Bitcoin ETFs just had their third-worst week of 2025, hemorrhaging $713 million like a broken faucet. Ether ETFs? Oh, they’re still in their “losing streak era,” with $82.47 million fleeing for the hills. Seven weeks in the red? Someone call a therapist. 🚨

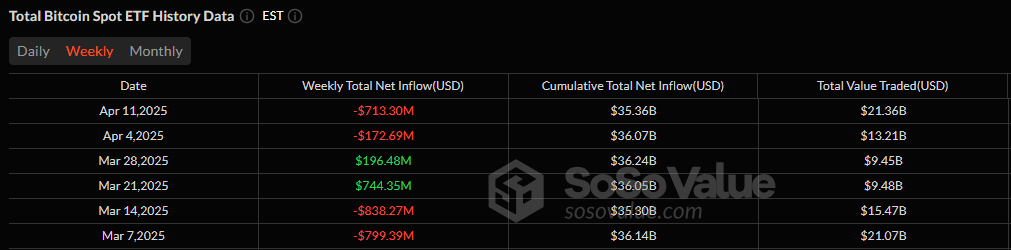

Investors were apparently in a “sell everything and run” mood last week, as bitcoin ETFs saw a jaw-dropping $713.30 million vanish into thin air. This marks their second consecutive week of losses and the third-largest weekly outflow of the year. Tuesday, April 8, was particularly brutal, with $326.27 million exiting stage left in a single day. Not a single day of net inflows? Ouch. 😬

Leading the exodus was Blackrock’s IBIT, which shed a whopping $342.61 million. Grayscale’s GBTC wasn’t far behind, losing $160.93 million, while Fidelity’s FBTC said goodbye to $74.63 million. It’s like a crypto version of “The Great Escape,” but with less Steve McQueen and more panic. 🏃♂️💨

Other ETFs weren’t spared either. Bitwise’s BITB lost $38.13 million, Invesco’s BTCO said goodbye to $27.30 million, and Ark 21shares’ ARKB waved off $26.01 million. Franklin’s EZBC, Wisdomtree’s BTCW, Vaneck’s HODL, and Valkyrie’s BRRR also joined the pity party with losses ranging from $5.32 million to $18.10 million. The only glimmer of hope? Grayscale’s Mini Bitcoin Fund, which managed a measly $2.39 million inflow. Yay? 🎉

Bitcoin ETFs ended the week with $93.36 billion in total net assets, a far cry from their previous highs of over $100 billion. It’s like watching a billionaire downgrade to a studio apartment. 🏙️

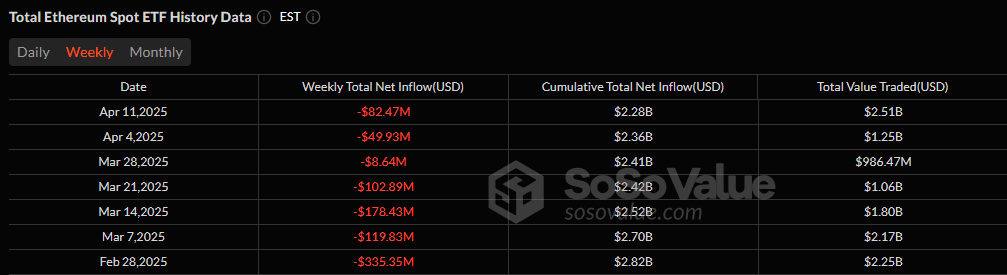

Ether ETFs fared no better, marking their 7th consecutive week of net outflows with $82.47 million fleeing the scene. Fidelity’s FETH led the charge with $45.04 million in losses, followed by Grayscale’s ETHE ($28.32 million), Bitwise’s BITB ($5.65 million), and VanEck’s ETHV ($4.44 million). Blackrock’s ETHA was the lone wolf with a tiny $977k inflow. A drop in the ocean, really. 🌊

As macroeconomic uncertainty and risk-off sentiment continue to haunt the markets, the crypto ETF space remains as volatile as a teenager’s mood. With no signs of a turnaround yet, all eyes are on this week’s flows to see if there’s a glimmer of hope or just more doom and gloom. Stay tuned, folks. 🍿

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- All 6 ‘Final Destination’ Movies in Order

- Every Minecraft update ranked from worst to best

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

2025-04-15 02:57