In the grand theater of the crypto world, where fortunes rise and fall like the tides, Binance and Coinbase have found themselves in a rather unenviable position. A new report on February CEX data reveals that these titans of trade have lost nearly 30% of their traffic. Spot and derivatives trading volumes have also taken a hit, as retail investors, ever the skittish creatures, retreat into their shells.

Both firms, despite their ostensibly positive developments in February, have underperformed relative to their competitors. It seems the bearish winds of the crypto market are blowing with a vengeance, leading to a contraction that even the mightiest cannot escape.

Binance and Coinbase: The Trail of Tears

Centralized exchanges (CEXs), those bastions of the crypto economy, are often seen as a barometer of its health. Towards the end of 2024, CEX trading volumes soared to a staggering $6.4 trillion in Q4. But alas, the broader market doldrums have taken their toll. According to a new report, CEX traffic has fallen sharply, with major firms like Coinbase and Binance approaching 30% losses. 🐻

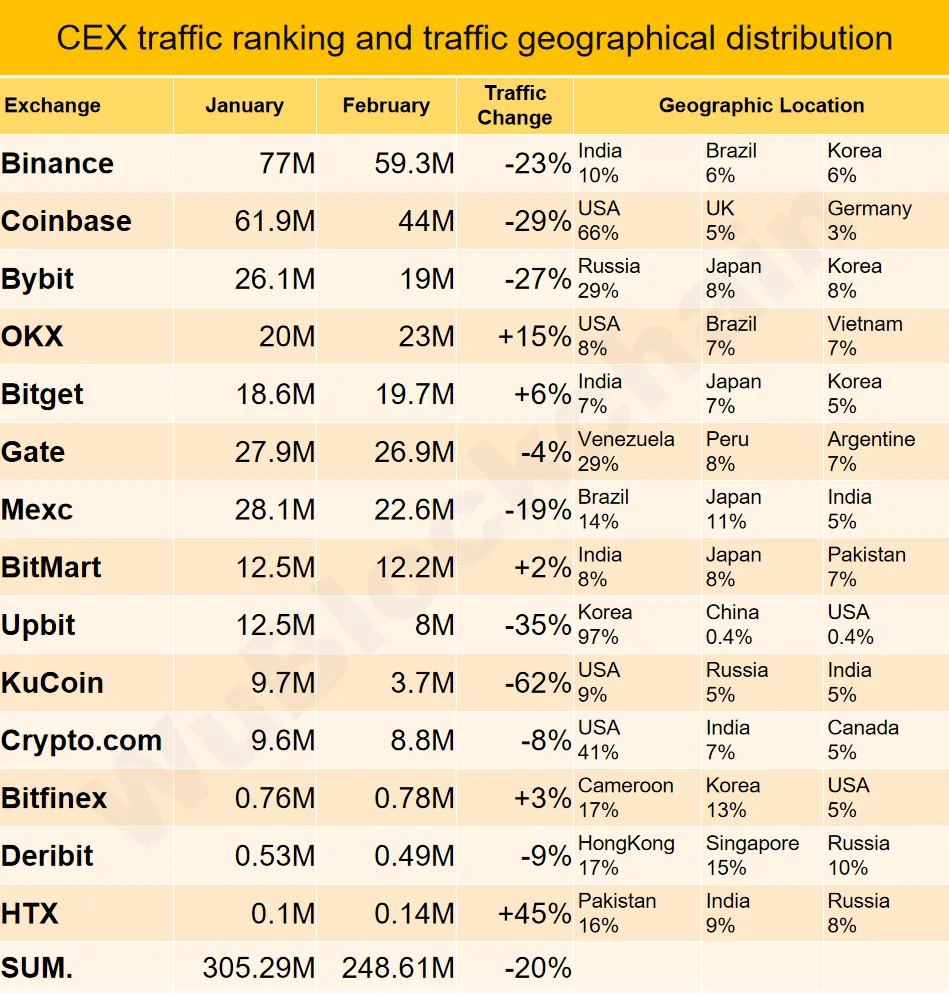

CEX traffic across the industry fell approximately 20%, making Binance and Coinbase clear outliers. To be fair, both firms slightly outperformed the average of all CEXs in spot trading volume. But let’s not kid ourselves—user traffic is a critically important metric for exchanges. It’s worrying that they fell so short of most competing firms. 😬

Coinbase, one of the world’s largest CEXs, fell even further than Bybit in February. Bybit, poor soul, fell victim to the largest hack in crypto history in late February, and the resultant traffic losses began quickly afterwards. By March, a significant number of its users switched to Binance, but this may not have fully materialized in February. 🤷♂️

Still, as CEX traffic goes, it doesn’t seem to make sense that Coinbase is even in the same conversation as Bybit. The firm should ostensibly be doing well as the SEC dropped a major lawsuit in February. But alas, the gods of crypto are fickle. 🎭

Binance, too, has seen bullish news, opening a community vote to list Pi Network that turned into a total policy shift by March. But even this has not been enough to stem the tide of declining traffic. 📉

In other words, declining CEX traffic and trade volume could be a bearish sign. OKX grew 15%, and Bitget grew 6%, but most of the largest exchanges declined significantly. This indicates a decline in market appeal for retail investors. Throughout March, weak investor sentiment continued for four weeks, and US investors led the market sell-off. 🏴☠️

Binance and Coinbase may have both received positive news, but this hasn’t stopped the broader trends impacting all CEXs. Even if Coinbase ended its legal problems, its new political influence hasn’t helped its position. In terms of traffic, Binance slightly benefited after the Bybit hack, but its listing policies are still controversial. And underlying it all, the market is in a state of fear. 😱

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- Thunderbolts: Marvel’s Next Box Office Disaster?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Does Oblivion Remastered have mod support?

- DODO PREDICTION. DODO cryptocurrency

- Elder Scrolls Oblivion Remastered: Best Paladin Build

- Demon Slayer: All 6 infinity Castle Fights EXPLORED

- Summoners War Tier List – The Best Monsters to Recruit in 2025

2025-03-11 22:19