As Bitcoin, that capricious beast, suddenly remembers its manners and clambers past $88,500 – a fleeting moment of glory unseen since March 25th, whispers begin to circulate. Altseason, they say, is nigh. A fever dream, perhaps, fueled by too much kvass and wishful thinking? 🤔

A certain Miles Deutscher, a name whispered with reverence in the hallowed halls of X (formerly known as Twitter, may its algorithms be forever perplexing), has fanned the flames of altcoin anticipation. He speaks of technical omens, of signs in the tea leaves, that foretell a grand altcoin uprising in the coming weeks. Or is it just another Tuesday? 🤷♂️

First, this Deutscher points to a most peculiar schism between Bitcoin (BTC), that golden calf of the digital age, and the dreary world of U.S. equities. While the S&P 500, like a wounded bear, stumbles downwards, weighed down by the heavy baggage of macroeconomic woes and trade squabbles, Bitcoin, bold and brazen, surges upwards! A 3% leap on Monday alone, and still it climbs, past $88,500! A miracle, or merely a well-timed pump? 😈

This divergence, mind you, coincides with gold, that ancient symbol of security, reaching a new zenith, a brief flirtation with $3,500 before retreating to a more modest $3,455. Historically, they say, gold’s triumphs foreshadow Bitcoin’s ascent, as if Bitcoin aspires to be a digital ingot. A safe haven, they proclaim! But from what, exactly? The inevitable collapse of civilization? 😅

This unholy alliance – Bitcoin breaking free from the shackles of equities and rekindling its romance with gold – supposedly lays the groundwork for an altcoin renaissance. For Bitcoin’s rallies, like a tipsy conductor, often set the stage for the altcoin orchestra. And to further bolster this fantastical notion, Deutscher proclaims that the altcoin market cap has formed a triple bottom – a bullish pattern, they say, where prices, like stubborn mules, test the same support level thrice, before finally relenting and reversing course. A trend reversal, they cry! Or just a momentary pause before the inevitable plunge? 📉

Meanwhile, the institutional titans, those behemoths of finance, seem to be growing ever fonder of Bitcoin. U.S.-based spot Bitcoin exchange-traded funds, those modern-day alchemy labs, recently recorded their highest daily inflows in three months, spurred by a resurgence of “risk-on” sentiment. All thanks to Trump’s renewed threats to dismiss Federal Reserve Chair Jerome Powell! Ah, the sweet music of chaos! 🎶

And let us not forget the stablecoins, those digital rubles of the crypto world. Tether’s (USDT) market cap has ballooned by 26%, while USD Coin’s (USDC) has surged by a staggering 93%! Capital, it seems, continues to trickle into the crypto coffers, despite the ongoing trade wars and the general air of impending doom. A flood of fool’s gold, perhaps? 🤡

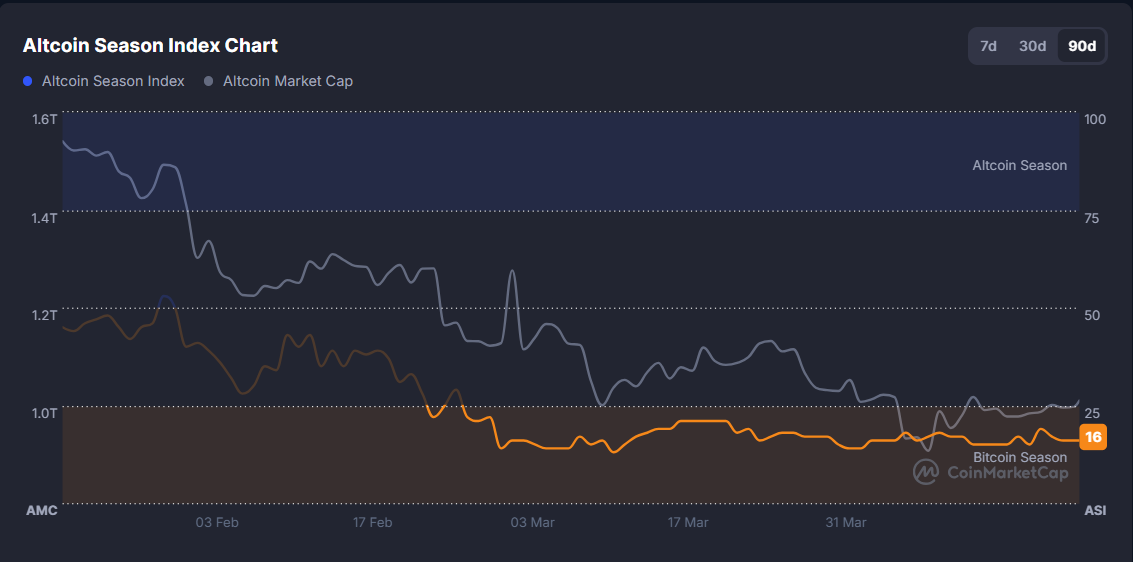

Yet, alas, not all are convinced by this rosy picture. Some analysts, those dour prophets of doom, like Matrixport, point to the lack of dovish Fed policy and Ethereum‘s waning influence as reasons to remain skeptical. If altseason is indeed on the horizon, they warn, it will be a slow and agonizing affair. The CoinMarketCap Altcoin Season Index, that mystical barometer of altcoin fortunes, languishes at a mere 16 – far below the 75 threshold that signals the true arrival of altcoin season. So, hold your horses, comrades! Or better yet, sell them while you still can! 🐴

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-04-22 15:06