- Strategy acquired an extra 3.4k BTC for $285M raised through the sale of MSTR stock

- Firm still has a $37 billion capital raising capacity yet to be deployed for BTC buys

On the 14th of April, Michael Saylor, creator of Strategy (previously known as MicroStrategy), disclosed that the company purchased an additional 3,459 Bitcoins [BTC] at a total cost of $285.8 million.

Strategy, a leader in Bitcoin corporate holdings, currently possesses approximately 531,644 Bitcoins. This news didn’t come as a shock, given the hint dropped by Saylor more recently – “There’s no tax on Bitcoin (represented by orange dots)”.

What’s next for BTC?

According to a document filed with the Securities and Exchange Commission (SEC), the recent purchase was made possible through the selling of MSTR shares.

According to the company’s strategy for acquiring $42 billion (a combination of $21 billion in debt and $21 billion through stock issuance), there remains an opportunity to raise an additional $37.6 billion via different means.

It’s been suggested by some analysts that the recent Bitcoin price movements from last week may have been influenced or triggered by Strategy’s bidding actions.

“That explains last week’s relative strength. Was all just Saylor.”

Bitcoin experienced a 7% surge over the past week, reaching as high as $86,000. As we speak, its value stands at around $85,000, falling slightly below the key bull support level of the 200-day simple moving average.

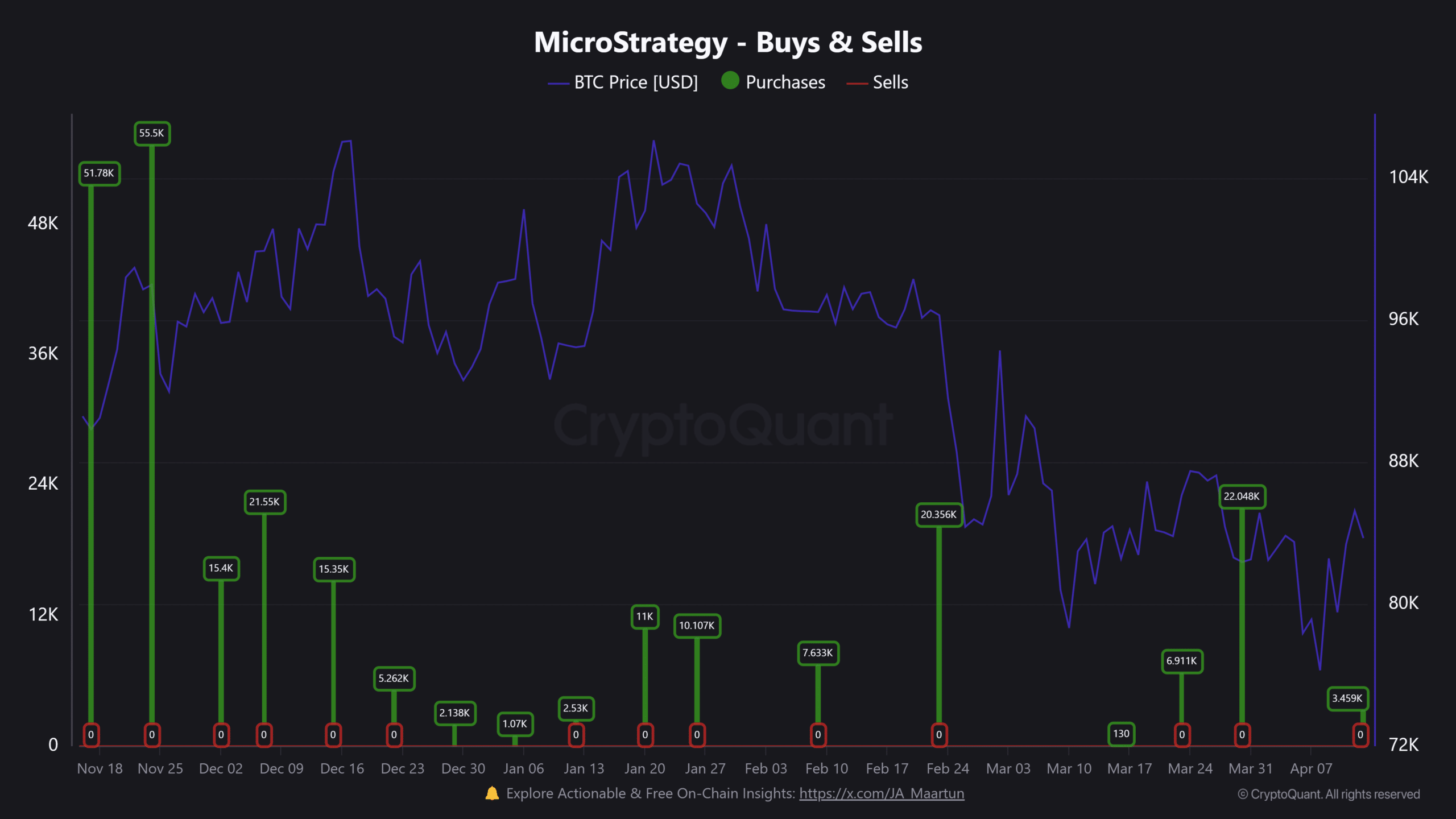

Speaking of which, the spending in 2025 has been significantly smaller than that seen in late 2024. Simultaneously, the value of Bitcoin dropped from approximately $109,000 to as low as $74,000, but it’s since held steady above $70,000.

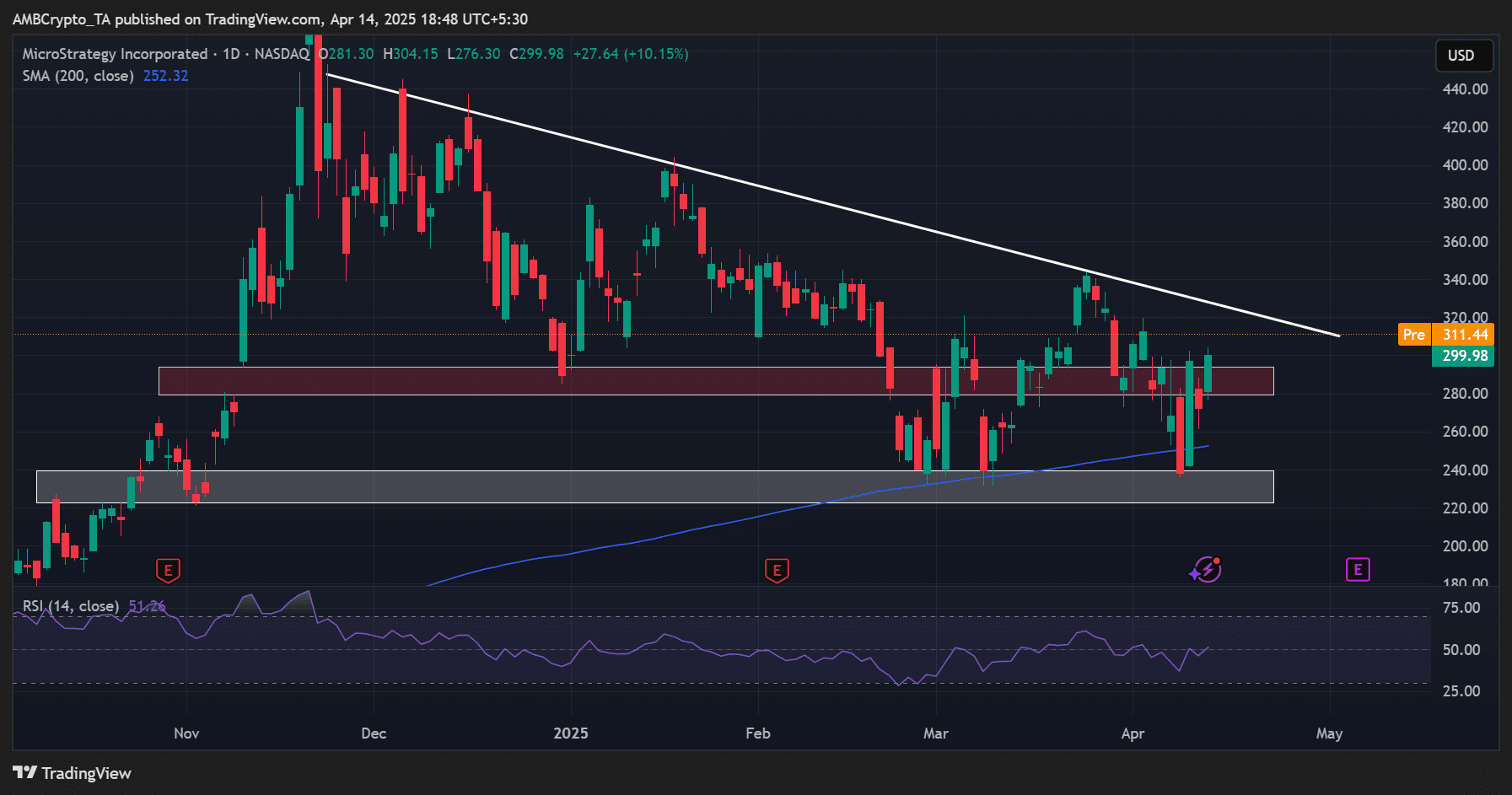

Consequently, Strategy’s potential earnings dropped by approximately $10 billion, from around $19 billion to $9 billion – Indicating a significant loss of $10 billion. The volatility in the price of Bitcoin seemed to impact MSTR as well. Since last November, Strategy’s shares have been experiencing a downtrend.

Over the last two months, it hit a local low near the 200-day moving average (represented by blue), fluctuating between approximately $230 and $330. If this upward trend continues beyond the trendline resistance, it could give bulls the strength to push prices even higher.

Read More

- Does Oblivion Remastered have mod support?

- Thunderbolts: Marvel’s Next Box Office Disaster?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion Remastered: Best Paladin Build

- Demon Slayer: All 6 infinity Castle Fights EXPLORED

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

2025-04-15 11:14