What You *Should* Know:

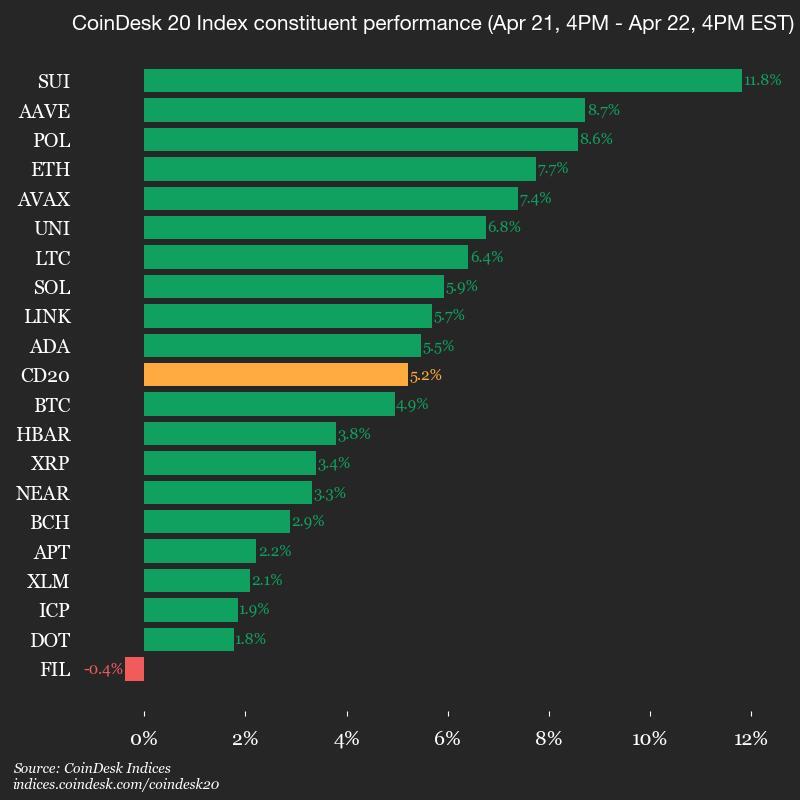

- Bitcoin dances over $91,000, fueled by trade optimism between the U.S. and China, while the CoinDesk 20 Index is 5.2% more fabulous than it was 24 hours ago.

- U.S. Treasury Secretary Scott Bessent, speaking behind closed doors (so you know it’s good), said that the trade spat between the U.S. and China is “unsustainable,” hinting that peace is just around the corner—or not.

- Despite the bullish headline, CryptoQuant’s report suggests Bitcoin is only pretending to be strong, with looming resistance threatening to pop this bubble faster than you can say “regret.”

Bitcoin (BTC) made a *dramatic* leap past $91,000 on Tuesday—up nearly 5%—as investors put on their rose-colored glasses and dreamed of peace in U.S.-China trade relations. But, as always, there’s a dark cloud hiding somewhere on the horizon, warns analytics firm CryptoQuant. Sure, the price surged, but don’t start booking your vacation just yet, folks.

The granddaddy of all cryptocurrencies hit $91,700 by the afternoon, its highest point since early March. It wasn’t just Bitcoin that was on a rampage, oh no—Ethereum’s ether (ETH) had an 8% glow-up, crossing the $1,700 mark, while dogecoin (DOGE) and Sui’s SUI token saw gains of 8.6% and 11.7%, respectively. Meanwhile, the CoinDesk 20 Index (aka the cool kids’ table) rose by 5.2%.

The market’s rise? Partly thanks to Treasury Secretary Scott Bessent, who spilled the beans at a private JPMorgan event. He said the tariff tension with China was like a bad reality show, “unsustainable,” and that “peace” was just around the corner. Ah, sweet, sweet optimism. But hold your horses—Bessent also warned that a full deal between the U.S. and China could take *years*. So much for “soon,” right?

The stock market bounced back too, with the S&P 500 and tech-heavy Nasdaq both gaining 2.5% and 2.7%, respectively. Meanwhile, gold took a sharp dive after flirting with a record price of $3,500—down 1% by the day’s end. Not that you care, but hey, if you’re holding gold, maybe next time you’ll find a better hiding spot.

Analysts at hedge fund QCP Capital (yes, they know things) noted that as investors seek refuge in safe-haven assets, both BTC and gold are soaking up the attention like a sponge. They pointed out the return of BTC ETFs on U.S. markets, with a cool $381 million net inflow just on Monday. Add that to last Thursday’s $107 million, and the institutional love affair with Bitcoin is clearly heating up.

But don’t get too excited yet, dear reader. CryptoQuant has a slightly less rosy outlook. Despite Bitcoin’s climb, on-chain data suggests the market underneath is as fragile as your grandma’s fine china. Over the past 30 days, Bitcoin’s demand has dipped by a jaw-dropping 146,000 BTC. Sure, it’s better than last month’s disaster, but it’s still negative, and that’s a big “yikes” in the crypto world.

Liquidity remains as soft as a pillow—seriously, the market cap growth of USDT is limping along at $2.9 billion over the past two months, well below the 30-day average. BTC rallies usually come with USDT growth over $5 billion. So, yeah, we’re not there yet.

To make matters even more spicy, Bitcoin is now facing a resistance zone between $91,000 and $92,000, which just so happens to be the “Trader’s On-chain Realized Price” metric. This has historically been a wall of resistance in more bearish conditions. So, let’s just say—CryptoQuant’s on-chain bull score isn’t exactly sending out party invites, and they’re calling the current market conditions “bearish.” Translation: a pause or pullback might be coming, so maybe keep your champagne on ice for now.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-04-23 01:01