In the shadowy corridors of the Bitcoin ETF market, a curious phenomenon unfolds. The issuers, those modern-day alchemists of finance, are once again indulging in the acquisition of BTC, as if it were the elixir of life itself. Fidelity and ARK Invest, the titans of this realm, have collectively amassed over $40 million in Bitcoin since the sun rose yesterday. Ah, the sweet scent of greed wafts through the air! 🍃

Yet, whispers of intrigue surround the behemoth known as BlackRock, the largest ETF issuer, who is rumored to have joined this fray of acquisition. Alas, these claims remain shrouded in uncertainty, like a fog that refuses to lift. Could these fresh purchases from asset managers be the harbinger of a much-needed bullish narrative, or merely a mirage in the desert of despair? 🤔

Will Bitcoin ETFs Spark a New Bullish Cycle, or Are We Just Chasing Shadows?

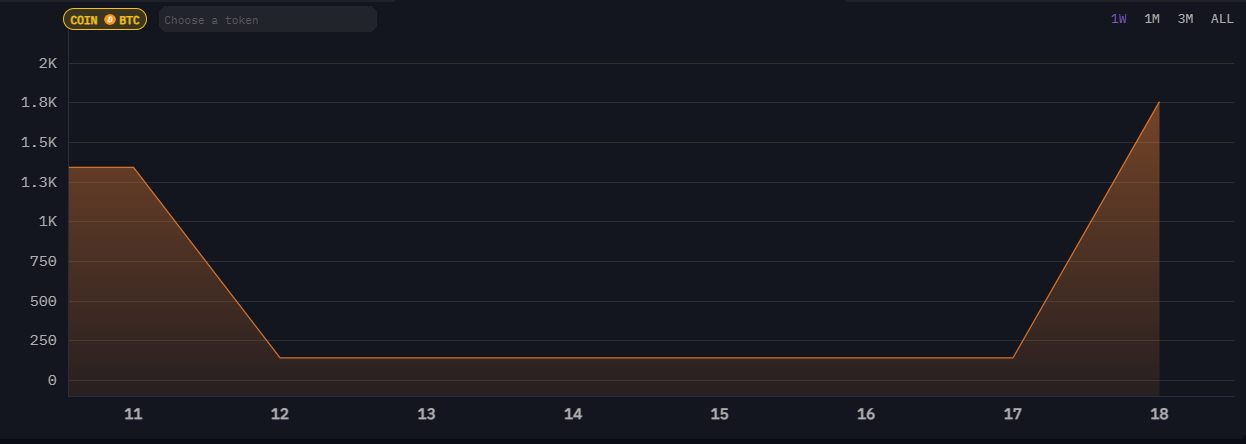

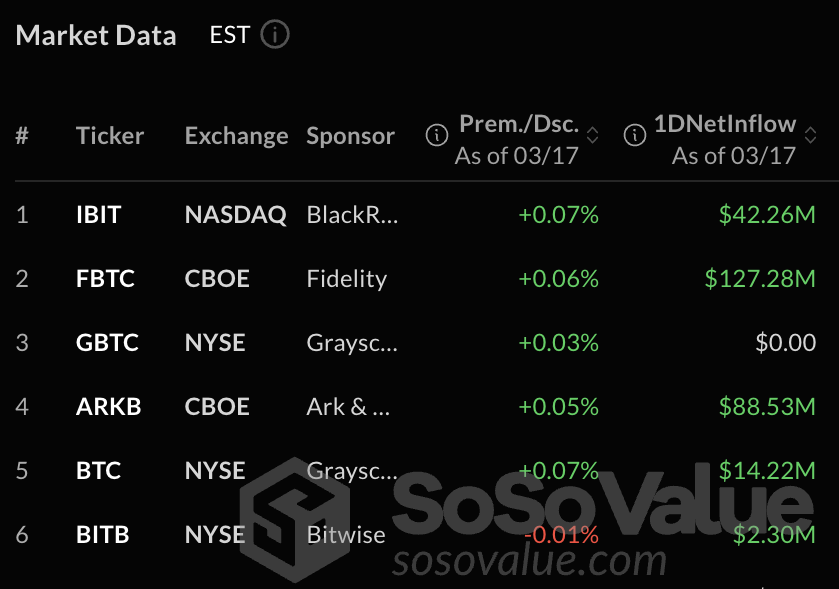

After enduring weeks of relentless ETF outflows, the market, like a phoenix, begins to rise from its ashes. On Monday, US spot Bitcoin ETFs experienced a staggering $274 million in net inflow—the largest daily influx since the fateful day of February 28. A miracle, or merely a trick of the light? 🌅

Meanwhile, the blockchain oracle known as Arkham proclaims that BlackRock is indeed making substantial BTC purchases.

“ARKHAM ALERT: BlackRock is buying $40 Million BTC. BlackRock is buying. Fidelity is buying. Ark is buying,” they declared, as if announcing the arrival of a new messiah.

However, dear reader, do not be deceived! The on-chain data tells a different tale, one of contradictions and disillusionment. Fidelity and ARK Investments have indeed acquired vast quantities of BTC today, with inflow transactions amounting to a staggering $41.16 million. Yet, BlackRock’s own data reveals a net decrease in their BTC holdings. Oh, the irony! 😂

These other noble ETF issuers have been purchasing Bitcoin, as independent verification can attest. The astute ETF analyst Shaun Edmondson claims they procured 665 BTC last Friday and a whopping 3,261 BTC on Monday. A veritable feast for the hungry! 🍽️

Yet, the price of Bitcoin dances wildly, a tempestuous lover, leaving many in a state of confusion regarding the ETF market. Just last week, the collective holdings of these issuers fell below the fabled Satoshi’s wallet, a milestone they had triumphantly crossed three months prior. What a tragic comedy! 🎭

However, it appears that institutional investors are slowly regaining their confidence, as most Bitcoin ETFs have turned a vibrant green this week. A sign of hope, or merely a fleeting illusion? 🌱

In the grand tapestry of Bitcoin’s market movement over the past year, institutional investors have played a pivotal role. If the net inflow continues to paint a positive picture in the ETF market, we may yet witness the birth of a much-needed bullish narrative amidst the prevailing clouds of bearish sentiment. Or perhaps, we are simply characters in a tragic farce, forever chasing the elusive dream of wealth. 🎭💸

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Every Minecraft update ranked from worst to best

2025-03-18 21:35