🚨 Made in USA Crypto Showdown: Which Tokens Will Soar in March? 🚨

As the sun rises over the vast expanse of the cryptocurrency landscape, a new week dawns, bringing with it the promise of possibility and the specter of uncertainty. Among the myriad of tokens vying for attention, a select few stand out as the most likely to make a splash in the third week of March. Let us take a closer look at these Made in USA cryptos, shall we?

XRP: The Unyielding Giant

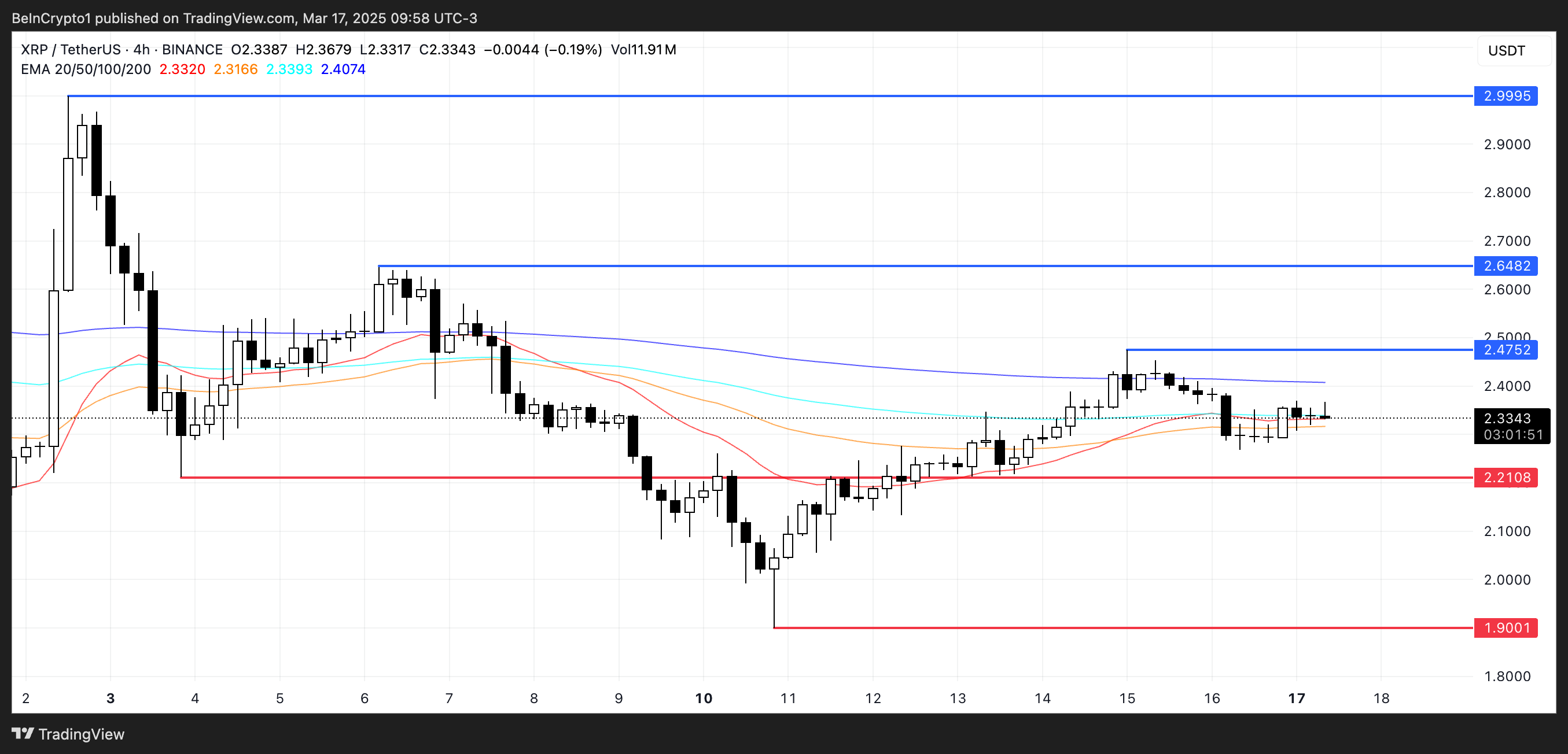

XRP, that stalwart of the cryptocurrency world, continues to defy the odds, its market cap a testament to its enduring popularity. Despite a 17% decline in the past month, it has rebounded with a vengeance, gaining nearly 6% in the last week. The whispers of a potential SEC reclassification have sparked a flurry of speculation, with some predicting a rally of biblical proportions.

As the SEC vs XRP case unfolds, the token’s price is poised to respond with a vigor that would put a Russian bear to shame. A breakout above the $2.47 resistance level could send XRP soaring towards $2.64, and if the stars align, perhaps even $3.

But, alas, the bearish sentiment that has gripped the market may yet prove too great, and XRP may succumb to the forces of gravity, plummeting back to the $2.21 support level, and if broken, further losses may await.

Pi Network (PI): The Token of Controversy

PI, that behemoth of a token, has been making waves in the cryptocurrency world, but not all of them are welcome. Its market cap has taken a beating, correcting by over 20% in the past 30 days, and its price has dropped below $10 billion. The rollout of its .pi domains has been met with skepticism, and the token’s mainnet migration has added to the woes.

As the token’s price continues to slide, the support level at $1.23 comes into focus. A breakdown could send PI below $1.20, a level not seen since February 22. But, if the token manages to reverse momentum, it could challenge the resistance at $1.57, with further upside potential towards $1.82, and if the stars align, even $2.35.

Story (IP): The Altcoin of the Moment

IP, that altcoin of the moment, has been making waves in the cryptocurrency world, its price surging nearly 235% in the past 30 days. Its market cap has reached almost $1.4 billion, making it one of the standout tokens in the market.

As IP enters a consolidation phase, the price action has slowed down, but if momentum returns, it could challenge key resistance levels at $6.66 and $6.96. A breakout above these levels might open the door for a push towards $7.95 and possibly beyond $8, setting new all-time highs.

On the flip side, if selling pressure increases and a correction takes hold, IP could first retest the $5 support level. If this level fails to hold, further downside could lead to a decline toward $4.49, and in a deeper pullback, the price could even fall to $3.65.

Jupiter (JUP): The Solana Token of Hope

JUP, that Solana token of hope, has been experiencing a sharp correction, its price dropping nearly 45% in the past 30 days. But, despite this decline, it remains one of the most profitable businesses in the crypto space, generating $27 million in revenue over the past seven days.

If the Solana ecosystem stages a recovery, JUP could benefit significantly, with price targets at $0.54, $0.598, and $0.63 as key resistance levels. A strong uptrend could even push the token towards $0.86. However, if the downtrend persists, JUP may retest the support at $0.48 and $0.44, and a further decline could see it fall below $0.40 for the first time ever.

Aerodrome Finance (AERO): The DEX of Opportunity

AERO, that DEX of opportunity, has been generating $1 million in fees over the past week, outperforming notable players in the Base ecosystem. Despite its strong fundamentals, its price has been under pressure, correcting more than 38% over the last 30 days.

If the downtrend persists, AERO could soon retest the support level at $0.48. But, if buying momentum returns and AERO establishes an uptrend, it could move towards resistance at $0.56 and $0.61. A breakout above these levels could open the door for a rally towards $0.67 and potentially $0.739.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

2025-03-18 03:11