Solana: The Whale’s Big Splash – Will SOL Finally Break Free?

- Solana’s price neared the breakout zone as whale activity stirs renewed interest.

- Liquidation clusters cleared while Open Interest dipped, signaling a potential trend reset.

A Solana [SOL] whale has just unstaked and deposited 71,448 SOL (worth $8.54 million) to Binance, instantly stirring speculation across the market. 🐳💸

Despite this massive move, the same whale continues to hold 568K $SOL (approximately $68 million) in staking, signaling confidence in the long-term value of the network. 🤔

This sharp on-chain activity has traders on edge, wondering whether a selloff is on the horizon. However, technical and behavioral signals suggest a different narrative might be unfolding. 😏

Can Solana break out of its months-long downtrend?

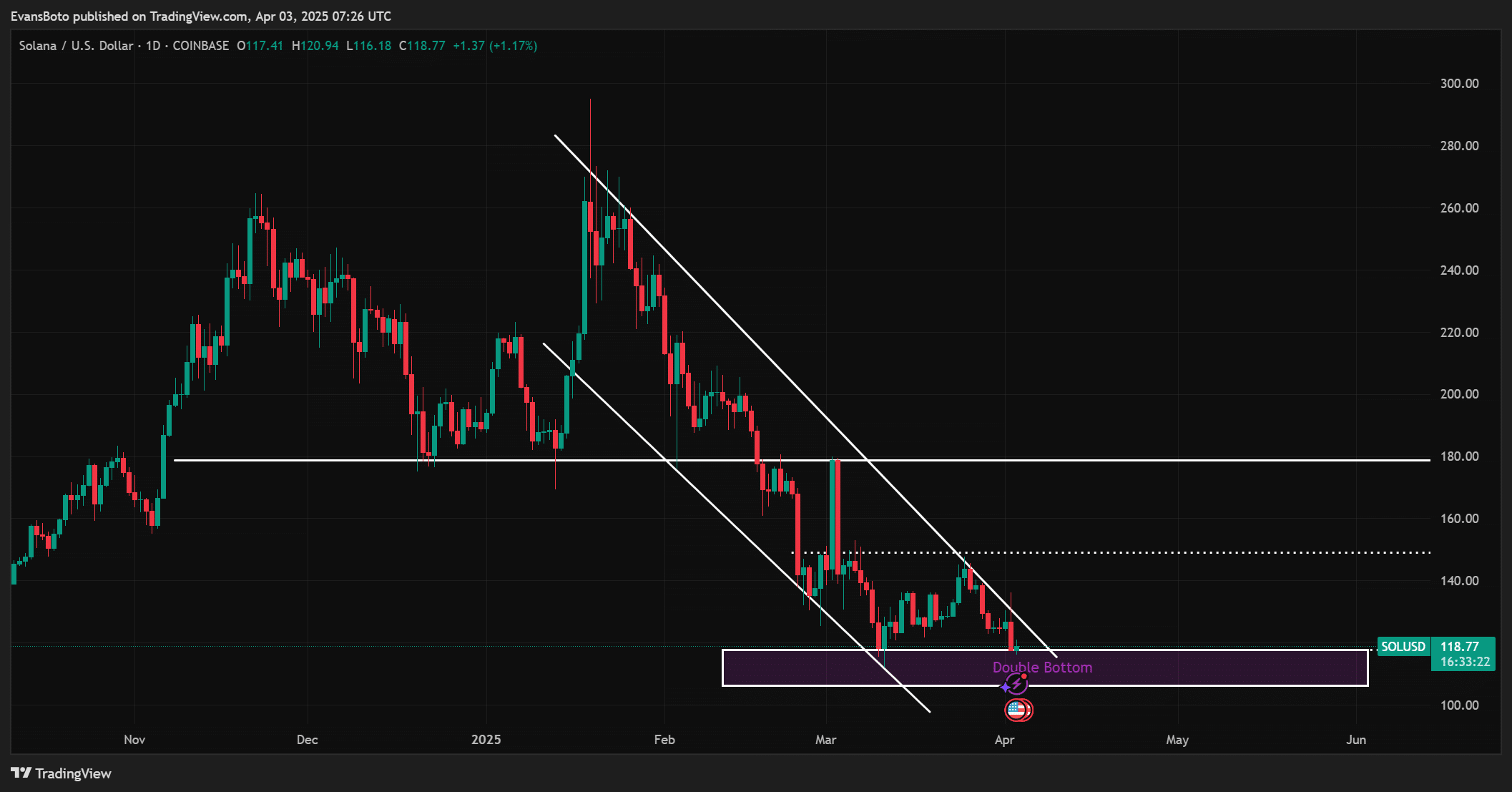

At the time of writing, Solana was trading at $118.74, down 4.41% in the last 24 hours. On the chart, Solana was bouncing off a well-defined support zone near $115, forming a clear double bottom pattern. 📈

Additionally, Solana’s price action was approaching the upper boundary of a descending channel that has constrained it for weeks. 🚧

If bullish momentum drives the price beyond $120, it could trigger fresh upward movement. However, failure to break this level might lead to renewed selling pressure, potentially testing the $110 support once again. 🚨

Why is Solana dominating crypto conversations?

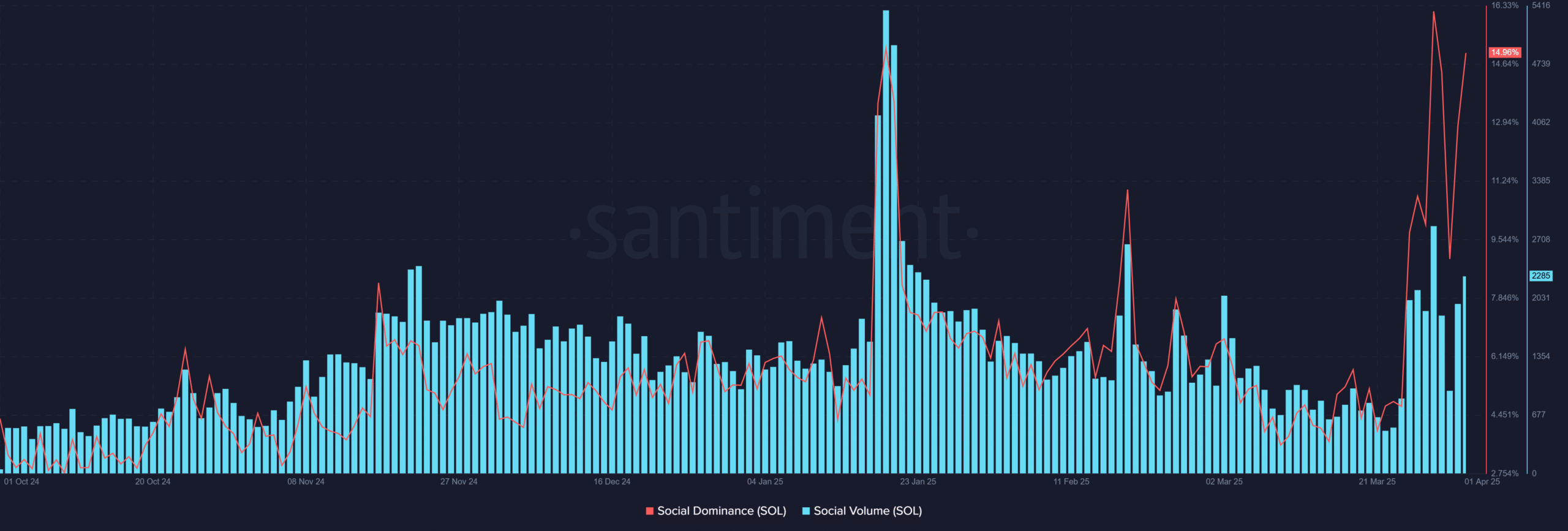

Social Volume for Solana has surged, with over 2,285 mentions and social dominance climbing to 14.96%. This spike indicates growing trader interest, potentially driven by the technical setup and whale movement. 📊

Moreover, the rise in discussions often reflects speculative anticipation, which fuels short-term volatility. Therefore, increased social buzz could be an early sign of a breakout attempt or a false rally trap. 🤷♂️

What does the liquidation map reveal about price pressure?

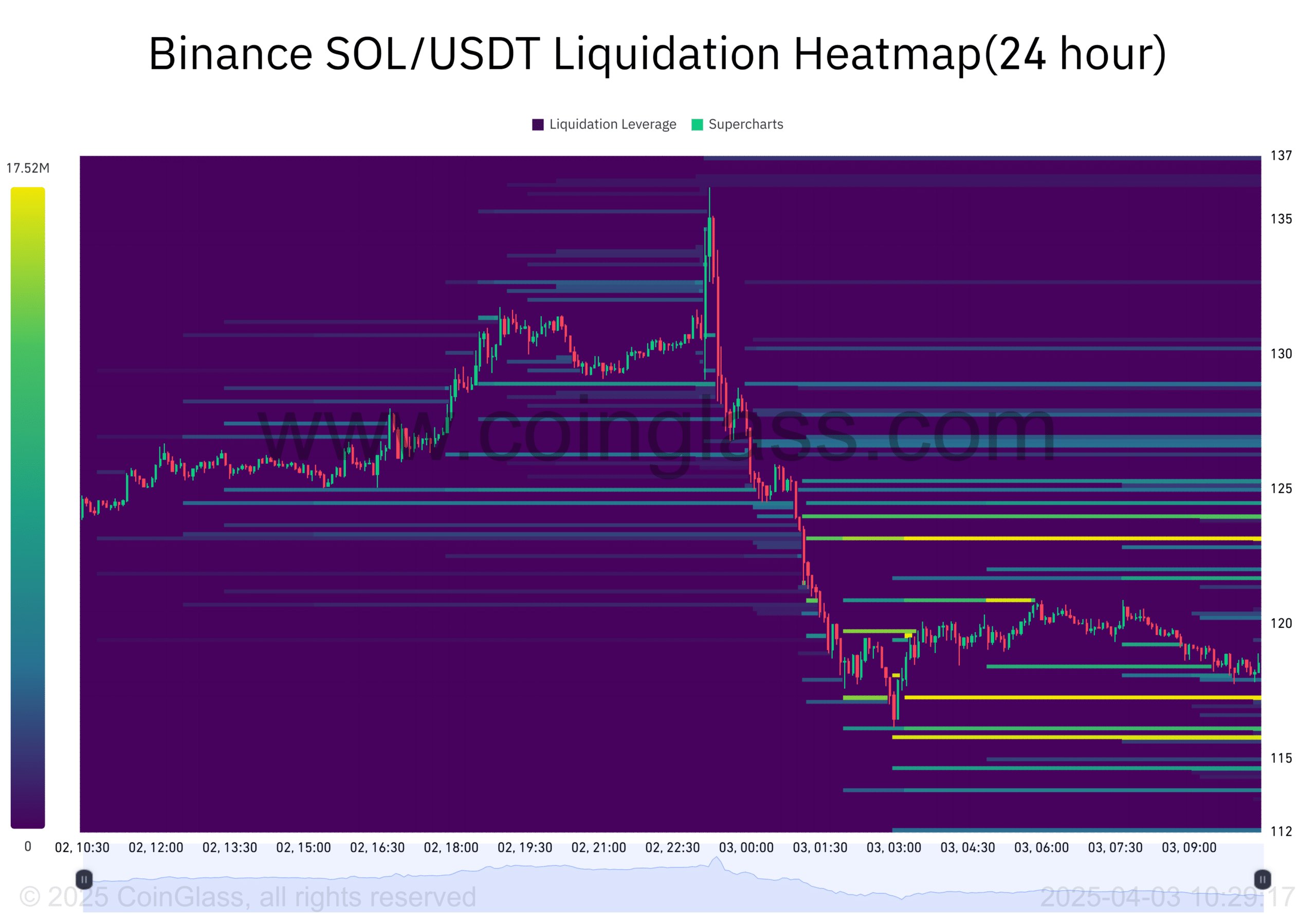

The Binance liquidation heatmap showed heavy liquidation activity, concentrated between $117 and $122. As price dipped into this zone, it triggered long liquidations that accelerated the decline. 💥

However, clearing out these over-leveraged positions reduces downside pressure and strengthens price stability. A clean move above $122 could force short positions to close, potentially igniting a rally toward $130. 🚀

How does Open Interest shape market expectations?

//ambcrypto.com/wp-content/uploads/2025/04/Screenshot-2025-04-03-103102.png”/>

What next for SOL

Given the whale’s remaining stake, strong technical rebound, increased social sentiment, and reduced leverage pressure, the move seems strategic rather than fear-driven. The deposit to Binance could be a positioning strategy ahead of anticipated market volatility. 🤔

Additionally, the current momentum indicates that Solana may be gearing up for a breakout if it reclaims key levels. 🚀

However, caution remains essential, as short-term fluctuations or selling pressure might arise before a definitive move materializes. 🚨

Read More

2025-04-03 14:20