Dear reader, it is with a touch of bemusement that I present to you the plight of Synthetix’s algorithmic stablecoin, sUSD, which finds itself rather disgracefully adrift from its intended dollar peg, currently languishing at a rather disheartening $0.90.

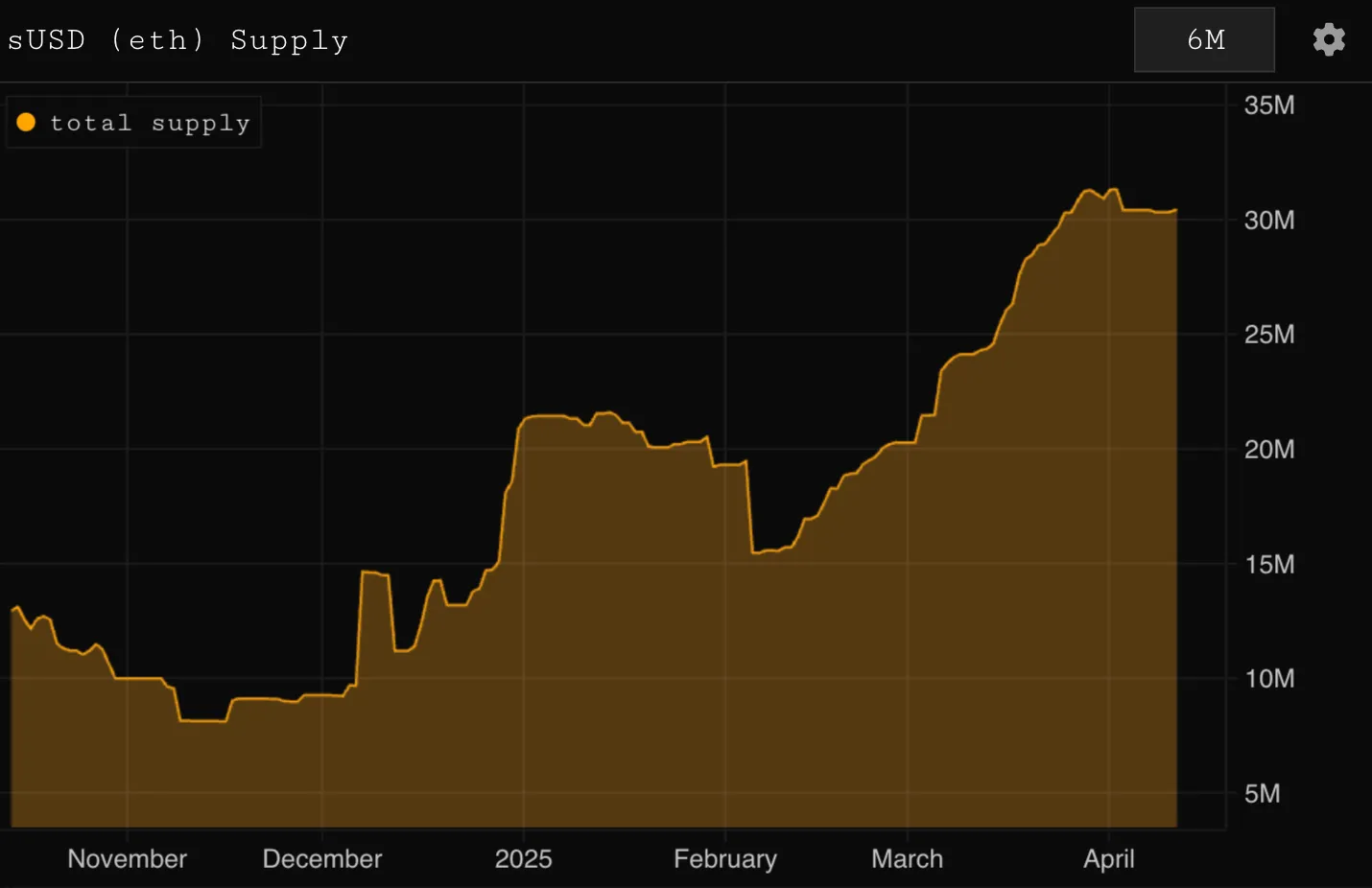

The unfortunate drift commenced in March when sUSD, in a fit of bewilderment, briefly fell below its ideal dollar mark. This predicament has only intensified following the recent enactment of SIP-420—a governance proposal that, one might say, was intended to enhance capital efficiency and render the user experience as palatable as a fine tea. However, as the saying goes, it is always the best intentions that lead to the most curious of outcomes. According to research from the illustrious Parsec, SIP-420 has unwittingly conjured a considerable increase in the sUSD supply, thus precipitating our current crisis of stability.

Notably, SIP-420 introduced a rather clever protocol-owned staking pool, a veritable delight for SNX holders who may wish to delegate their staking duties to a shared pool. This change, while ostensibly benevolent, has reduced the collateralization ratio from an exhaustive 500% to a mere 200%. Thus, more sUSD may now be minted at an astonishing 2.5 times the previous rate, as reported by Parsec. However, this delightful efficiency has removed the very stabilizing mechanism that kept our dear stablecoin somewhat, well, stable. Individual stakers have lost their motivation to purchase sUSD at a charming discount to settle their debts when the price descends beneath the cherished peg.

As a result, with debt pooled as it were, our valiant stakers find themselves, rather unexpectedly, devoid of any dire need to remedy the situation. To add further insult to injury, the 420 Pool proudly boasts over $80 million in SNX, leading to a considerable expansion of sUSD supply. Some Curve liquidity pools are positively bursting with over 90% sUSD—convenient, perhaps, yet devoid of the requisite demand that would balance this increase and restore harmony to pricing.

Alas, the situation grows more absurd. Infinex, in a moment that might be described as lacking foresight, began incentivizing the holding of sUSD in their wallet just as the depegging commenced. These incentives, while seemingly generous, have resulted in liquidity flooding the system without the corresponding demand to justify it. A rather riled-up user on Infinex’s Discord channel lamented, “You fellows advocate for sUSD via campaigns; you must take responsibility!” In truth, it seems they might very well be correct.

The Synthetix team, ever the optimists, have assured their faithful users that this is merely a “transition period.” They are laboring diligently to devise new demand sinks, including integrations with Aave (AAVE) and Ethena (ENA), to curtail the surplus of sUSD. Furthermore, they promise enhanced incentives for liquidity pools on Curve, as if offering a sweet promise of better days ahead.

In conclusion, dear readers, while the SIP-420 upgrade heralded improvements in capital efficiency and a simpler user experience, it regrettably sacrificed our organic peg stabilizer, resulting in the sUSD depeg as a most unanticipated byproduct. The shift to a protocol-owned staking pool and the notable reduction of the collateralization ratio have led to an abundance of sUSD, bereft of sufficient demand to counterbalance it. Thus, we find the stablecoin floundering, its price hovering haplessly around $0.90. One must wonder, will sUSD holders choose to exit this tumultuous sea now, or shall they resolutely hold out for a return to calmer waters?

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-04-11 14:04