ETH 2030: $10K or a Crypto Comet? 🚀💰

So, what’s next? Will ETH hit $10K by 2030? Buckle up, buttercup – we’re diving into the chaos of Ethereum’s price prediction 2030. 🚀

So, what’s next? Will ETH hit $10K by 2030? Buckle up, buttercup – we’re diving into the chaos of Ethereum’s price prediction 2030. 🚀

In a statement that smells more like a saloon parlor than a court of law, the SEC proclaimed that staking cryptocurrencies through protocols and receiving those liquid tokens as proof of ownership doesn’t count as securities. Who knew? So all that fuss about securities laws and crypto might just be a lot of wind and no pony. 🤠

In their latest announcement, Coinbase casually dropped that Mamo is joining their listing roadmap, which is basically their way of saying, “Hey, we might let you trade this someday. Maybe. No promises.” 🤷♀️

Now, hold your breath: Cronos (CRO) token is hanging around the $0.1347 mark, as it’s been for the last few days. This might sound boring, but here’s the kicker – it’s 74% higher than its lowest point this year. So, it’s not all doom and gloom, folks! Technical indicators are pointing to even more thrilling adventures ahead. 💰

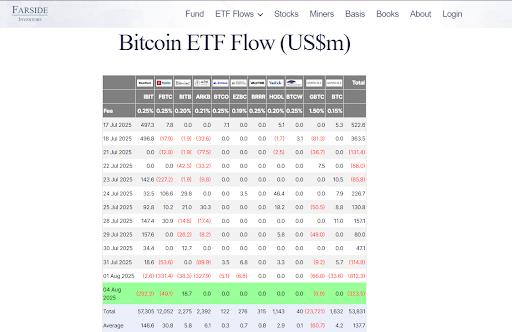

BlackRock’s iShares Bitcoin Trust (IBIT)-a name fancier than a preacher’s Sunday hat-just set its own record for losing friends (and dollars) in a single day. Mark my words, if Constable Bob managed the town’s savings like this, he’d be run outta town on a rail.

The company tittered confidentially to TopMob (over cocktails, one assumes) that it parted with approximately $4.89 million to amass this splendid pile of solana (SOL), thus creating a treasury one can only hope is guarded by something suitably dramatic. This purchase, they coyly suggest, supports their oh-so-moody new validator.

This marks Strategy’s third-largest Bitcoin binge since it began hoarding the digital gold five years ago. And naturally, this is excellent news for the crypto glitterati-the presales currently frolicking in the limelight. When institutions like Strategy toss billions into $BTC, it tends to lift market sentiment faster than champagne corks on New Year’s Eve. Cue renewed interest in early-stage projects, darling.

Ah, the good old legal tangle that started back in December 2020-imagine a peculiarly British cricket match but with more money and less sportsmanship. The SEC, smelling blood, accused Ripple of breaking a few laws with their XRP tokens, originally demanding a cool $2 billion. Quite a penny, wouldn’t you say? Since then, it’s been a rollercoaster of rulings, counter-rulings, and the ever-present hope that someday, somehow, someone will announce the final curtains. Judge Torres, ever the diplomat, decided in 2023 that Ripple’s secondary market shenanigans weren’t securities offerings, leading to a modest $125 million slap on the wrist-small change in the grand scheme. But no, the fun isn’t over! The SEC has thrown a fit and appealed, demanding further attention-by August 15, no less. Meanwhile, the shrewd lawyer Bill Morgan wonders if SEC chairman Paul Atkins is enough of a puppet master to sway the vote. Oh, the drama!

After the big rally, Litecoin (LTC) finally hit its technical ceiling near $130. You know, that place where it always seems to get stuck. Despite the rejection, the market still looks bullish with solid support below. The next few days will tell us if LTC is going to take a nap or make another run at it. 🏃♂️💨

What’s behind this miraculous recovery, you ask? Gains in balance sheet holdings and a stellar performance by its global markets division, apparently. But let’s not forget the real star of the show: their Bitcoin stash. By the end of Q2, Galaxy was sitting pretty with 17,102 BTC (valued at $1.95 billion). That’s up from 13,704 BTC in Q1-a cheeky addition of 4,272 coins. Someone’s been busy stacking sats! 💰