In the land of Nigeria, where the sun beats down like a relentless taskmaster, the people have found themselves grappling with an economic crisis that could make even the most stoic farmer weep. Inflation, that sneaky little devil, has surged to heights that would make a mountain climber dizzy, reaching record highs by the end of 2024. And while there’s been a slight easing, the citizens still feel the pinch in their pockets, like a persistent mosquito buzzing around their heads.

Meanwhile, the Nigerian government, in a fit of regulatory fervor, is scrambling to get a grip on the wild world of cryptocurrency. They’re hoping that by tightening the reins, they might just wrangle in some much-needed revenue. Who knew that digital coins could be the golden ticket? 🎟️

Nigeria Faces Inflationary Pressures

Ah, Nigeria, the bustling giant of Africa, where the population is as vibrant as the markets, yet the economy often resembles a wobbly table. Reports indicate that the annual inflation rate soared to a staggering 24.48% in January 2025, only to dip slightly to 23.18% in February. A decline, yes, but it’s like saying the storm has calmed when the winds are still howling.

The naira, bless its heart, has taken a beating, losing a whopping 230% of its value against the US dollar over the past year. It’s like watching a beloved old dog struggle to keep up with the pack.

“The drop in the inflation rate is mainly due to the rebase of the Consumer Price Index (CPI), not an actual reduction in price levels or inflationary pressure,” lamented one weary citizen, as if trying to explain the complexities of life to a particularly dense cabbage.

In this import-dependent economy, where every external shock feels like a punch to the gut, President Bola Tinubu’s administration has rolled out bold reforms. They’ve removed fuel subsidies that had been clinging on like a stubborn barnacle and unified the country’s multiple exchange rates. But, as with all grand plans, the consequences have been as unpredictable as a cat on a hot tin roof, leading to skyrocketing fuel prices and a cost-of-living crisis that has left many gasping for breath.

In the conflict-ridden regions, where communities rely on subsistence farming, the effects of inflation are particularly cruel, like a thief in the night stealing away their hopes.

Crypto as a Hedge With New Regulations on the Horizon

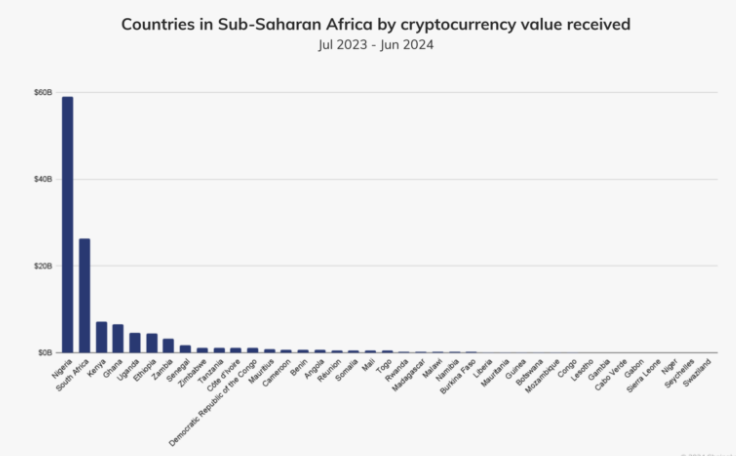

Yet, amid this chaos, many Nigerians have turned to crypto, that digital lifebuoy, as a hedge against inflation and the devaluation of their beloved naira. According to the blockchain wizards at Chainalysis, between July 2023 and June 2024, Nigerians traded a staggering $59 billion in crypto assets. That’s a lot of digital coins flying around! 💰

This surge in crypto adoption is a testament to the growing distrust in the traditional financial system, as if the people have collectively decided that the old ways are as useful as a screen door on a submarine.

//www.youtube.com/watch?v=BE0w0Bg5o9Y[/embed]

A proposed bill outlining taxation policies for crypto transactions is under legislative review, and the general sentiment is that it will pass faster than a chicken on a junebug. 🐔

Meanwhile, the Central Bank of Nigeria is doing its best to stabilize the currency and restore investor confidence. Governor Olayemi Cardoso announced that the bank had cleared $2.5 billion of the foreign exchange backlog, with another $2.2 billion expected to be resolved soon. It’s like trying to bail out a sinking ship with a thimble, but hey, every little bit helps!

President Tinubu has also ordered the release of food reserves and the establishment of a commodity board to curb hoarding and stabilize prices. It’s a noble effort, but one can’t help but wonder if it’s akin to putting a Band-Aid on a bullet wound.

While Nigeria’s economic crisis leaves millions struggling, the government’s intervention efforts involving crypto taxes and signs of easing inflation suggest a potential turnaround. But much depends on how effectively these policies are implemented and whether the global economic winds remain favorable.

At the same time, the rise of cryptocurrency presents both opportunities and challenges. If regulated properly, these digital assets could provide Nigerians with financial alternatives to navigate the stormy seas of economic instability. But let’s not kid ourselves; finding the right balance between innovation and regulation is like trying to walk a tightrope while juggling flaming torches.

“Currently, Nigeria needs massive investment in both formal and professional education; this is essential to increase our skilled labor force and be competent in today’s global digital economy. Special attention should be paid to areas in Blockchain, Digital Assets, Web3,” one user shared on X, as if the solution were as simple as flipping a switch.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-03-18 22:28