- Bitcoin might miraculously tiptoe past $100K in 2025 before doubling like a stubborn champ in 2026.

- Models and prophets agree, even as tariffs threaten like grumpy jail wardens.

In these bleak modern times, the sage Lyn Alden steps forth with a vision: Bitcoin, that digital rebel, shall break through the $100,000 barrier come 2025. Worse yet—or better, depending on one’s faith—it may double that figure by 2026, challenging the patience of even the most harrowed hopefuls. Oh, how numbers mock our weary souls.

This modest ascent rests uneasily atop the crumbling edifice of tariff skirmishes, a saga of economic fencing that never truly ends. Yet, if the mysterious Federal Reserve decides to throw open the floodgates of liquidity, as if beckoning a grand deluge, Bitcoin’s rise could resemble a steam engine bursting free from shackles long forgotten.

The labyrinth of hope for Bitcoin’s future

The MVRV, a fearful oracle of valuation, has yet to sound its cycle-top shriek above the ominous threshold of 3. Recent peaks—glittering yet shallow—hovered near a paltry 2, teasing us mere mortals that the end of the ascent is not yet written in stone nor in code.

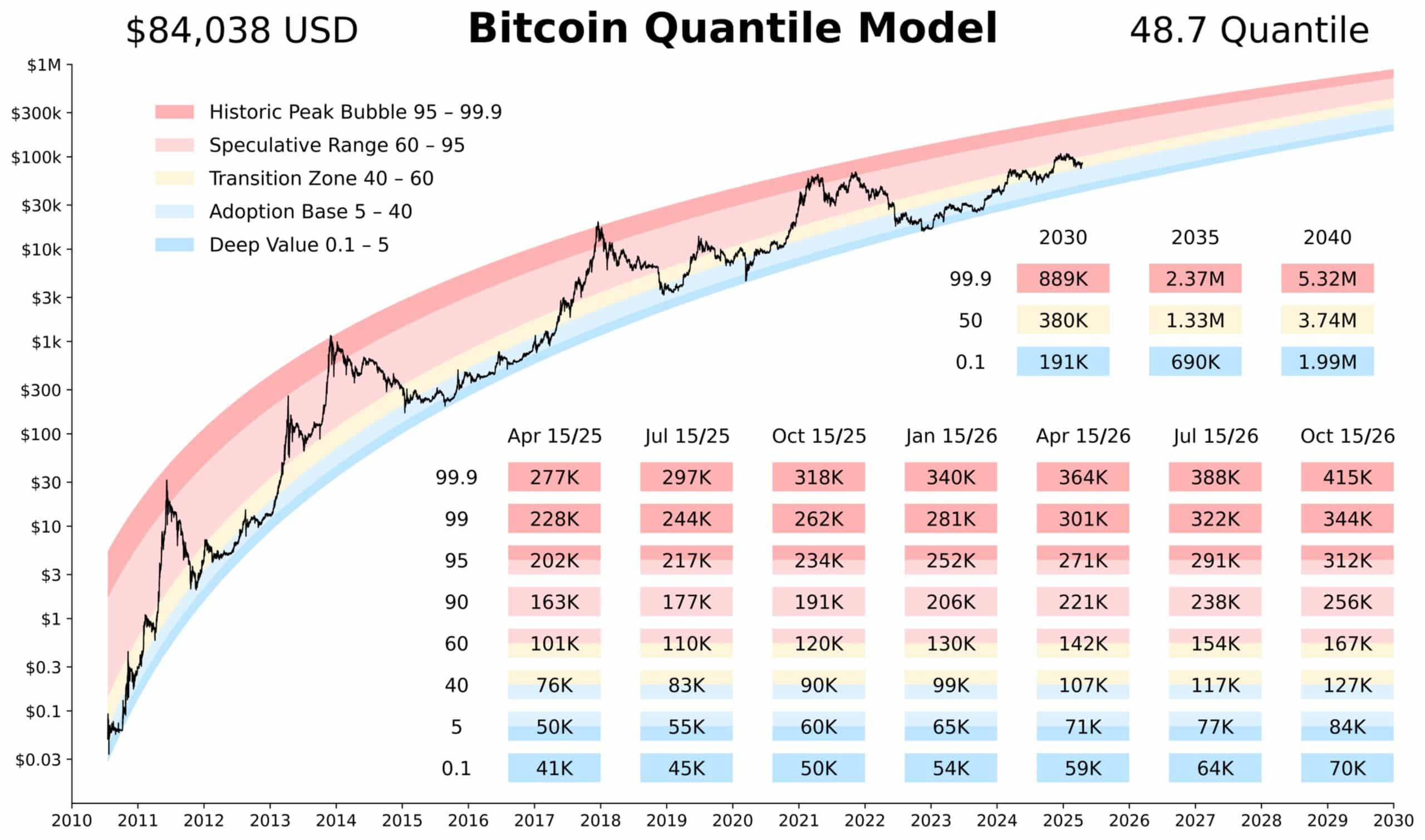

Bernstein’s courtly analysts echo this tale of continued conquest, daring to dream $200K before the year’s close. The Bitcoin Quantile Model, a cryptic script scrawled from past cycles, nods solemnly in agreement.

Dr. Sina, the wise co-founder of 21st Capital, expects even grander heights—$200K to $300K—should history play the same cruel musical score once more. His solemn words:

“Even if we only get to the 95th quantile this cycle, it is a 3x from here.”

In layman’s terms, this implies a Bitcoin summit near $250K, a daring echo of Charles Hoskinson’s dreams whispered in Silicon Valley salons.

On Polymarket, the masses bet $1.3 million dollars that Bitcoin will reach $110K, but they are cautious, assigning only a 52% chance—as if hedging bets against eventual disappointment.

Other bets flutter at $150K and $200K, with sober odds of 22% and 13%, as if investors are timid party guests reluctant to stay late.

Options traders, ever the gamblers watching shadows, place modest faith above $100K in the latter half of 2025, but for the loftier $150K or $250K, they whisper doubts in the form of 10–15% probabilities.

To sum this tragicomedy: Bitcoin will likely reclaim $100K this year, but dreams of $150K and beyond seem delayed, pending the outcome of the ever-persistent tariff nightmare—our economic purgatory where fortunes are made, lost, and endlessly speculated upon.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-04-19 06:18