- SOL ETF Futures products have all the charm of a damp sock, struggling to keep up with BTC‘s glitz.

- Will the upcoming U.S. spot SOL ETF products face a similar fate as expired milk? 🍞

In the theatrical universe of cryptocurrency, Senior Bloomberg ETF analyst Eric Balchunas plays the role of the astute observer, noting that the newly minted Solana [SOL] ETF (exchanged traded funds) Futures are about as impressive as a snail in a racing competition against the agile rabbit of Bitcoin.

Balchunas quipped,

“The new Solana futures ETF hasn’t done much. A million in volume during the first few days is quite splendid—if you’re a developer in the slow lane. But compared to BTC? It’s like bringing a spoon to a sword fight—about 80 times less than $BITO’s initial days or $IBIT’s. The further you drift from BTC, the less appealing the asset becomes. Imagine trying to trade in Monopoly money!”

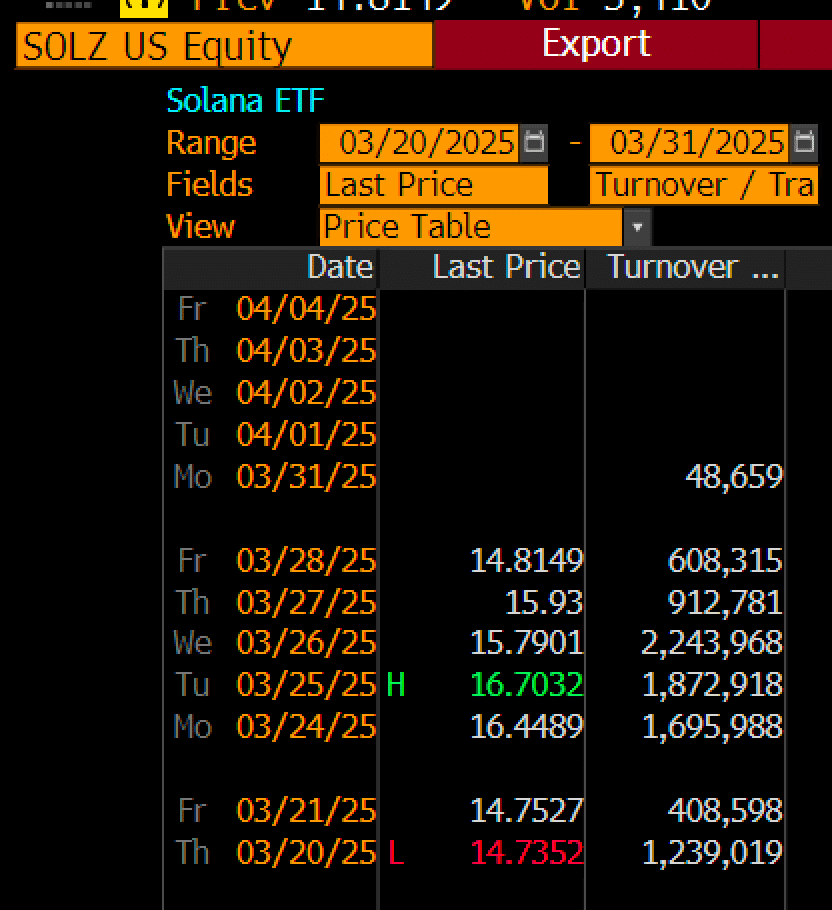

The SOL ETF Futures, launched with much fanfare by Volatility Shares on March 20, made a modest splash with a $1 million trading volume, a sum that could barely fill a kiddie pool in a desert.

However, as illustrated by the attached Bloomberg chart, volumes took a nosedive on March 31, plummeting to an astonishingly low $48K—akin to watching a balloon slowly deflate at a children’s party.

Solana vs. Bitcoin: The Epic Showdown

Balchunas, with a glint of futurology in his eyes, previously suggested that the market dynamics could sway interest in newer ETF products like leaves in a gusty wind.

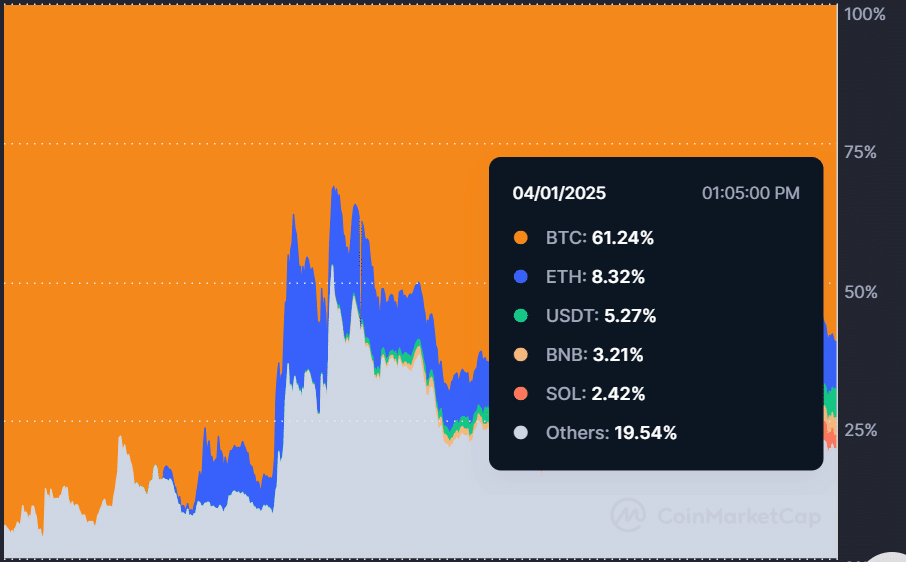

Currently, BTC reigns supreme with a thunderous 61% market share, followed by Ethereum [ETH] twinkling at 8%, while our dear SOL languishes in fifth place at a meager 2.4%, recently overtaken by the rapidly ascending Binance Coin [BNB]—a cosmic tragedy.

Much like a rock concert where the headliner is a no-show, BTC ETFs have enjoyed fabulous success since their debut, raking in a whopping $36B in cumulative inflows. 🎤💰

In stark contrast, the U.S. spot ETH ETFs from last July have only managed $2.4B, making them 15 times less popular than their BTC counterparts. It’s practically a digital game of “Will it blend?” and BTC is the blender that never stops blending.

If the stars align, will the same trend plague the U.S. spot SOL ETFs? The recently launched SOL CME (Chicago Mercantile Exchange) Futures have echoed this tragic narrative, debuting with $12M in trading volumes—nearly 10 times less than BTC CME Futures, which had $102M, and ETH’s palsy $31M.

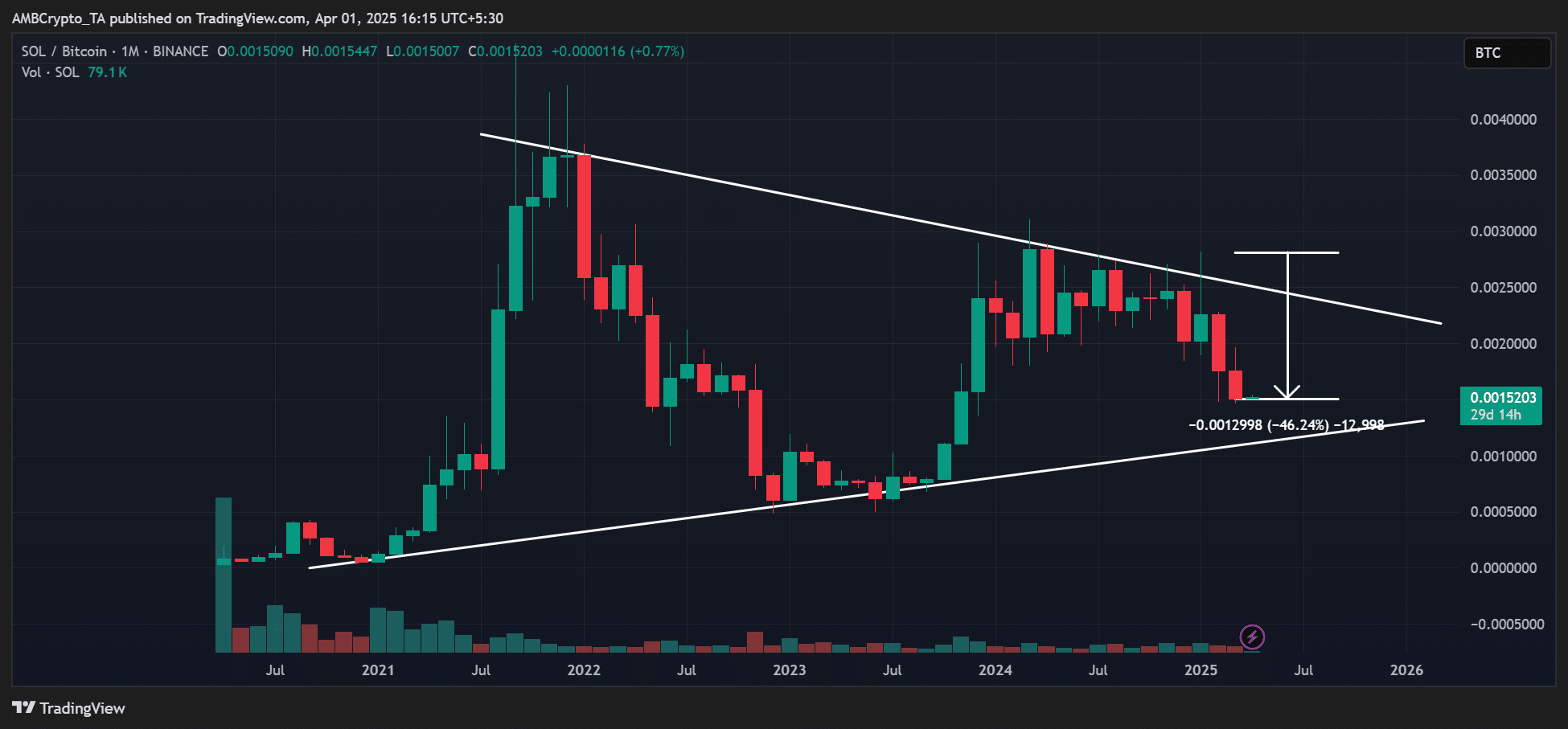

Moreover, speculative souls seem to prefer wrapping themselves in the comforting embrace of BTC during market meltdowns rather than draping themselves in SOL or ETH—much like a hedgehog avoiding a thorny bush. During Q1, SOL staggered along, underperforming compared to BTC by a staggering 50%. 🦔💥

If SOL’s current trend continues its downward spiral, we might witness the SOL/BTC ratio sloping to 0.0012, a support line that looks as inviting as a waiting room with outdated magazines, before possibly rebounding with the grace of a cat landing on its feet.

As of this cosmic moment, the altcoin is valued at $128, teetering above the critical $120 annual support like a cat on the edge of a busy countertop.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-04-02 03:07