After a rather dreary spell of outflows that would make even the most optimistic chap weep, Bitcoin exchange-traded funds (ETFs) have finally decided to don their party hats, recording a rather splendid $274.6 million in inflows on the 17th of March.

This delightful turn of events marks the largest single-day net inflow in a staggering 41 days, hinting at a flicker of renewed investor interest. However, before we pop the champagne, one must ponder: Is demand returning to Bitcoin ETFs, or is this merely a temporary dalliance? 🍾

Bitcoin ETFs See First Major Inflows in Weeks

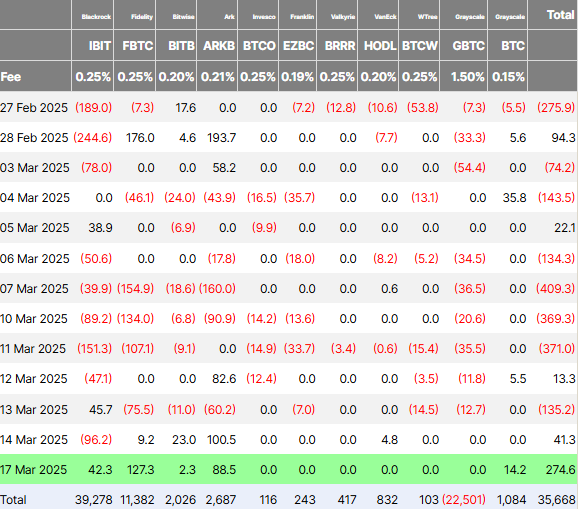

According to the latest gossip from Farside Investors, BlackRock’s iShares Bitcoin Trust (IBIT) managed to wrangle in $42.3 million on Monday. Yet, despite this positive flow, IBIT found itself trailing behind, much like a tortoise in a race against hares, due to the ongoing headwinds of stock market correlation.

Fidelity’s Bitcoin ETF (FBTC) was the belle of the ball, attracting a whopping $127.28 million, making it the day’s biggest gainer. The ARK Bitcoin ETF (ARKB), managed by the ever-astute ARK Invest and 21Shares, also saw significant interest, pulling in a respectable $88.5 million.

On the flip side, the Grayscale Bitcoin Trust (GBTC), which has been the subject of much lamentation, remained as flat as a pancake at $0 million. This is particularly noteworthy as GBTC has lost billions in assets since its rather unfortunate transition to a spot ETF.

Meanwhile, Grayscale’s other Bitcoin product saw a modest inflow of $14.22 million. Other Bitcoin ETFs, including those from Valkyrie, Invesco, Franklin, and WisdomTree, recorded no daily inflows, leaving them to ponder their existence.

However, while Bitcoin ETFs were having a jolly good time, Ethereum-based spot ETFs continued their downward spiral, logging their ninth consecutive day of net outflows at $7.3 million. Poor Ethereum, it seems, is having a bit of a rough patch! 😢

“Bitcoin spot ETFs attract $275 million in inflows, while Ethereum ETFs experience outflows, reflecting shifting investor preferences,” one user on X suggested, likely while sipping a cup of tea.

Notably, while this could suggest a returning demand for Bitcoin ETFs after weeks of outflows, analysts are quick to remind us that one green day does not a trend make. Nevertheless, it is a shift worth keeping an eye on, like a hawk watching a particularly juicy mouse.

Bitcoin ETFs Have Lost Billions in Recent Weeks

Just a week ago, Bitcoin ETFs had recorded four straight weeks of net outflows totaling more than $4.5 billion. Profit-taking, regulatory concerns, and broader economic uncertainty have fueled this rather dismal shift in investor sentiment.

The crypto market as a whole has also seen capital flight. As BeInCrypto reported, total crypto outflows exceeded $800 million last week, signaling strong negative sentiment among institutional investors. Quite the exodus, I must say!

With this context, while Monday’s inflow of $274 million could be seen as a sign of stabilization, it is far too early to determine whether this marks the beginning of a broader recovery or just a mirage in the desert of despair.

Nevertheless, the sudden surge in ETF inflows raises the question of whether this is a resurgence of the so-called “Trump crypto boom” or merely a case of fear of missing out (FOMO). Some analysts believe hedge funds and institutional players are driving the action more than retail investors, who are likely still trying to figure out how to use their wallets.

Crypto entrepreneur Kyle Chassé has previously argued that hedge funds play a major role in Bitcoin’s ETF flows. He claims that large investors strategically withdraw and reinvest capital to manipulate price movements, making it as clear as mud when it comes to determining organic demand.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Every Minecraft update ranked from worst to best

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2025-03-18 16:09