The state of the crypto market today is one of notable vigor, with the total market capitalization rising to a most impressive $3.47 trillion. Bitcoin, in particular, has reached a new and wondrous all-time high, while altcoins, ever eager to join the festivities, are also presenting themselves in an optimistic light. Their daily trading volume has soared by a rather remarkable 46.62%. Despite this most promising rise in fortunes, a singular question remains most insistent in the minds of investors: “What, pray tell, are the whales doing at this very moment?”

This question is indeed of great import, for the actions of these whales often signal whether the next great rally or inevitable correction is nigh. With the Fear & Greed Index at a neutral 58 and Bitcoin’s dominance standing robust at 63.8%, all signs appear to suggest that Bitcoin remains firmly in control. Yet, beneath the surface of these encouraging figures, the behavior of the whales reveals a tale more intricate and most curious. I daresay you are intrigued, dear reader. Allow me to offer you a comprehensive overview of whether these grand creatures of the sea are turning their affections towards Bitcoin or the glistening altcoins. 😊

What Does OnChain Speak?

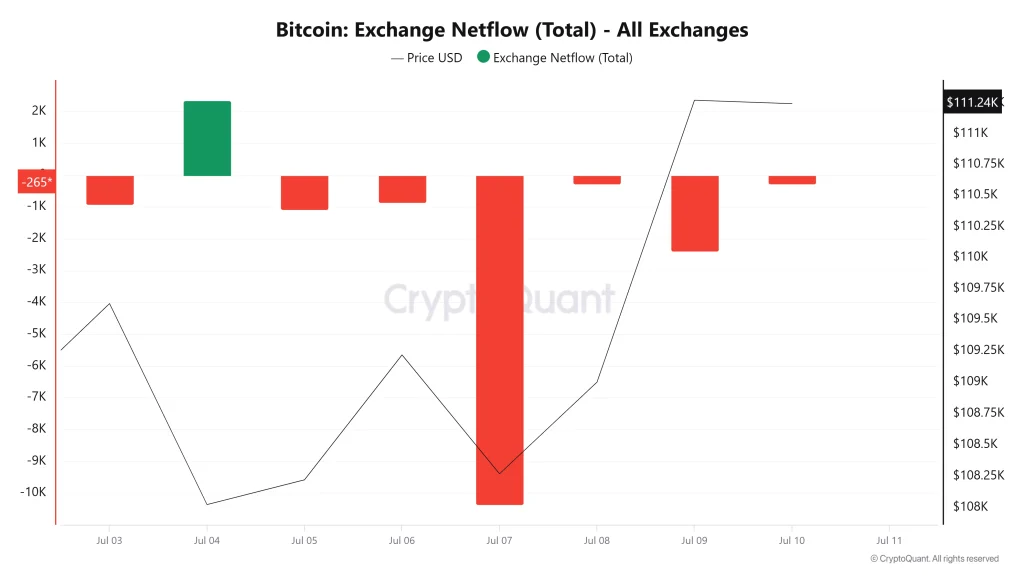

Exchange Netflows Show BTC Exits

Upon consulting the CryptoQuant exchange netflow chart, one finds a succession of negative netflows, with July 7th standing out in particular. On that day, over 10,000 BTC were withdrawn from exchanges, marking the greatest single-day outflow in recent weeks. A most curious development indeed, suggesting a strong sentiment for HODLing. This, we are told, is commonly interpreted as a bullish sign, as whales are less inclined to sell their precious Bitcoin at the drop of a hat. 🐋

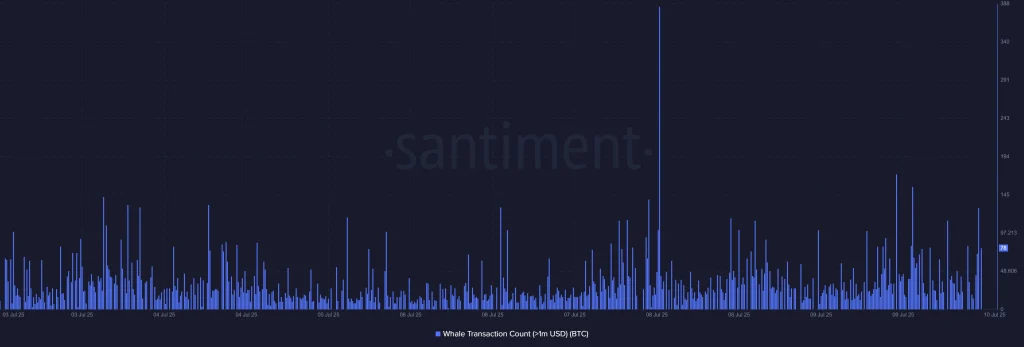

Whale Transaction Spike Big?

Santiment’s whale transaction count, featuring transactions greater than $1 million, revealed a massive surge on July 8th. Such activity, no doubt, reflects both accumulation and distribution, with the timing of this spike occurring just before Bitcoin’s price breakouts. One might suspect, with all due respect, that this hints at a potential rotation into the high-risk, high-reward altcoins. Who can resist such a temptation? 💸

Altcoin Season Still a Distant Dream?

Despite a number of promising metrics, the Altcoin Season Index, according to CoinMarketCap, sits at a modest 28/100, suggesting that we are not yet in the throes of full rotation. However, I daresay this may change with the swiftness of a lady’s fan if Bitcoin dominance falters and the altcoins manage to sustain their breakouts. 👀

BTC vs Alts

As one may observe from the accompanying chart, Bitcoin faces a formidable obstacle near its all-time high, despite the bullish netflows. Momentum indicators, namely RSI and MACD, suggest that a period of cooling off may be in order. In contrast, certain altcoins, including Ethereum and Solana, amongst others, are beginning to show promising signs of breaking free from their consolidations. This, of course, is supported by increasing whale wallet activity and the ever-growing inflow of stablecoins into altcoin-heavy exchanges. The stage may be set for something truly remarkable! 🏁

And should you find yourself pondering Ethereum’s future with a delightful curiosity, do read our most esteemed Ethereum (ETH) Price Prediction for 2025, 2026-2030! 📈

FAQs

Why do whales rotate from BTC to altcoins?

Whales, ever the astute players in the market, rotate to maximize their profits. When Bitcoin rallies and begins to show signs of fatigue, these grand creatures of the sea often shift their attentions to the altcoins, where fortune may still be found. 🐋💰

What does a drop in BTC dominance mean?

Ah, dear reader, it often signals the onset of an altcoin season, as capital, like a restless traveler, flows from Bitcoin into the eager arms of altcoins such as Ethereum, Solana, and perhaps even newer Layer-1s. 🌊

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- The Weight of First Steps

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Opendoor’s Stock Takes a Nose Dive (Again)

2025-07-10 14:24