Ah, behold the Horizon, a whimsical endeavor by the illustrious Aave Labs, which dares to propose a financial contraption that ushers real-world assets (RWAs) into the grand theater of decentralized finance (DeFi), all while donning the regulatory garb of respectability. 🎩💰

In this audacious ballet of numbers and tokens, the initiative is poised to conjure new revenue streams for the Aave DAO, hastening the adoption of GHO, and fortifying Aave’s stature as a veritable titan in the burgeoning realm of tokenized assets. As institutions waltz into the blockchain ballroom, projections flirt with the tantalizing figure of $16 trillion in RWAs over the next decade. 💃📈

Horizon’s Daring Proposal: A Licensed RWA Product as Aave’s Newest Star

In a press release that could make even the most stoic of hearts flutter, Aave Labs’ Horizon has proposed the launch of an RWA product, a licensed instance of the Aave Protocol, designed to allow institutions to use tokenized money market funds (MMFs) as collateral for borrowing stablecoins like USDC and the ever-so-charming GHO. 🏦✨

This strategic maneuver is expected to unlock liquidity for stablecoins, expanding institutional access to the DeFi wonderland. Imagine, if you will, a DeFi that is not just a playground for the daring but a welcoming garden for the regulated financial entities, all while showering blessings upon the Aave ecosystem. 🌼💸

The allure of tokenized real-world assets is palpable, as blockchain technology sprinkles its magic dust, enhancing liquidity, slashing costs, and enabling transactions that are as programmable as your favorite playlist. 🎶💻

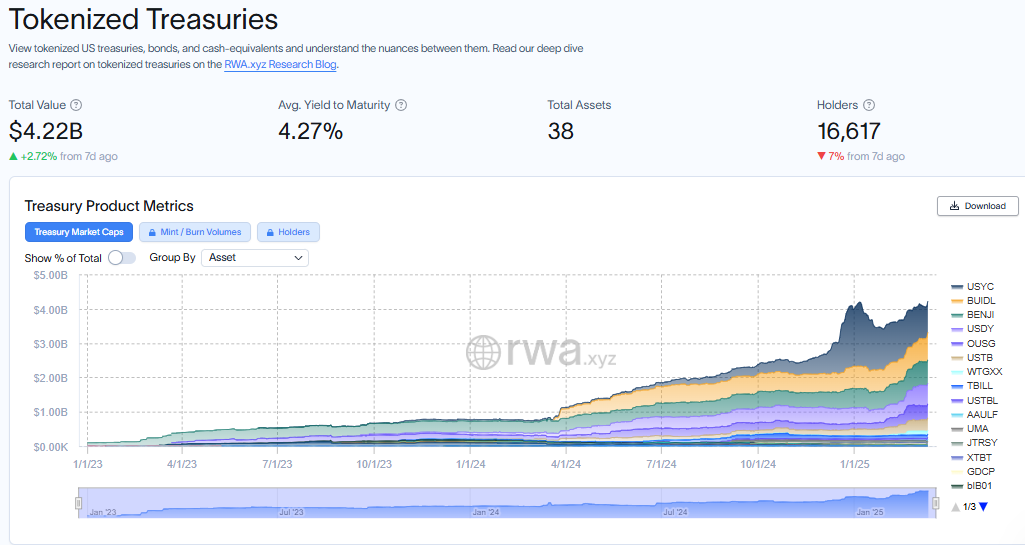

Moreover, the tokenization of traditional assets has made them more accessible on-chain, with tokenized US Treasuries blossoming by a staggering 408% year-over-year, reaching a delightful $4 billion. 🌱💵

Pending the Aave DAO’s nod of approval, Horizon’s RWA product will initially pirouette onto the stage as a licensed instance of Aave V3, before gracefully transitioning to a custom deployment of Aave V4 when the stars align. Horizon has also proposed a structured profit-sharing mechanism, ensuring a long-term romance with the Aave DAO. 💞📊

“…a 50% revenue share to Aave DAO in Year 1, alongside strategic incentives to drive ecosystem growth,” Horizon whispered to BeInCrypto, as if sharing a delightful secret. 🤫

Should Horizon decide to launch its token, a generous 15% of its supply will be lovingly allocated to the Aave DAO treasury and ecosystem incentives, with a portion reserved for the noble staked AAVE holders. 🏅

Meanwhile, the rise of RWAs is reshaping the financial landscape, and institutions are taking note, like curious cats peering into a box. Tokenized assets are emerging as a bridge between the staid world of traditional finance (TradFi) and the exhilarating realm of DeFi, offering investors new avenues to explore yield-bearing assets. Key players in this grand performance include BlackRock (BUILD), Franklin Templeton, and Grayscale. 🎭💼

Institutions to Access Regulated Yet Permissionless Stablecoin Liquidity

However, the open and permissionless nature of DeFi presents a conundrum, akin to a riddle wrapped in an enigma. It lacks the compliance frameworks necessary for large-scale institutional participation, leaving many a suit scratching their heads. 🤔🕵️♂️

Institutional adoption remains a delicate flower, limited without tailored solutions, and the integration of RWAs into DeFi at scale is a challenge that looms large. 🌸

Horizon seeks to bridge this chasm, allowing institutions to access permissionless stablecoin liquidity while meeting the compliance and risk management requirements

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Does Oblivion Remastered have mod support?

- DODO PREDICTION. DODO cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Oblivion Remastered: How to get and cure Vampirism

- ‘We’re All Sort Of Waiting’: Chris Hemsworth Sheds Light On Thor’s Possible Future In The MCU During SDCC 2024

- Demon Slayer: All 6 infinity Castle Fights EXPLORED

2025-03-13 17:18