So, the crypto world is having a meltdown—shocking, right? Meanwhile, tokenized real-world assets (RWAs) are thriving like they just got cast in a hit HBO show. Over 30 days, they’ve climbed 12.5%, and tokenized Treasuries? Oh, they’re up 8.7% in just seven days. 🚀

Tokenized Treasuries Hit $5.49B

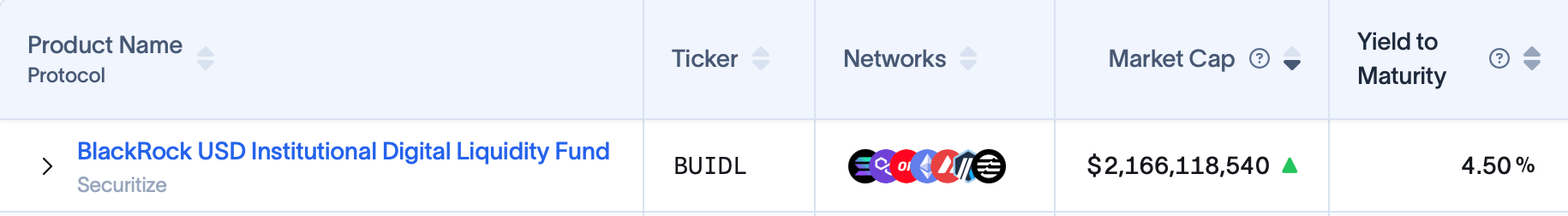

Tokenized Treasuries are having a moment. According to rwa.xyz, as of April 10, 2025, the market is now worth $5.49 billion—up 8.7% since last week. Blackrock’s BUIDL fund? It’s over $2 billion now. $2.166 billion, to be exact. 🤑

On April 4, BUIDL was at $1.949 billion. Now? It’s ballooned by 11.13%. Meanwhile, Franklin Onchain’s BENJI dropped from $708 million to $706 million. Ouch. 😬

Ondo’s USDY fund? It went from $585 million to $586 million. Big whoop. Hashnote’s USYC? Down 11.18% to $557 million. But hey, Janus Henderson’s JTRSY and Openeden’s TBILL Vault are up. So, not everyone’s having a bad week. 🎉

What’s going on here? Investors are flocking to blockchain-driven TradFi instruments. By April 10, 17,628 investors had staked claims in tokenized Treasuries, lured by an average annual yield of 4.36%. Stability? In this economy? Preposterous. But here we are. 🤔

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

2025-04-10 20:00