In a most enlightening survey conducted by the esteemed firm Grayscale, it has come to light that a rather impressive 26% of American investors, each possessing the enviable sum of over $1 million in investible assets, have taken the plunge into the world of cryptocurrency. Furthermore, a staggering 38% are contemplating such an investment! It appears that the winds of economic uncertainty have stirred the older generation, whilst the younger set finds themselves quite taken with the notion of crypto as a legitimate asset class. How modern! 😏

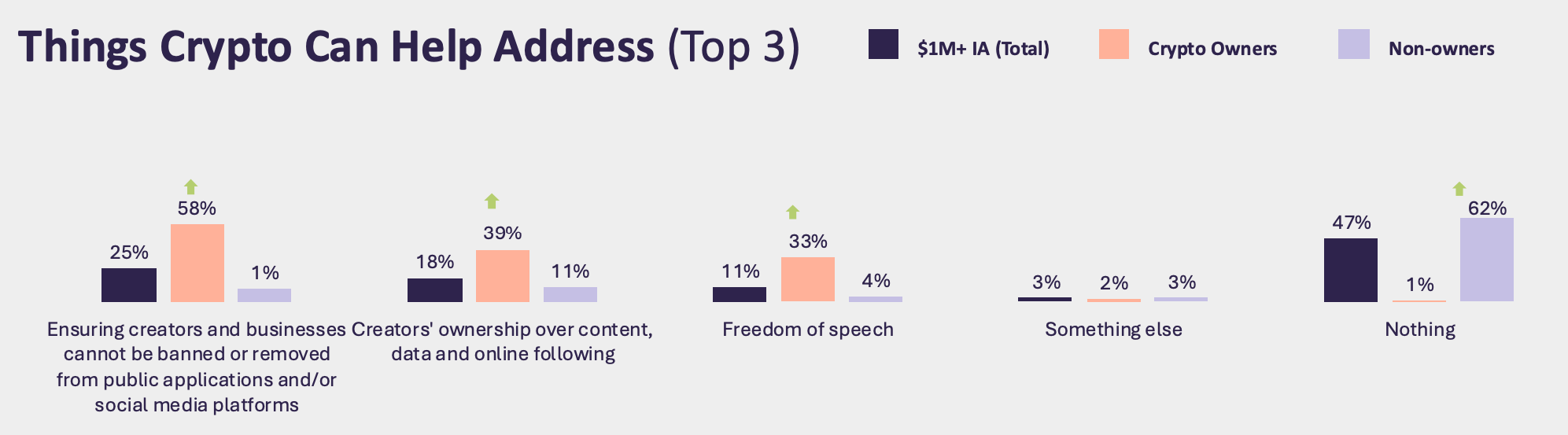

Yet, dear reader, it is rather amusing to note that nearly half of these affluent respondents remain unconvinced of any utility for crypto beyond mere investment. This revelation serves to underscore a rather amusing divide within the community, as some express trepidation over a potential decline in technological innovation. Oh, the irony! 🤔

Wealthy Investors Yearn for Crypto

Today, the asset management firm Grayscale has unveiled a report that suggests high-net-worth investors are developing a keen interest in the realm of cryptocurrency. How delightful! 🎉

“It is positively thrilling to observe the momentum shift in crypto as more investors begin to acknowledge the value of digital assets. Remarkably, 38% of high-net-worth investors believe their investment portfolio shall include crypto in the future,” proclaimed Grayscale CEO Peter Mintzberg on the ever-popular social media. One can only imagine the excitement! 😄

Grayscale undertook a comprehensive survey of wealthy Americans to gauge their sentiments and purchasing proclivities regarding crypto. The findings reveal a burgeoning affinity across several key metrics.

For instance, it is claimed that 26% of investors with over $1 million in investible assets possess crypto, a figure that surpasses that of the general populace. How curious! 🧐

These investors exhibit a variety of motivations for their interest in crypto, which appear to be rather age-dependent. A remarkable 78% of wealthy respondents over the age of 50 are drawn to it due to the current economic climate, echoing the age-old argument that Bitcoin serves as a hedge against inflation. How quaint! 💰

Conversely, their younger counterparts regard it as a perfectly normal investment option, seemingly unperturbed by such concerns.

“Over a third (36%) of these high-net-worth investors are paying closer attention to Bitcoin and other crypto assets due to geopolitical tensions, inflation, and a weakening US dollar,” the Grayscale study asserts. How very astute! 📉

However, this survey has also revealed certain chinks in the traditional crypto narrative. For instance, the backlash to President Trump’s recent Crypto Summit highlights a growing rift within the community.

Can crypto indeed forge a new economic future, or is it merely a means to acquire more fiat currency? It appears that these investors decidedly prefer the latter interpretation. How practical! 😅

It must be noted, however, that this sample may not be entirely representative. Grayscale’s survey polled 5,368 adults, all of whom were inclined to vote in the last US Presidential election. How very democratic! 🗳️

In conclusion, this survey presents a dual outlook for the industry, contingent upon one’s perspective. On one hand, wealthy investors may soon inundate the crypto market with vast sums of money, particularly in times of economic strife.

Yet, this influx of capital may not significantly contribute to the development of novel technologies. Most investors remain yet to perceive any utility for crypto beyond investment purposes.

Ultimately, future endeavors shall need to strike a balance between these concerns. How delightfully complicated! 😜

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-03-14 02:06