential crisis, suggesting if political shenanigans continue to shake things up, BTC might just keep charging ahead.

To cut through the financial jargon: as the world’s liquidity expands, Bitcoin is happily trotting alongside gold as a dependable store of value—one that’s apparently more fun at parties.

With traditional finance throwing a few curveballs, investors increasingly see Bitcoin as the cool kid on the block ready for another growth spurt.

Will Bitcoin hit $90K and maybe even crash the $100K party? It’s possible.

But if the FED steps in like a strict chaperone to handle the mess left by Trump-era policies, Bitcoin might just be politely asked to sit down around $85K for a bit.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-04-23 07:08