Ah, the grand spectacle of tokenization! It gallops forth like a wild stallion, heralding a seismic shift in the realm of global finance. Picture this: blockchain-based U.S. Treasuries, equities, commodities, and private credit, all poised for a meteoric rise this year, as foretold by the illustrious scribes at Keyrock and Centrifuge.

Keyrock and Centrifuge Analysis: Tokenized RWAs Could Capture 10% of Stablecoin Market by Year’s End

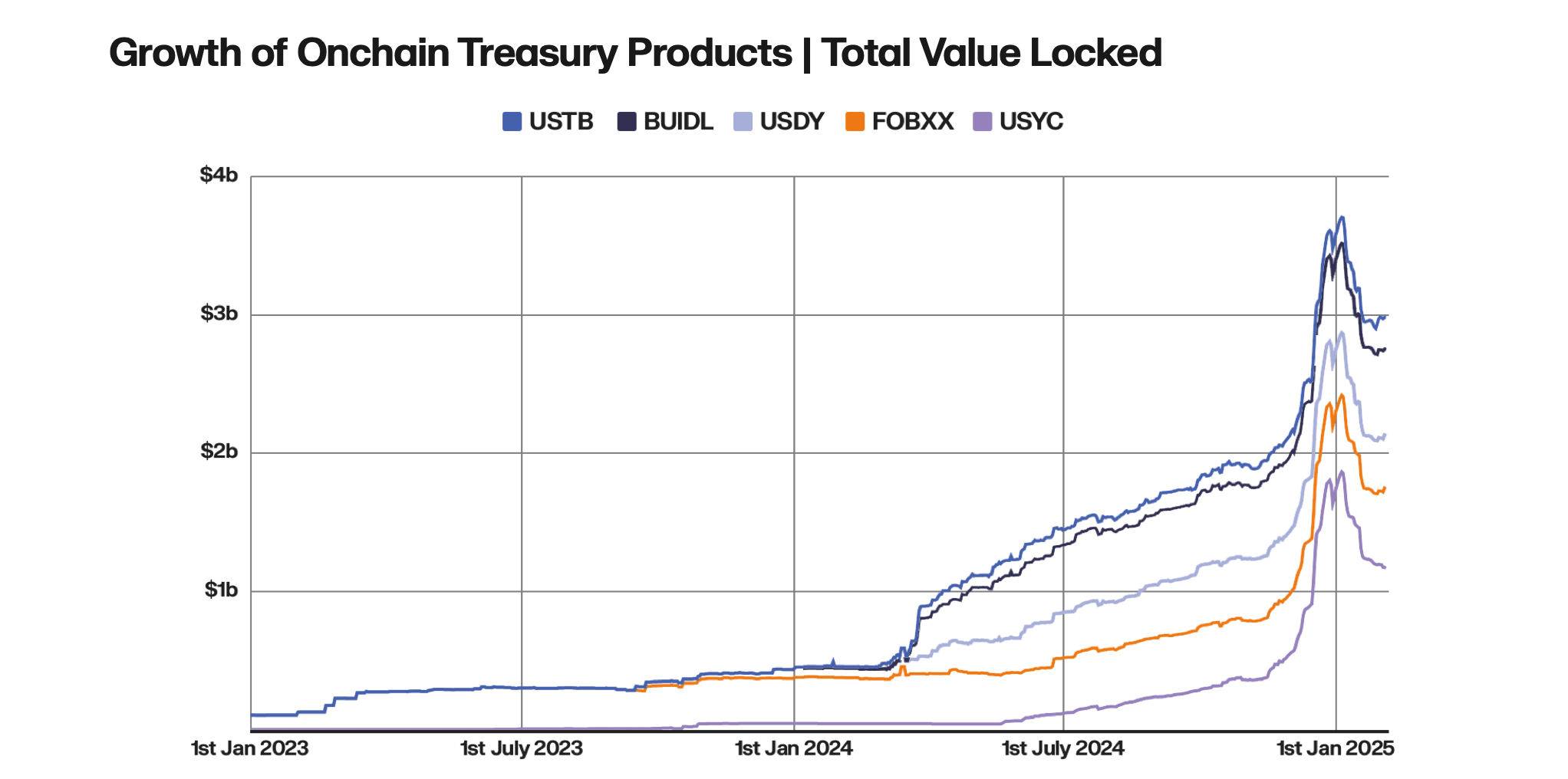

Behold! Tokenized U.S. Treasuries have skyrocketed by a staggering 415% year-over-year, driven by the insatiable appetite of yield-hungry stablecoin aficionados and the ever-watchful eyes of institutional investors, as the two firms report. Keyrock and Centrifuge predict that this sector could swell to a whopping $28 billion if tokenized products manage to snag a mere 10% of the $210 billion stablecoin market. “We expect tokenized Treasuries to evolve from a niche innovation into a core infrastructure component of global digital finance,” the report notes, with a wink and a nudge.

Now, let us not forget the tokenized equities, which, bless their hearts, are still crawling at a modest $15 million TVL. But fear not! 2025 is on the horizon, promising regulatory clarity like a lighthouse guiding lost ships. Backed Finance and Ondo Global Markets have opened the gates to permissionless access to tokenized S&P 500 exchange-traded funds (ETFs) and corporate shares. Huzzah!

“The democratization of sophisticated financial tools through non-KYC, permissionless protocols promises to unlock trillions in untapped market potential from previously underserved regions and populations,” the Keyrock and Centrifuge study proclaims, as if announcing the arrival of a new messiah.

Meanwhile, commodities like gold are grappling with liquidity gaps, despite a tokenized supply of $1.2 billion. But fear not, for synthetic platforms like Ostium Labs are here to capture the speculative demand like a cat with a laser pointer. Private credit, on the other hand, leads the pack with $12.2 billion TVL, as Centrifuge’s institutional pools slice securitization costs by a jaw-dropping 97%. Talk about a bargain!

Yet, the specter of regulatory hurdles looms large, particularly for equities. But fret not, dear reader! Keyrock and Centrifuge assure us that bipartisan U.S. legislation and European frameworks like MiCA are paving the way. The report forecasts that total tokenized RWAs could reach a staggering $50 billion in a 2025 bull case, fueled by institutional uptake and significant decentralized finance (DeFi) integration. Can I get a hallelujah?

“This movement envisions restructuring global finance by democratizing access, increasing efficiency, and enhancing transparency across asset classes,” the tokenized RWA analysis explains, as if it were a grand manifesto. “Instead of slow settlement pipelines, markets could operate on blockchain rails with near-real-time settlement and verifiable ownership records, reducing counterparty risks and back-office friction.” Oh, the dreams we weave!

With tokenized Treasuries modernizing settlements and private credit democratizing access, Keyrock and Centrifuge herald 2025 as the inflection point for blockchain’s $30B–$50B breakthrough. And who knows? Perhaps we’ll all be sipping champagne on our yachts by then! 🍾

Read More

- Who Is Abby on THE LAST OF US Season 2? (And What Does She Want with Joel)

- DEXE/USD

- ALEO/USD

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Discover the Exciting World of ‘To Be Hero X’ – Episode 1 Release Date and Watching Guide!

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

- Yellowstone 1994 Spin-off: Latest Updates & Everything We Know So Far

- ‘I’m So Brat Now’: Halle Berry Reveals If She Would Consider Reprising Her Catwoman Character Again

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Who Is Sentry? Exploring Character Amid Speculation Over Lewis Pullman’s Role In Thunderbolts

2025-04-12 00:57