Research overview

March 2025 was a rollercoaster ride for the global cryptocurrency market, with ups and downs that would make a theme park jealous. After the chaos of February, we saw some signs of recovery, but let’s not get too excited – volatility was still lurking around every corner. 🎢💰

Bitcoin tried to stabilize after its steep drop in February, even daring to peek above the $88K level for a brief moment. Ethereum, on the other hand, was struggling to find its footing, despite the headwinds. Altcoins had a mixed bag, with some large-cap tokens rebounding modestly and mid-caps rallying on project-specific news. But let’s not forget, caution was still the name of the game. 🤔💰

Thematic market shifts

- Macroeconomic relief and policy clarity: The U.S. Federal Reserve decided to hold rates steady, hinting at future easing despite inflation concerns. President Trump softened his aggressive tariff stance, alleviating some risk-off sentiment. Regulatory clarity improved as the SEC signaled a more constructive approach by dropping its appeal in the Ripple case. 🤝💰

- Institutional moves bolstering confidence: MicroStrategy’s $584 million Bitcoin purchase and modest inflows returning to Bitcoin ETFs underpinned market optimism. Major exchanges and funds pursued growth, indicating continued long-term interest. 📈💰

- Crypto sectors diverging: Real-world asset (RWA) tokenization and DeFi platforms quietly expanded, with total RWA value locked surpassing $10B. AI-related tokens and memecoins led short-term rallies as risk appetite ticked up toward month-end. In contrast, NFT markets remained in a downturn, with trading volumes hitting multi-month lows despite growth in user participation. 📉💰

- Security and trust rebuilding: Following February’s record hacks, March saw no breaches on the same scale, but security remained a focal point. A $8.4M exploit of an RWA protocol and other minor incidents kept developers and exchanges vigilant, implementing safeguards and collaborating with law enforcement to prevent another Bybit-scale event. 🔒💰

Looking ahead

Bitcoin rebounds as institutions re-enter cautiously

- BTC recovered from a March low of ~$75K, briefly spiking to $88.7K before closing the month just under $87K.

- MicroStrategy’s $584M Bitcoin buy bolstered confidence, helping offset earlier ETF outflows.

- U.S. spot Bitcoin ETFs saw inflows return by late March, reversing February’s negative trend.

- Bitcoin dominance held steady despite rising memecoin interest.

Ethereum lags behind amid weak sentiment, but fundamentals stay strong

- ETH traded below $2,200 for most of March and closed the month near $2,050, hitting lows near $1,750 before recovering slightly.

- ETF outflows persisted early in the month, though signs of stabilization emerged by month-end.

- Ethereum staking reached a new high (31M+ ETH locked), and active validators exceeded 920K.

- The upcoming Pectra upgrade in Q2 became a focal point for long-term investor optimism.

Altcoins diverge: XRP, SOL, and FIL shine while others stall

- Solana (+15%) led large-cap rebounds, bouncing from ~$110 to ~$127.

- XRP gained ~10% after the SEC dropped its appeal, solidifying Ripple’s legal win.

- Filecoin surged +18% on upgrade excitement and ecosystem growth.

- Mid-tier altcoins without strong narratives remained mostly flat or rangebound.

Top crypto sectors of March: DeFi-RWA, AI tokens, and memecoins

- RWA protocols crossed $10B in total value locked (TVL), led by MakerDAO and BlackRock’s BUIDL fund.

- AI tokens (e.g., AGIX, FET) rallied on renewed hype and integration news.

- Memecoins saw late-month spikes—DOGE rose 7.8% after an Elon Musk tweet, SHIB and PEPE followed with double-digit jumps.

NFT market contracts, but participation ticks up

- NFT sales volume dipped to ~$418M in March, down ~12% month-over-month.

- Blue-chip collections like BAYC and CryptoPunks saw further floor price declines.

- However, active NFT traders and transactions rose, hinting at steady user engagement despite lower prices.

- Polygon and Mythos chains gained ground amid continued brand and gaming NFT activity.

Security focus intensifies post-February chaos

- No billion-dollar hacks in March, but the $8.4M Zoth RWA exploit reminded users that vulnerabilities persist.

- A GitHub supply chain attack targeting Coinbase’s repositories triggered software pipeline reviews across exchanges.

- Platforms implemented new safeguards: MPC wallets, admin time-locks, and phishing detection tools gained traction.

Bitcoin’s March 2025 recap: Rebounding amid cautious optimism

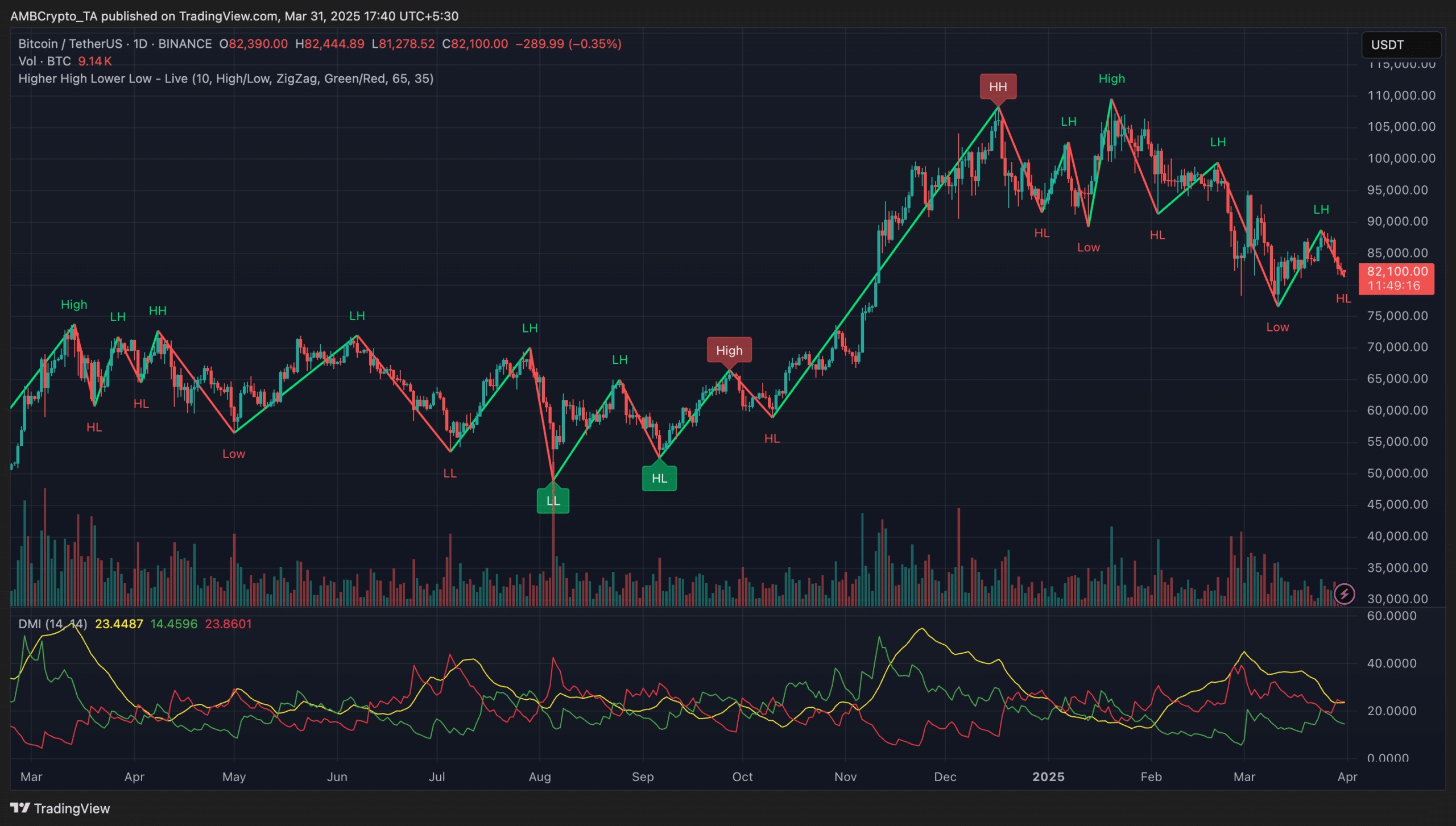

Bitcoin navigated a path of gradual recovery in March 2025 following a steep decline in February, reflecting resilience amid lingering macroeconomic uncertainties. 🌪💰

Key points

- BTC started the month around $85,000–$86,000, experiencing a sharp “V-shaped” recovery after dipping to lows of $74,500–$76,000.

- Bitcoin ended March with a marginal monthly loss (~3%), significantly better than its February decline (~17%).

Price volatility and key levels

- Bitcoin opened March trading near $85,000–$86,000, still reeling from February’s steep correction.

- Early-month fears pushed BTC briefly down into the $74,500–$76,000 zone by the second week, influenced by investor caution and macroeconomic pressures.

- By March 25, Bitcoin rebounded sharply to approximately $87,000, briefly peaking at $88,758 before retracing slightly, highlighting improved market sentiment yet persisting resistance.

Drivers of the recovery

Easing macroeconomic concerns

- Investor confidence improved significantly following reports that President Trump’s proposed April tariffs would be narrower and more flexible than initially anticipated.

- The U.S. Federal Reserve indicated potential rate cuts later in 2025, further boosting market optimism.

- Analysts commented, “Bitcoin is attempting to form a bottom, supported by Trump’s recent flexibility on tariffs.”

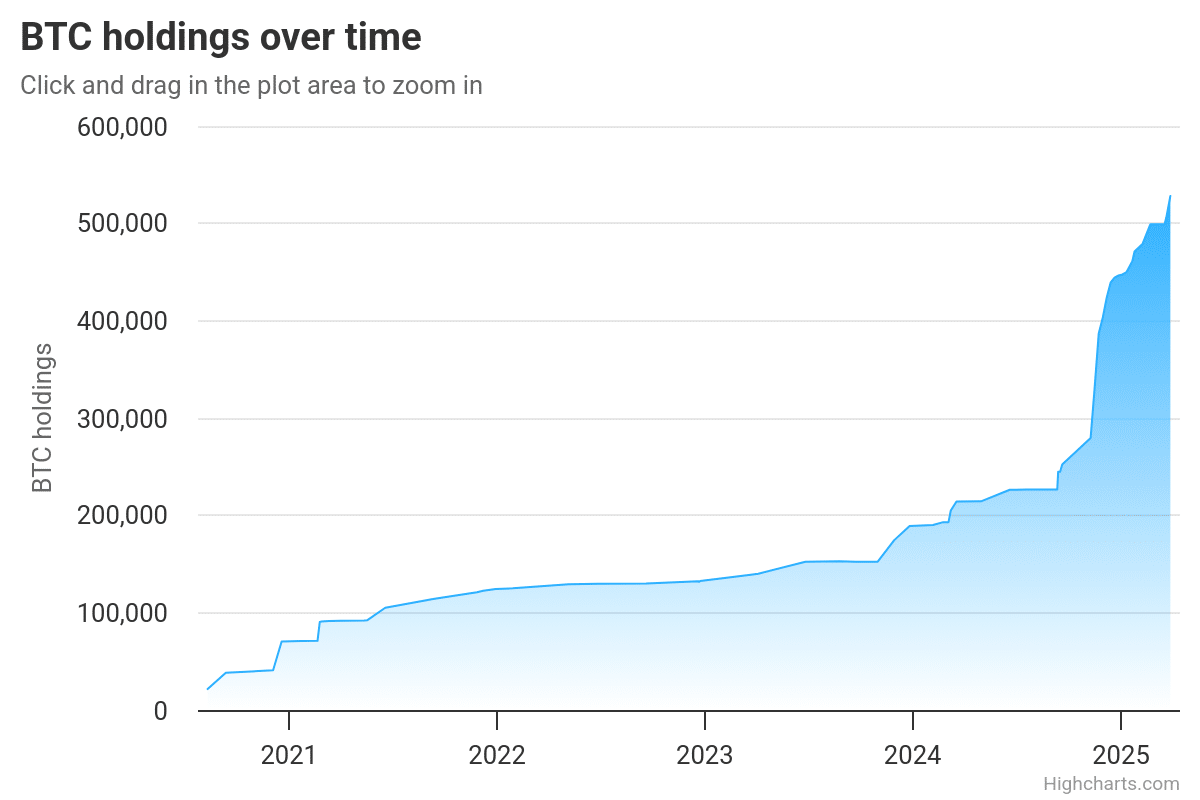

Institutional accumulation

- MicroStrategy executed a substantial $584 million Bitcoin purchase, one of its largest acquisitions to date, signaling robust institutional confidence.

- Exchange reserves continued to decline slightly in early March as investors moved Bitcoin to cold storage, signaling steady long-term holder accumulation amid market dips and post-Bybit hack concerns. Although not at multi-year lows, reserves remained suppressed throughout the month, reflecting a broader trend of cautious investor behavior.

- On-chain activity remained relatively stable month-over-month, with no dramatic surge or decline in active addresses or transaction volumes, indicating cautious yet consistent market participation.

- Futures funding rates turned positive by late March, and open interest gradually increased, suggesting traders’ cautious positioning for further upside.

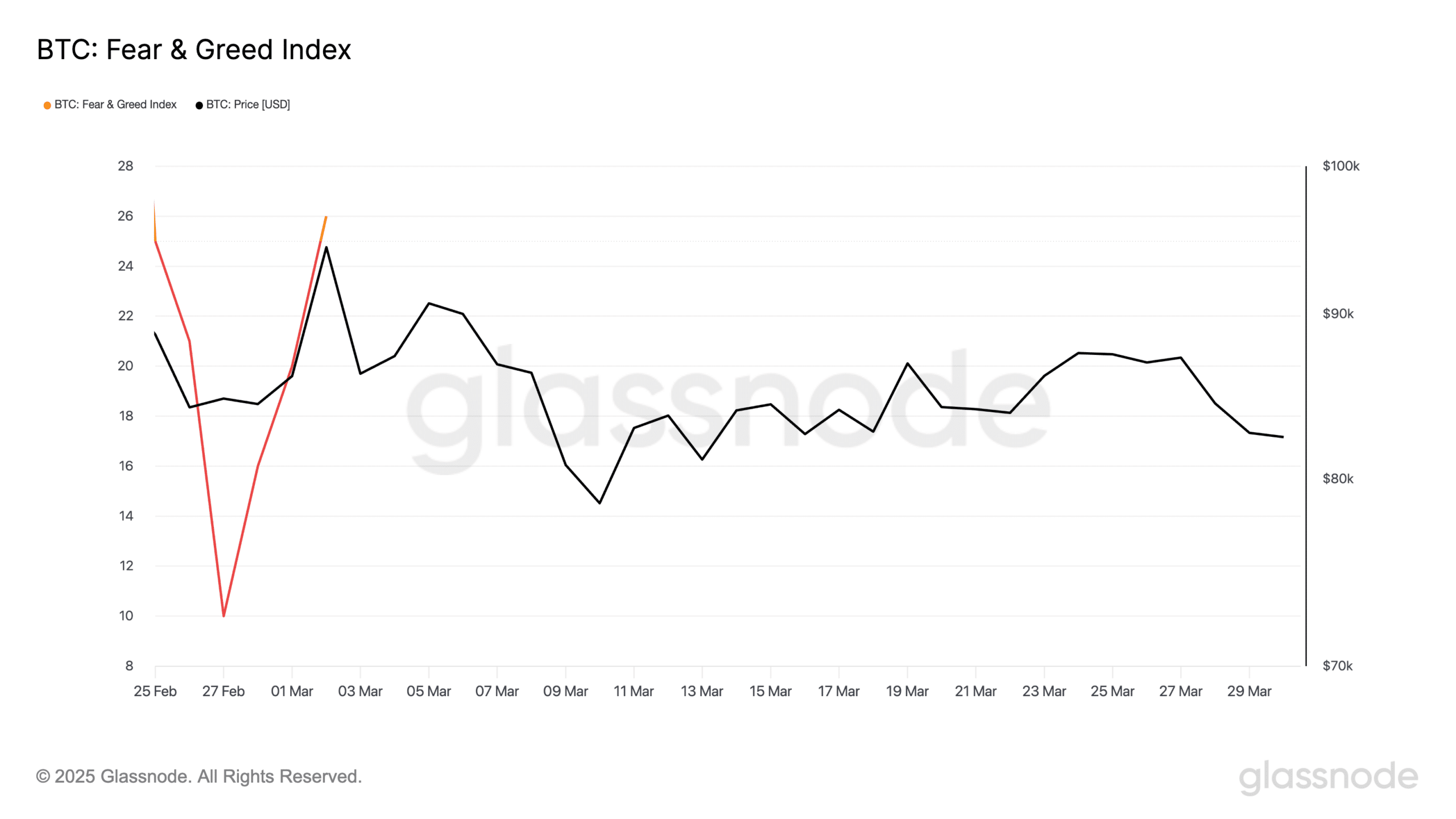

- Bitcoin’s market sentiment showed minor improvement in early March, with the Crypto Fear & Greed Index recovering from “Extreme Fear” levels (~10 on Feb 28) to the low-20s by the first week. However, sentiment remained subdued throughout the month, oscillating between 16 and 23, indicating persistent caution among market participants.

- Bitcoin’s market dominance increased slightly, surpassing 59–60% by late March (up from ~58% in February), as investors cautiously rotated funds from altcoins into BTC amid lingering uncertainty.

- Market analysts noted, “Market sentiment remains cautiously optimistic, with altcoin gains present but Bitcoin still commanding investor focus due to institutional support and ETF inflows.”

- The Federal Reserve’s steady rate stance and easing trade tensions positively influenced market sentiment.

- Significant regulatory developments, particularly in the Ripple case, bolstered crypto legitimacy.

- Institutional engagement and market infrastructure developments continued robustly despite market volatility.

- The U.S. Federal Reserve maintained steady interest rates in mid-March and indicated potential rate cuts later in 2025.

- The U.S. core inflation remained just above 3% year-over-year, slightly above target, while headline inflation hovered around 2.8%—reinforcing the Fed’s patient stance.

- Crypto markets, sensitive to interest rate dynamics, reacted positively, stabilizing alongside equities.

- Initial market fears from President Trump’s proposed reciprocal tariffs (25% on Canada & Mexico) significantly eased as March progressed.

- Reports of more flexible and narrower tariff implementations emerged, alleviating investor concerns.

- Bitcoin and major equity indices responded positively, notably rallying on the announcement of potential tariff exemptions.

- The SEC officially dropped its appeal against Ripple Labs, providing critical regulatory clarity around XRP, affirming it as a non-security in secondary markets.

- The ruling significantly enhanced investor confidence and broadened altcoin legitimacy.

- SEC Commissioner Hester Peirce’s Crypto Task Force engaged industry stakeholders to develop clearer regulatory frameworks.

- A comprehensive bipartisan crypto regulatory bill re-emerged, aimed at clarifying SEC and CFTC jurisdictions and setting stablecoin issuance standards.

- March saw renewed net inflows into the U.S. Bitcoin ETFs, reversing February’s trend.

- Market optimism rose regarding potential approval of Ethereum spot ETFs, driven by a notably softer regulatory stance.

- Trump Media & Technology Group partnered with Crypto.com, announcing plans for crypto-themed ETF products.

- EU: Conducted compliance workshops preparing for MiCA (Markets in Crypto-Assets) regulations scheduled later in 2025.

- Asia: Hong Kong’s retail crypto market attracted steady capital inflows, solidifying its position as a crypto hub.

- UAE: Updated guidelines for crypto businesses operating within its jurisdiction.

- Coinbase engaged in discussions to acquire Deribit, potentially marking a major consolidation in the crypto derivatives market.

- DWF Labs launched a new $250 million fund targeting mid- to large-cap crypto projects, reflecting strategic market positioning.

- Wall Street firms increased crypto holdings, taking advantage of the market dip to strategically enhance exposure.

- Nasdaq began onboarding institutional clients for crypto custody services, setting the stage for broader crypto trading offerings.

- Kraken obtained an EU e-money license to expand crypto-fiat services under the upcoming MiCA regulations.

- Binance adjusted its offerings in specific jurisdictions to align better with regulatory frameworks.

- Fidelity reported significant growth in 401(k) accounts allocating assets to Bitcoin, showcasing increasing mainstream acceptance.

- A notable U.S. university endowment fund publicly disclosed investment in a crypto-focused venture capital fund, indicating growing institutional comfort.

- Ethereum largely traded below $2,000, reaching a monthly low around $1,750–$1,780, before partially recovering to around $1,950–$1,980 by late March.

- Ethereum opened March near $1,950–$2,000 following continued late-February selling pressure and quickly declined further below the psychologically significant $2,000 mark amid persistent market uncertainties.

- The asset recorded its lowest monthly price around $1,750–$1,780, marking the lowest levels since mid-2024.

- Despite a modest recovery, ETH ended approximately 7–9% lower month-on-month, significantly underperforming Bitcoin.

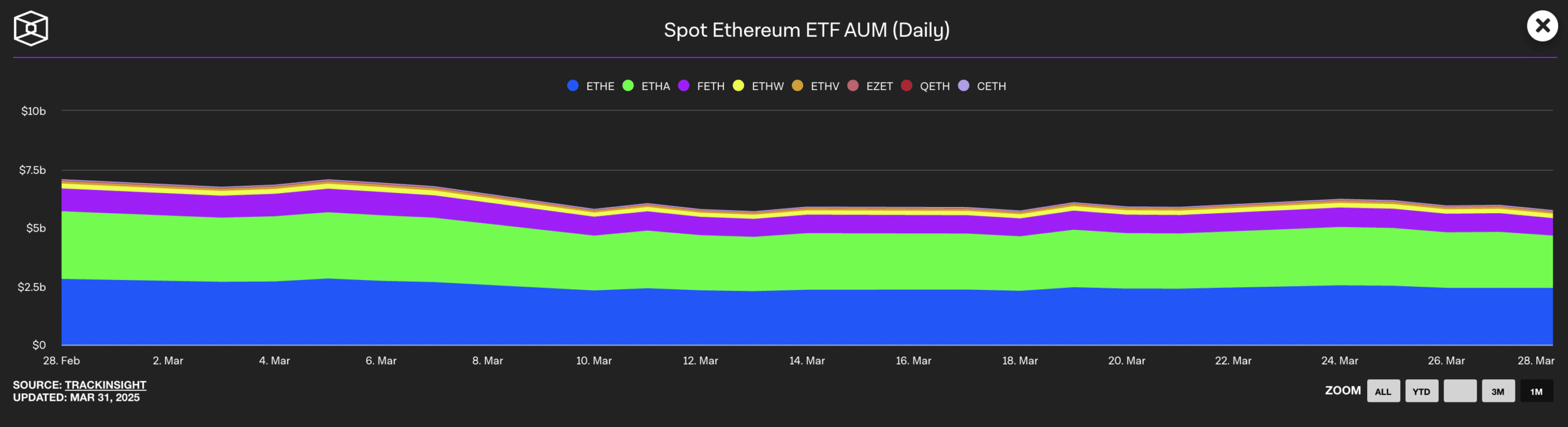

- Institutional interest in Ethereum-focused products remained cautious, with spot ETF assets under management (AUM) continuing their February downtrend during early March. Although outflows persisted, the pace slowed mid-month, and AUM levels showed signs of stabilization in the final week.

- While early March experienced significant daily outflows (reportedly over 16,000 ETH), the latter half saw smaller inflows, suggesting tentative institutional re-entry amid improving sentiment.

- Ethereum’s ETF AUM hovered between $6.5 billion and $7.3 billion throughout March, showing no major recovery but also avoiding further steep declines.

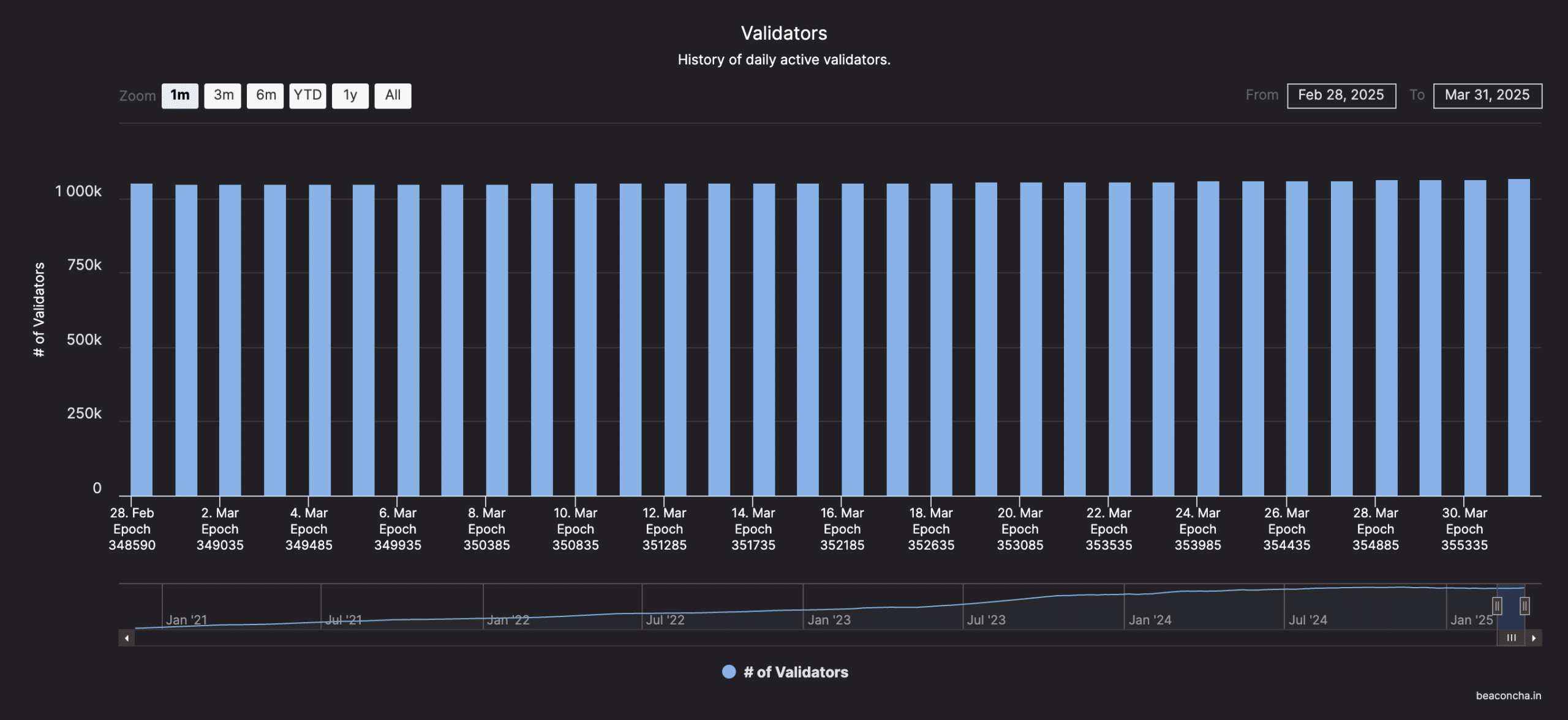

- Ethereum’s fundamental metrics demonstrated strength despite price weaknesses, with the number of active validators rising above 920,000, up from approximately 900,000 in February.

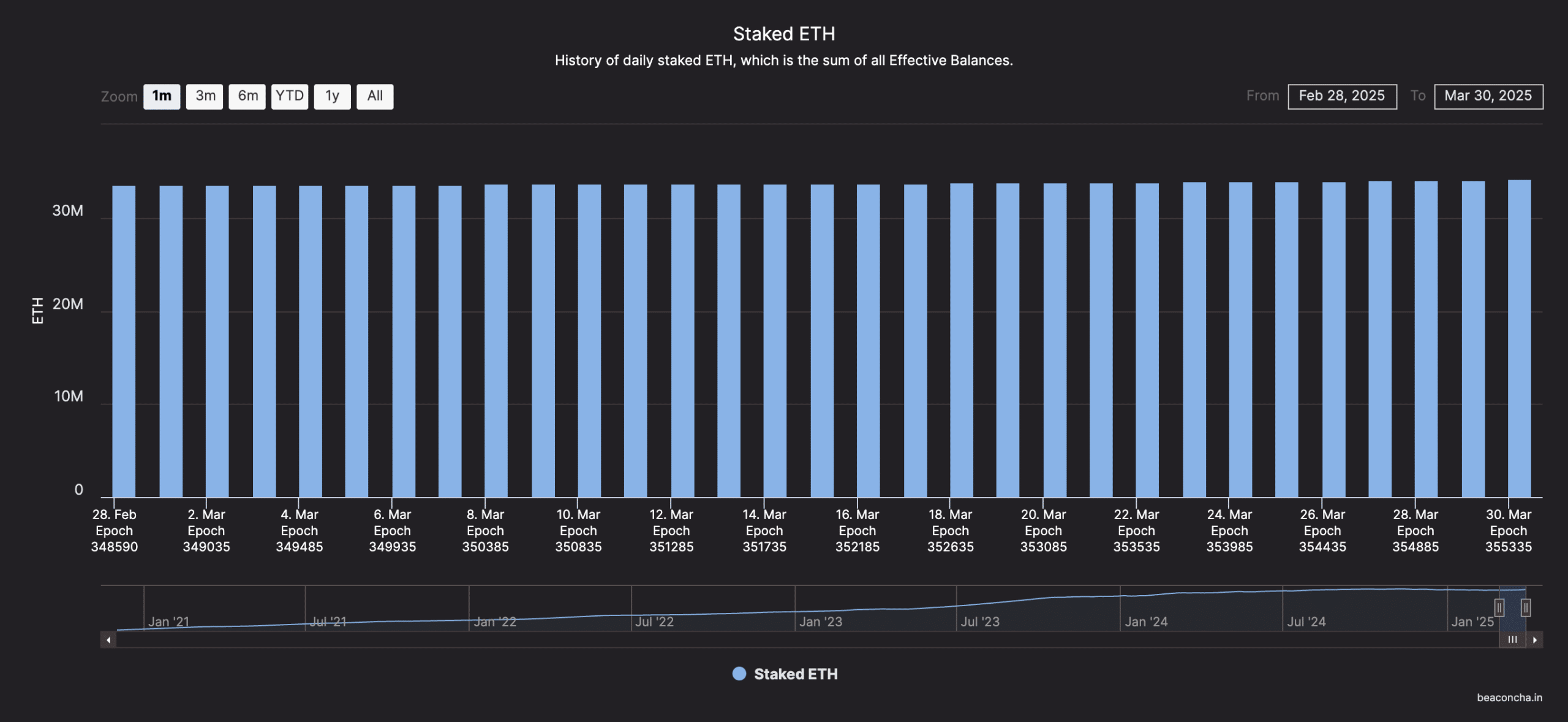

- Total ETH staked reached an all-time high, surpassing 31 million ETH, emphasizing sustained long-term investor confidence and the attractiveness of staking rewards.

- Ether’s available supply on exchanges fell to its lowest point since November 2015, indicating increased movement to staking or long-term storage.

- Daily transactions and DeFi activity saw slight increases in late March, primarily driven by memecoin trading and Layer-2 scaling solutions, although NFT trading activity continued its downward trajectory.

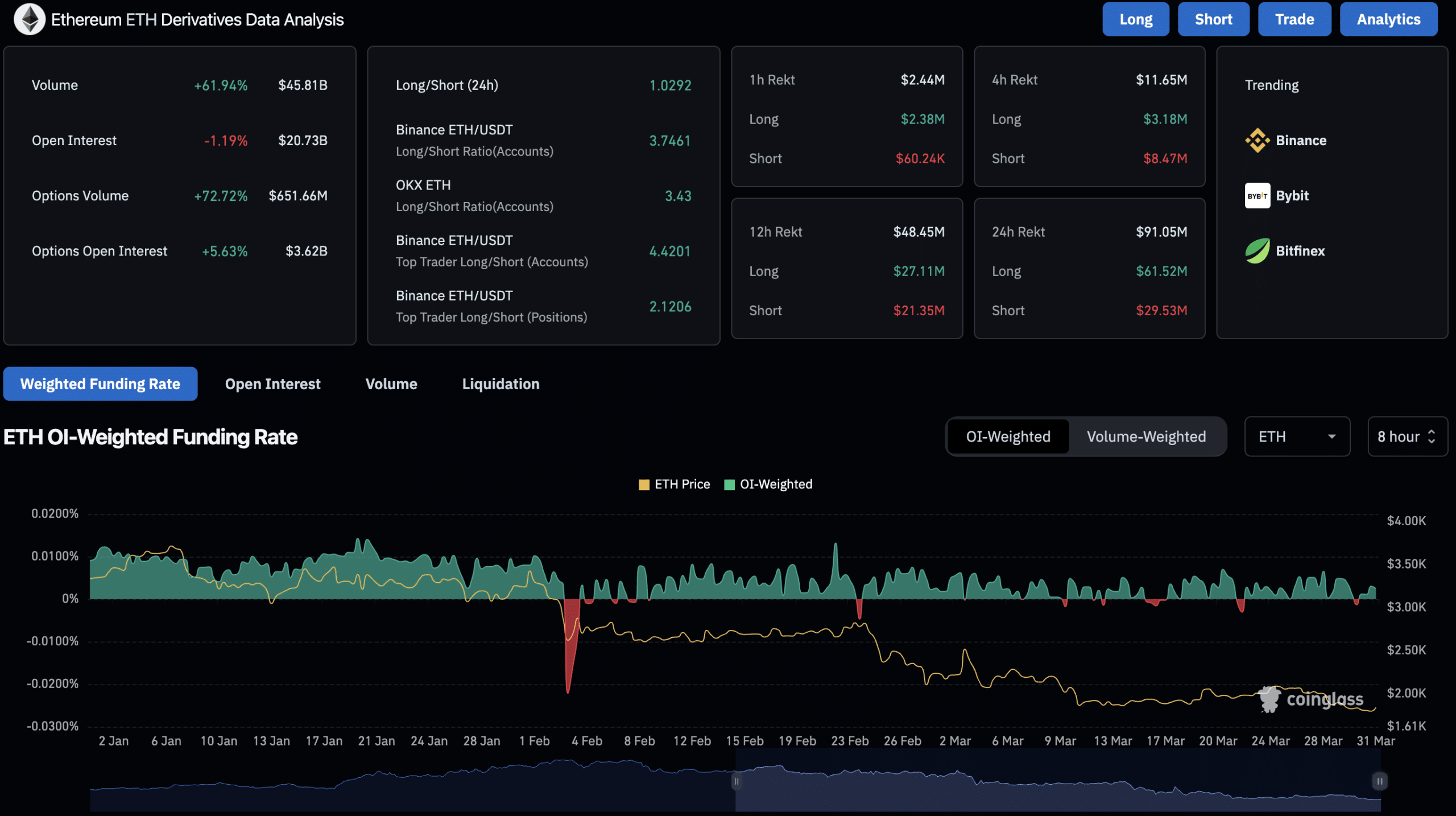

- Ethereum’s derivatives market echoed cautious investor sentiment, with open interest remaining subdued and futures funding rates hovering near neutral before turning slightly positive by the month’s end.

- The ETH options market reflected moderation, with traders positioning for relatively lower volatility compared to February’s extremes.

- Despite price pressure, long/short ratios and volume metrics across top exchanges indicated stable engagement in Ethereum’s derivatives market.

- The Ethereum community closely watched developments related to the upcoming “Pectra” upgrade, scheduled for Q2 2025, aimed at significantly enhancing network efficiency and throughput.

- Successful testnet deployments in March set a positive technical groundwork, although immediate market reactions were subdued.

- Market analysts highlighted potential bullish momentum if the Pectra upgrade achieves expected performance improvements, creating a speculative “buy the rumor” atmosphere reflected in slightly rising ETH open interest toward month-end.

- Early March saw extended losses across major altcoins, with significant rebounds emerging by mid-to-late month.

- Altcoins ended March with modest overall gains, although recovery was notably uneven.

- Large-cap altcoins (excluding Ethereum) faced early-month pressure, declining an additional 5–15% from February’s already significant losses.

- Solana (SOL) fell from approximately $140 at February’s close to around $105–$110 by March 10, recovering partially to about $123–$125 by month-end.

- Cardano (ADA) and XRP also experienced similar downward trajectories initially. XRP dipped to about $1.95–$2.00 before bouncing strongly mid-month to around $2.60–$2.70, though it retraced to close March near $2.07.

- Dogecoin (DOGE) saw a late-month recovery, rising roughly 8% during the final week amidst renewed memecoin interest.

- The total altcoin market capitalization bottomed mid-month and closed March near $0.50 trillion, marking a modest net gain.

- Filecoin (FIL) surged approximately 9–14%, driven by anticipation for its CalibrationNet upgrade and heightened network activity.

- Polygon (MATIC) gained approximately 10% due to upcoming hardfork announcements aimed at network scalability.

- Animecoin (ANIME) also rallied ahead of its mainnet launch, capturing market attention.

- Ripple (XRP) strengthened significantly mid-month after the SEC withdrew its appeal, providing regulatory clarity and triggering renewed institutional interest.

- Chainlink (LINK) rose approximately 12%, boosted by new real-world asset partnerships and increased adoption of its Cross-Chain Interoperability Protocol (CCIP).

- Solana (SOL) and Dogecoin (DOGE) benefited notably from technical rebounds after substantial February declines, positioning them as top performers late in the month.

//ambcrypto.com/wp-content/uploads/2025/04/Bitcoin-Exchange-Reserve-All-Exchanges.png”/>

Market sentiment and dominance

What’s next?

Bitcoin demonstrated clear resilience in March, successfully defending the critical support around the $80,000 level and regaining confidence following macroeconomic clarity and renewed institutional interest. However, the inability to decisively breach the $90,000 barrier signals remaining caution among investors. 🚧💰

Moving into Q2 2025, Bitcoin’s ability to build on March’s cautious optimism will largely depend on external economic developments, institutional flows, regulatory updates, and ongoing network strength. Investors will closely monitor whether current momentum translates into sustained upward trends or if volatility continues to cap BTC’s upside. 📈📉💰

Investor sentiment exclusive: 5.3K+ weigh in on government-held Bitcoin reserves

//ambcrypto.com/wp-content/uploads/2025/04/Government-held-Bitcoin-reserves-market-manipulation.png”/>

Likelihood of market manipulation by government-held Bitcoin reserves

The survey revealed that nearly half (47.3%) of respondents perceive a genuine risk, believing that governments could influence Bitcoin’s supply and market price. In contrast, 27.0% remain confident in Bitcoin’s decentralized design, arguing it inherently safeguards against manipulation. Another 25.7% think manipulation might occur, but only if reserves grow excessively large, suggesting a cautious optimism tempered by vigilance. 🕵️💰

This split underscores ongoing worries about government influence conflicting with Bitcoin’s decentralized ethos, emphasizing the delicate balance the crypto community seeks between adoption and autonomy. 🤝💰

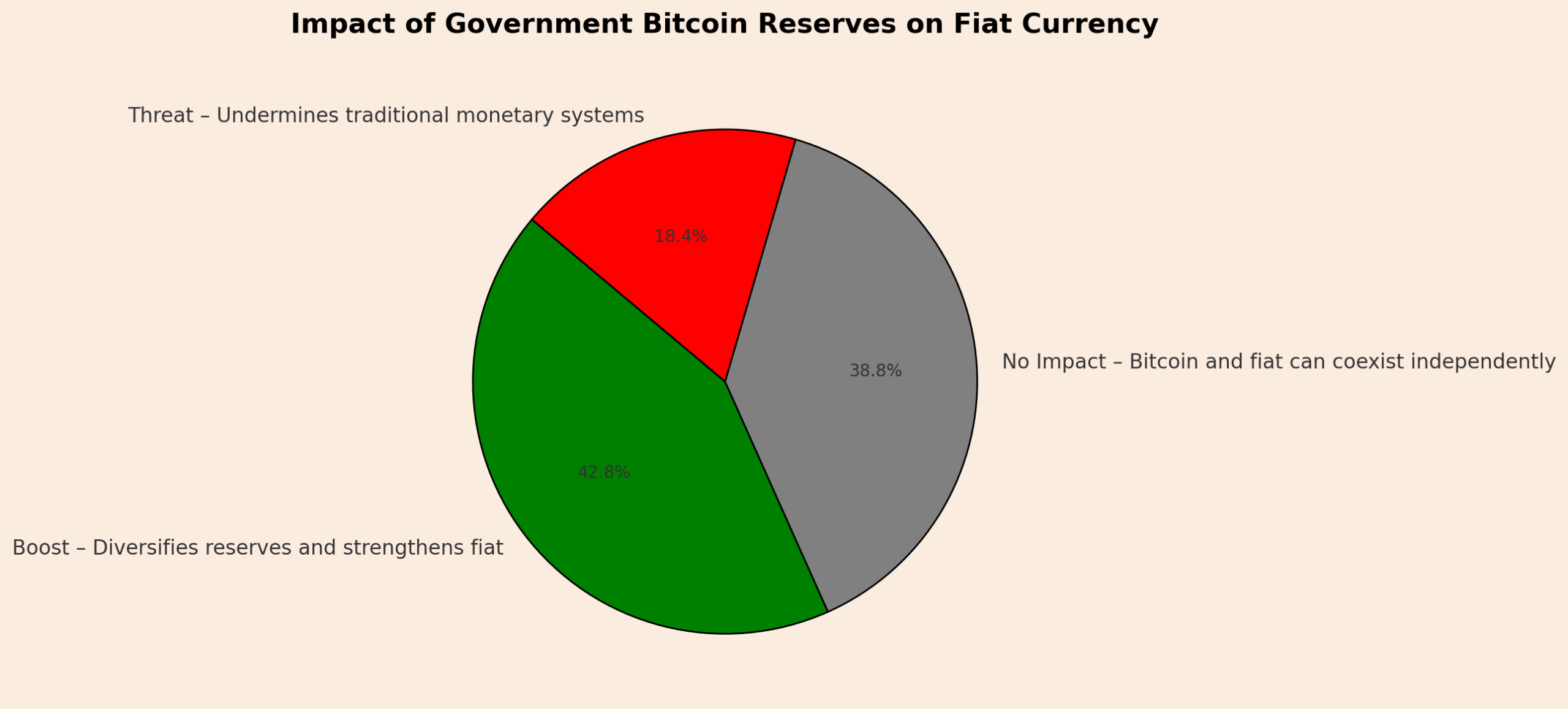

Government Bitcoin reserves: A boost or threat to fiat currency?

Investors also weighed in on whether governments holding Bitcoin reserves would strengthen or weaken traditional fiat currencies. 📉📈💰

Impact of government Bitcoin reserves on fiat currency

A plurality (42.8%) believes incorporating Bitcoin diversifies national reserves, thus bolstering fiat currencies. Conversely, 18.4% fear this strategy undermines traditional monetary systems, potentially weakening fiat. Meanwhile, 38.8% see no direct impact, arguing that Bitcoin and fiat can coexist independently without significant effects on each other. 🤝💰

These findings reflect broader uncertainty about Bitcoin’s role in global finance, as investors grapple with its potential as both a stabilizing and disruptive financial force. 💥💰

Investors’ biggest concerns and hopes regarding government Bitcoin holdings

many respondents hope government involvement might increase institutional legitimacy, accelerate mainstream adoption, and spur further financial innovation. 🤝🚀💰

One investor summarized this dual sentiment succinctly: “Government involvement could finally give Bitcoin mainstream credibility, but it must be carefully managed to avoid sacrificing the decentralization that makes Bitcoin valuable.” 🤝💰

Navigating adoption with caution

Overall, AMBCrypto’s March 2025 survey reveals a crypto community cautiously receptive to governments holding Bitcoin, provided such holdings remain transparent and limited enough to preserve Bitcoin’s core principles. Investors are optimistic about increased legitimacy and mainstream adoption, yet remain wary of potential centralization risks and market manipulation. 🤝💰

Ultimately, while government-controlled Bitcoin reserves could represent a significant step toward broader acceptance, ensuring this adoption aligns with Bitcoin’s foundational values remains the community’s key priority moving forward. 🤝💰

Macroeconomic and regulatory trends: March’s market shapers

Global economic and regulatory events significantly influenced cryptocurrency markets in March 2025, notably in the U.S., where policy decisions and economic shifts provided both relief and caution. 🤝💰

Key points

Federal Reserve policy and inflation

Trump’s tariff and trade policy developments

Regulatory developments and clarity

Ripple case resolution:

Crypto Task Force & legislative progress:

ETF developments:

Global regulatory landscape

Institutional and market infrastructure developments

Mergers & acquisitions:

Investment fund initiatives:

Exchange expansion and regulation:

Institutional adoption:

What’s next?

The macroeconomic and regulatory environment in March provided essential support for market recovery, reducing near-term risks and improving investor sentiment. Moving forward, sustained market resilience and growth will likely depend on continued regulatory clarity, macroeconomic stability, and ongoing institutional participation. 🤝💰

Ethereum in March: Awaiting catalysts amid subdued recovery

Ethereum’s recovery in March 2025 was relatively muted, lagging behind Bitcoin as it struggled to regain upward momentum due to ongoing investor caution and lack of immediate bullish triggers. 📉💰

Key points

//ambcrypto.com/wp-content/uploads/2025/04/ETHUSD_2025-03-31_17-44-53.png”/>

Institutional trends and ETF activity

Network fundamentals and staking

Derivatives and market sentiment

Upcoming catalysts: Pectra upgrade

What’s next?

Ethereum concluded March in a cautious stance, underperforming Bitcoin and remaining about 7–9% lower than its February close. While persistent concerns around institutional ETF outflows and lack of immediate bullish catalysts weighed on price action, robust underlying network metrics and anticipation of the Pectra upgrade offer potential optimism. 📉📈💰

As the market moves forward, Ethereum’s trajectory will likely depend significantly on broader macroeconomic stability and the successful implementation of upcoming upgrades. Investors remain watchful, positioning Ethereum for a potential recovery should positive catalysts materialize. 🤝💰

Altcoin market overview: Mixed March with selective gains

March 2025 was marked by an initial extension of February’s bearish sentiment in the altcoin market, which later gave way to selective recoveries among tokens backed by strong fundamentals or significant news. 📉📈💰

Key points

General market performance

Rotation into quality altcoins

Investors became more selective, favoring altcoins with clear, positive developments:

Protocol upgrades and launches:

Ecosystem strength and strategic partnerships:

Technical oversold bounces:

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Jurassic World Rebirth: Scarlett Johansson in a Dino-Filled Thriller – Watch the Trailer Now!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

2025-04-01 07:51