- TAO soared over 80% in April, leaving BTC and SOL scratching their heads.

- Some wise men blame AI greedy Bittensor clans for this unexpected bonanza.

The stubborn beast called Bittensor [TAO] clawed its way up more than 80% this April, then hopped another 30% last week—while Bitcoin and Solana just watched, chewing on their digital nails. But what sorcery stirred this feverish dance?

Who fed the TAO frenzy?

Mark Jeffrey, our oracle of the cryptic X (the bird lost its name, not its gossip), proclaims that it’s the hunger of Bittensor’s AI cults—those subnet tribes crafting secret machines—that fuels TAO’s rise. Quoth he:

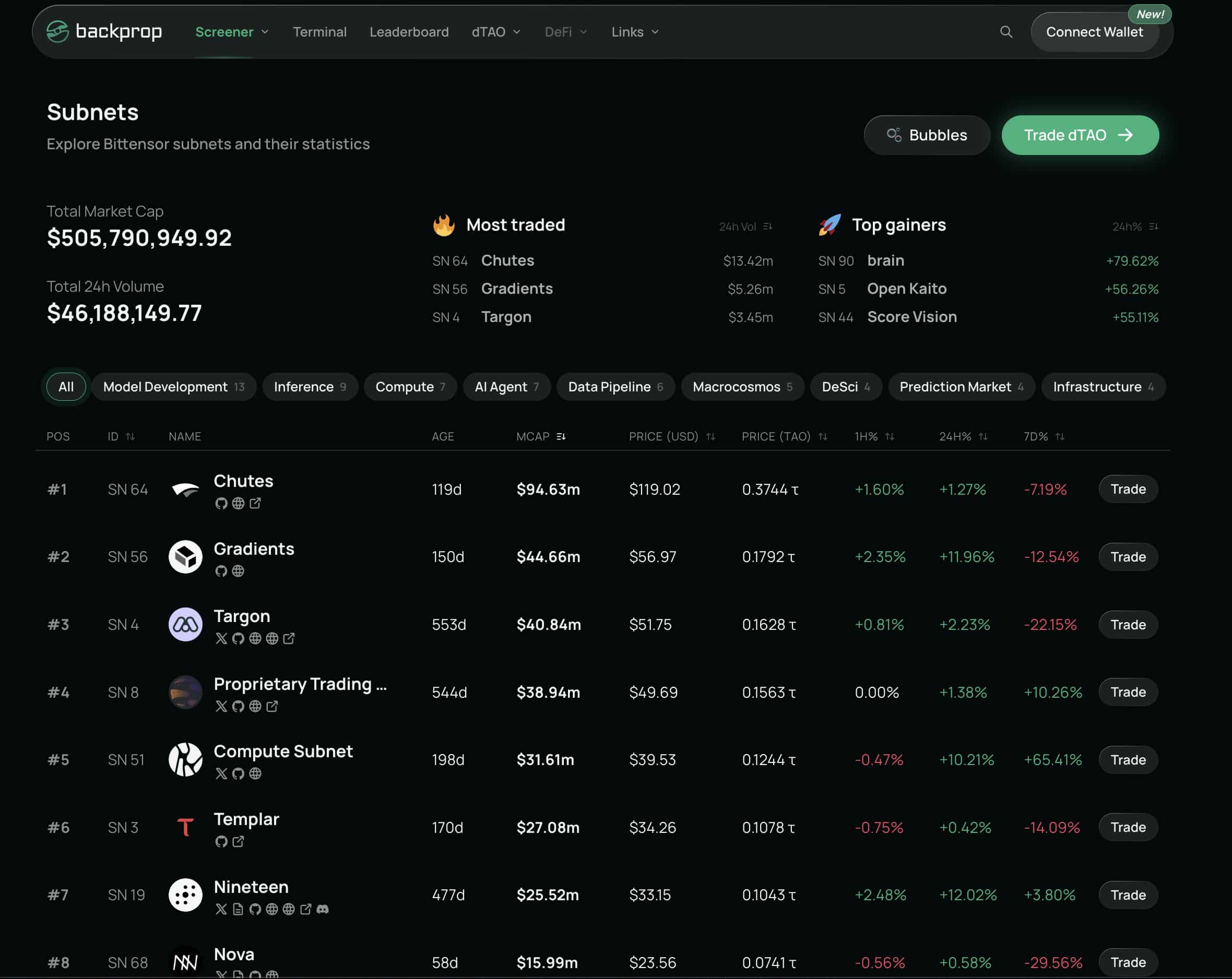

“$TAO Subnet total market cap just smashed through $500M. That’s ten times more than the scrappy tribes had nine weeks ago.”

These subnet wizards must chain-lock their TAO tokens to summon AI magic, thus gobbling the token up like hungry bears in spring. A tenfold growth in nine weeks? Sounds like a crypto fairytale, or a fever dream.

TaoStats whispers that these subnets paused to catch breath in the cold months of January, then lunged forward—going from 65 to 95 subnets by April. A 46% expansion, not shabby for a digital jungle.

Predictably, the AI bandwagon keeps rolling on, with Coingecko crowning AI as King Narrative. Yet, DeFi Jeff, the skeptical prophet, warns the smart money hasn’t yet filled the room—only 6% of TAO sits locked in these subnets while hedge fund leviathans and crypto whales sharpen their teeth on this ecosystem.

“Still early days, folks—big sharks like Unsupervised Capital and YumaGroup are betting hard on this TAO tale.”

But every rose has its thorns. Market signs blinked uneasy at press time. Coinglass reported a brutal volume plunge; Binance alone saw $214 million evaporate in a week. Meanwhile, Kraken played sell orders receiving $390K worth of TAO tokens, as Binance users dazzled with bullish hoarding of $192K TAO.

In other words, last week was a cocktail of panic selling and greedy grabbing—a trader’s soap opera as they scrambled for profits after that juicy 30% leap.

Yet, the spot Cumulative Volume Delta (CVD) stood stubbornly flat, like an audience bored by the spectacle, signaling the real demand stubbornly refused to dance. Contrarily, Open Interest shot up 100%, revealing that this rollercoaster was powered mainly by borrowed money and wild bets.

Bottom line? TAO’s recent leaps might resemble a fireworks show—bright, loud, but fleeting unless the genuine buyers awaken soon.

Read More

- Who Is Abby on THE LAST OF US Season 2? (And What Does She Want with Joel)

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- DEXE PREDICTION. DEXE cryptocurrency

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- General Hospital Spoilers: Will Willow Lose Custody of Her Children?

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

- Fact Check: Did Lady Gaga Mock Katy Perry’s Space Trip? X Post Saying ‘I’ve Had Farts Longer Than That’ Sparks Scrutiny

- SDCC 2024: Robert Downey Jr. Confirms MCU Return As Dr Doom In Avengers: Doomsday

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

2025-04-22 09:19